David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that BAIC Motor Corporation Limited (HKG:1958) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for BAIC Motor

What Is BAIC Motor's Debt?

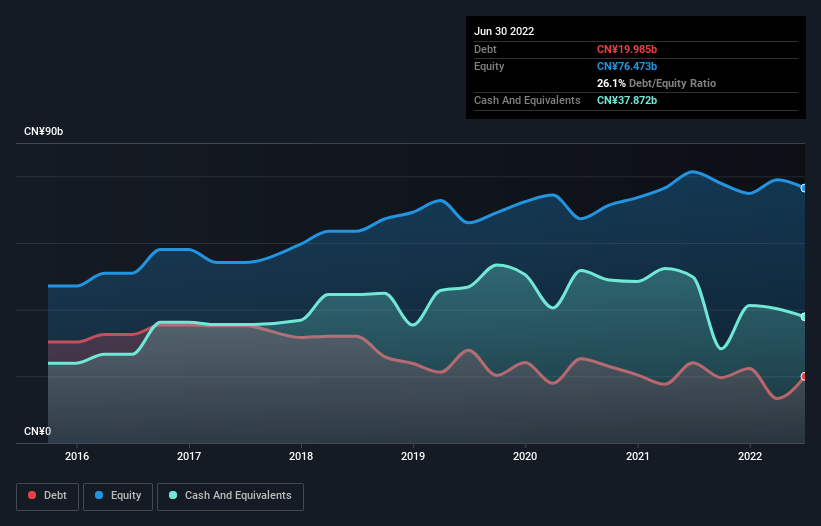

You can click the graphic below for the historical numbers, but it shows that BAIC Motor had CN¥20.0b of debt in June 2022, down from CN¥24.1b, one year before. But it also has CN¥37.9b in cash to offset that, meaning it has CN¥17.9b net cash.

How Healthy Is BAIC Motor's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that BAIC Motor had liabilities of CN¥87.5b due within 12 months and liabilities of CN¥13.5b due beyond that. On the other hand, it had cash of CN¥37.9b and CN¥20.0b worth of receivables due within a year. So it has liabilities totalling CN¥43.2b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥14.1b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, BAIC Motor would likely require a major re-capitalisation if it had to pay its creditors today. Given that BAIC Motor has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

The modesty of its debt load may become crucial for BAIC Motor if management cannot prevent a repeat of the 23% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if BAIC Motor can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. BAIC Motor may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, BAIC Motor recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While BAIC Motor does have more liabilities than liquid assets, it also has net cash of CN¥17.9b. Despite the cash, we do find BAIC Motor's level of total liabilities concerning, so we're not particularly comfortable with the stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for BAIC Motor you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if BAIC Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1958

BAIC Motor

Engages in the research and development, manufacture, sale, and after-sale service of passenger vehicles in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives