- Hong Kong

- /

- Auto Components

- /

- SEHK:3931

Could CALB Group’s (SEHK:3931) New Debt Program Signal a Shift in Financial Flexibility Strategy?

Reviewed by Sasha Jovanovic

- CALB Group recently announced that it has secured regulatory acceptance to register and issue up to RMB5 billion in medium-term notes over two years, with two tranches already completed.

- The company also released unaudited financial statements for the nine months ending September 30, 2025, highlighting both active financial management and adherence to PRC compliance requirements.

- Let's examine how the expanded medium-term notes issuance may influence CALB Group's investment narrative and future financial flexibility.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is CALB Group's Investment Narrative?

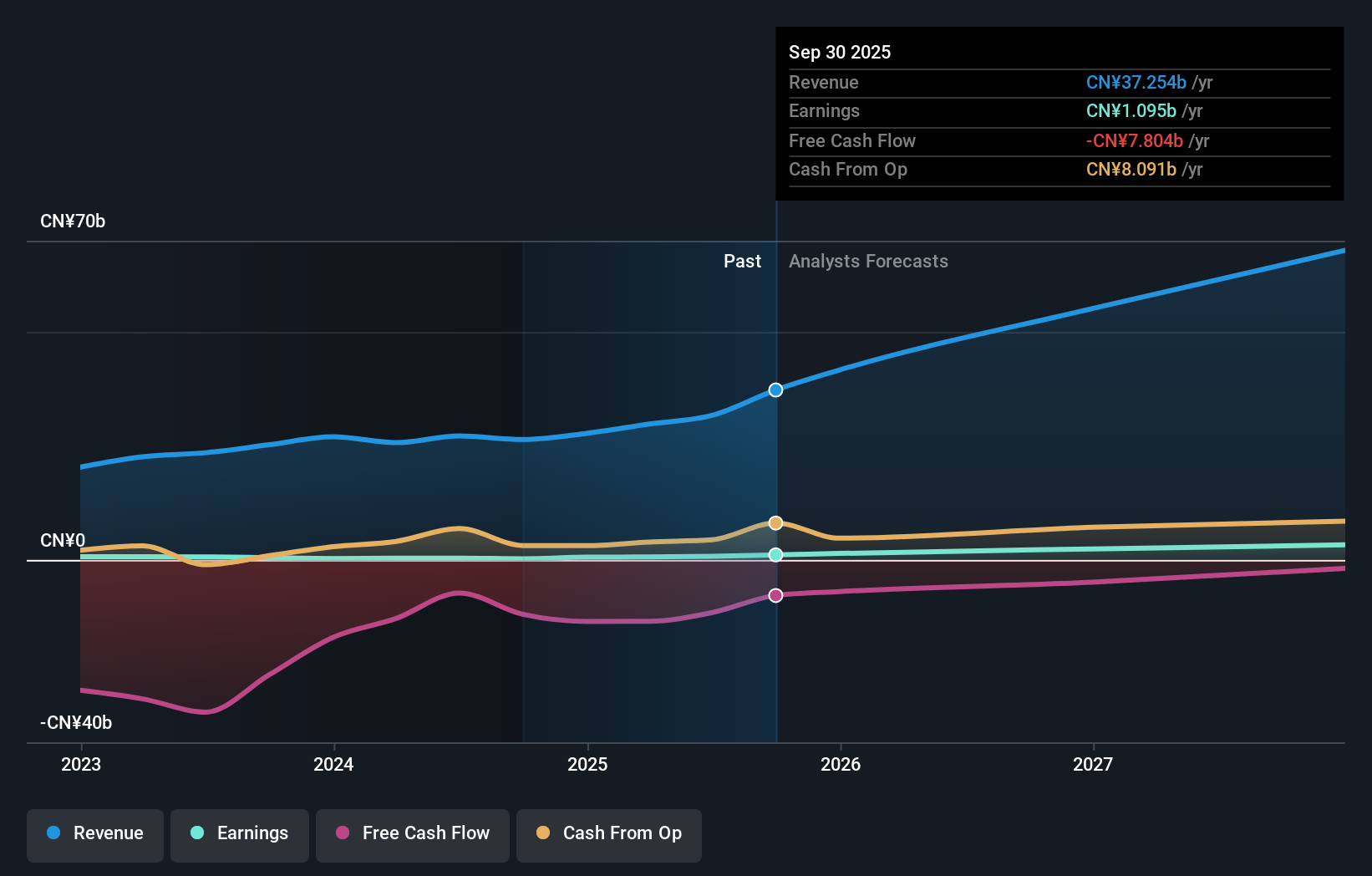

For shareholders of CALB Group, the core thesis is all about believing in the continued growth of the electric vehicle battery market and CALB’s ability to secure meaningful market share, supported by expanding revenue and earnings. The recent regulatory acceptance to register and issue up to RMB5 billion in medium-term notes is a meaningful development, boosting the company’s financial flexibility just as capital requirements for capacity expansion and R&D are growing. With two tranches already issued, CALB’s balance sheet could be better positioned for short-term investment or operational needs, potentially mitigating near-term liquidity risks that were top of mind prior to this announcement. However, the new funding does little to address ongoing legal challenges or the relatively high valuation that persists compared to industry peers. Investors will want to watch how access to additional debt influences execution on growth, as well as margin improvement, in the next few quarters.

On the other hand, ongoing legal disputes could become a bigger distraction than the market expects.

Exploring Other Perspectives

Explore 2 other fair value estimates on CALB Group - why the stock might be worth as much as HK$31.17!

Build Your Own CALB Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CALB Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CALB Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CALB Group's overall financial health at a glance.

No Opportunity In CALB Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3931

CALB Group

A new energy technology company, engages in the design, research, development, production, and sale of electric vehicle (EV) batteries and energy storage system (ESS) products in Mainland China, Europe, Asia, the United States, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives