- Hong Kong

- /

- Auto Components

- /

- SEHK:1809

Prinx Chengshan Holdings (HKG:1809) Will Pay A Larger Dividend Than Last Year At CN¥0.30

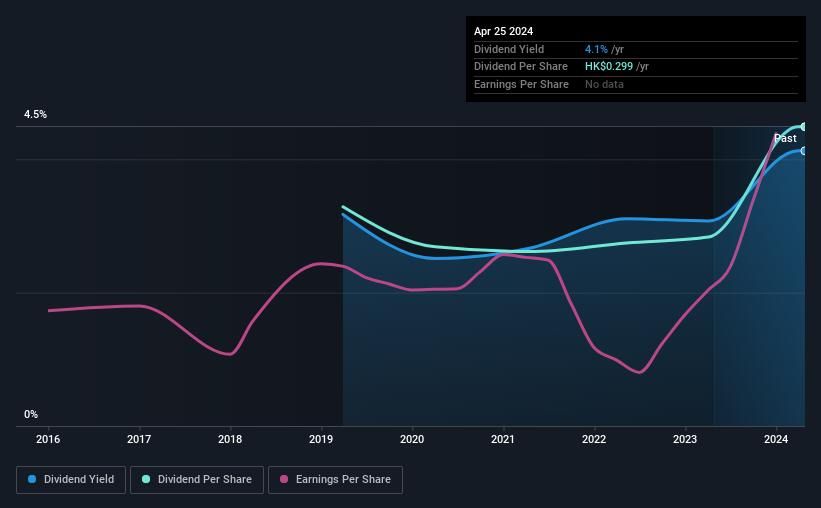

Prinx Chengshan Holdings Limited's (HKG:1809) dividend will be increasing from last year's payment of the same period to CN¥0.30 on 17th of June. The payment will take the dividend yield to 4.1%, which is in line with the average for the industry.

Check out our latest analysis for Prinx Chengshan Holdings

Prinx Chengshan Holdings' Payment Has Solid Earnings Coverage

We aren't too impressed by dividend yields unless they can be sustained over time. However, Prinx Chengshan Holdings' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

If the trend of the last few years continues, EPS will grow by 12.5% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 16% by next year, which is in a pretty sustainable range.

Prinx Chengshan Holdings Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 5 years of history we want to see a few more years of history before making any solid conclusions. Since 2019, the annual payment back then was CN¥0.203, compared to the most recent full-year payment of CN¥0.277. This works out to be a compound annual growth rate (CAGR) of approximately 6.4% a year over that time. Prinx Chengshan Holdings has a nice track record of dividend growth but we would wait until we see a longer track record before getting too confident.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Prinx Chengshan Holdings has been growing its earnings per share at 12% a year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Prinx Chengshan Holdings Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Prinx Chengshan Holdings that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1809

Prinx Chengshan Holdings

An investment holding company, researches and develops, designs, manufactures, and sells tires and related products.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives