- Hong Kong

- /

- Auto Components

- /

- SEHK:1809

Cautious Investors Not Rewarding Prinx Chengshan Holdings Limited's (HKG:1809) Performance Completely

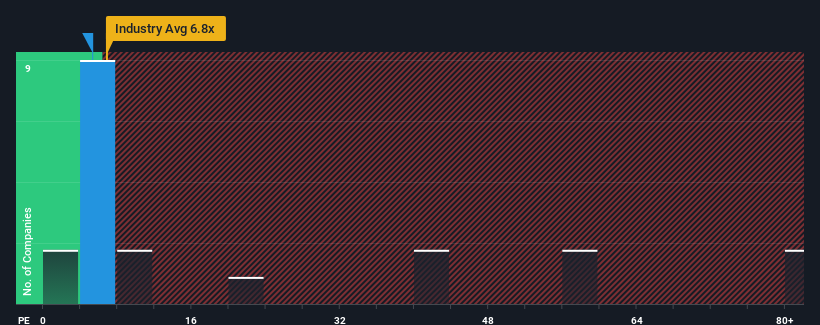

With a price-to-earnings (or "P/E") ratio of 5.3x Prinx Chengshan Holdings Limited (HKG:1809) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Prinx Chengshan Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Prinx Chengshan Holdings

Is There Any Growth For Prinx Chengshan Holdings?

In order to justify its P/E ratio, Prinx Chengshan Holdings would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 162%. The latest three year period has also seen an excellent 71% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Prinx Chengshan Holdings' P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Prinx Chengshan Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Prinx Chengshan Holdings revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Prinx Chengshan Holdings you should know about.

You might be able to find a better investment than Prinx Chengshan Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1809

Prinx Chengshan Holdings

An investment holding company, researches and develops, designs, manufactures, and sells tires and related products.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives