- Hong Kong

- /

- Auto Components

- /

- SEHK:1930

Are Robust Financials Driving The Recent Rally In Shinelong Automotive Lightweight Application Limited's (HKG:1930) Stock?

Shinelong Automotive Lightweight Application's (HKG:1930) stock is up by a considerable 26% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Shinelong Automotive Lightweight Application's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Shinelong Automotive Lightweight Application

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shinelong Automotive Lightweight Application is:

14% = CN¥40m ÷ CN¥279m (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.14 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Shinelong Automotive Lightweight Application's Earnings Growth And 14% ROE

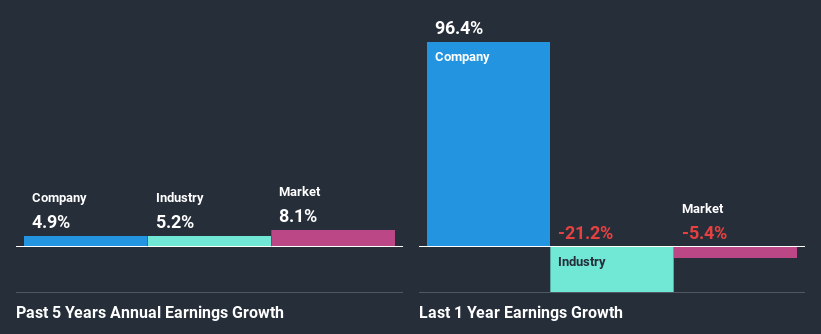

To begin with, Shinelong Automotive Lightweight Application seems to have a respectable ROE. On comparing with the average industry ROE of 8.5% the company's ROE looks pretty remarkable. Despite this, Shinelong Automotive Lightweight Application's five year net income growth was quite low averaging at only 4.9%. This is interesting as the high returns should mean that the company has the ability to generate high growth but for some reason, it hasn't been able to do so. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or poor allocation of capital.

As a next step, we compared Shinelong Automotive Lightweight Application's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 5.2% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Shinelong Automotive Lightweight Application fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Shinelong Automotive Lightweight Application Making Efficient Use Of Its Profits?

Shinelong Automotive Lightweight Application has a low three-year median payout ratio of 11% (meaning, the company keeps the remaining 89% of profits) which means that the company is retaining more of its earnings. However, the low earnings growth number doesn't reflect this as high growth usually follows high profit retention. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Additionally, Shinelong Automotive Lightweight Application started paying a dividend only recently. So it looks like the management must have perceived that shareholders favor dividends over earnings growth.

Conclusion

Overall, we are quite pleased with Shinelong Automotive Lightweight Application's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. As a result, the decent growth in its earnings is not surprising. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. You can see the 2 risks we have identified for Shinelong Automotive Lightweight Application by visiting our risks dashboard for free on our platform here.

If you’re looking to trade Shinelong Automotive Lightweight Application, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1930

Shinelong Automotive Lightweight Application

An investment holding company, designs and develops moulding services and solutions in Mainland China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026