- Hong Kong

- /

- Auto Components

- /

- SEHK:179

Johnson Electric (SEHK:179): Assessing Valuation Following Half-Year Earnings and Dividend Update

Reviewed by Simply Wall St

Johnson Electric Holdings (SEHK:179) just released its half-year results, showing a minor dip in sales along with a modest increase in net income. Alongside the earnings, the company also confirmed its interim dividend payout.

See our latest analysis for Johnson Electric Holdings.

Johnson Electric’s latest results and the confirmed dividend payout seem to have sparked investor interest earlier this year, with the stock’s share price surging 168% so far in 2025. While momentum faded recently with a sharp 12.68% drop over the past month, the company’s one-year total shareholder return of 168.76% still puts it well ahead of the market.

If this kind of turnaround story has you thinking about what else is out there, now is the perfect time to broaden your investing search and discover See the full list for free.

The real question now is whether Johnson Electric’s recent run still has room to extend, or if the market is already factoring in every bit of its future growth potential. Is there still a genuine buying opportunity here?

Price-to-Earnings of 13.2x: Is it justified?

Johnson Electric Holdings’ current price-to-earnings (P/E) ratio of 13.2x stands well below the average for both its industry peers (21x) and the broader Asian Auto Components sector (21.5x), hinting at a significant discount relative to the group. With the shares last closing at HK$29.48, the market appears to be giving investors a notable value gap.

The P/E ratio measures what investors are willing to pay for each dollar of company earnings. A lower multiple like this can suggest the market expects slower future growth, or it may reflect doubts about the sustainability of the company’s profitability. For a company like Johnson Electric, with an established growth profile and a seasoned management team, this figure is especially important as it points to market sentiment about its earnings prospect.

Relative to both its fair P/E ratio of 14.6x and to industry norms, Johnson Electric looks attractively priced. The company trades not just below peers but below what regression analysis suggests could be its reasonable level, revealing a potential opportunity if market sentiment shifts.

Explore the SWS fair ratio for Johnson Electric Holdings

Result: Price-to-Earnings of 13.2x (UNDERVALUED)

However, a slowdown in revenue growth or unexpected market shifts could limit further upside. As a result, sustained momentum is far from guaranteed.

Find out about the key risks to this Johnson Electric Holdings narrative.

Another View: What Does the DCF Say?

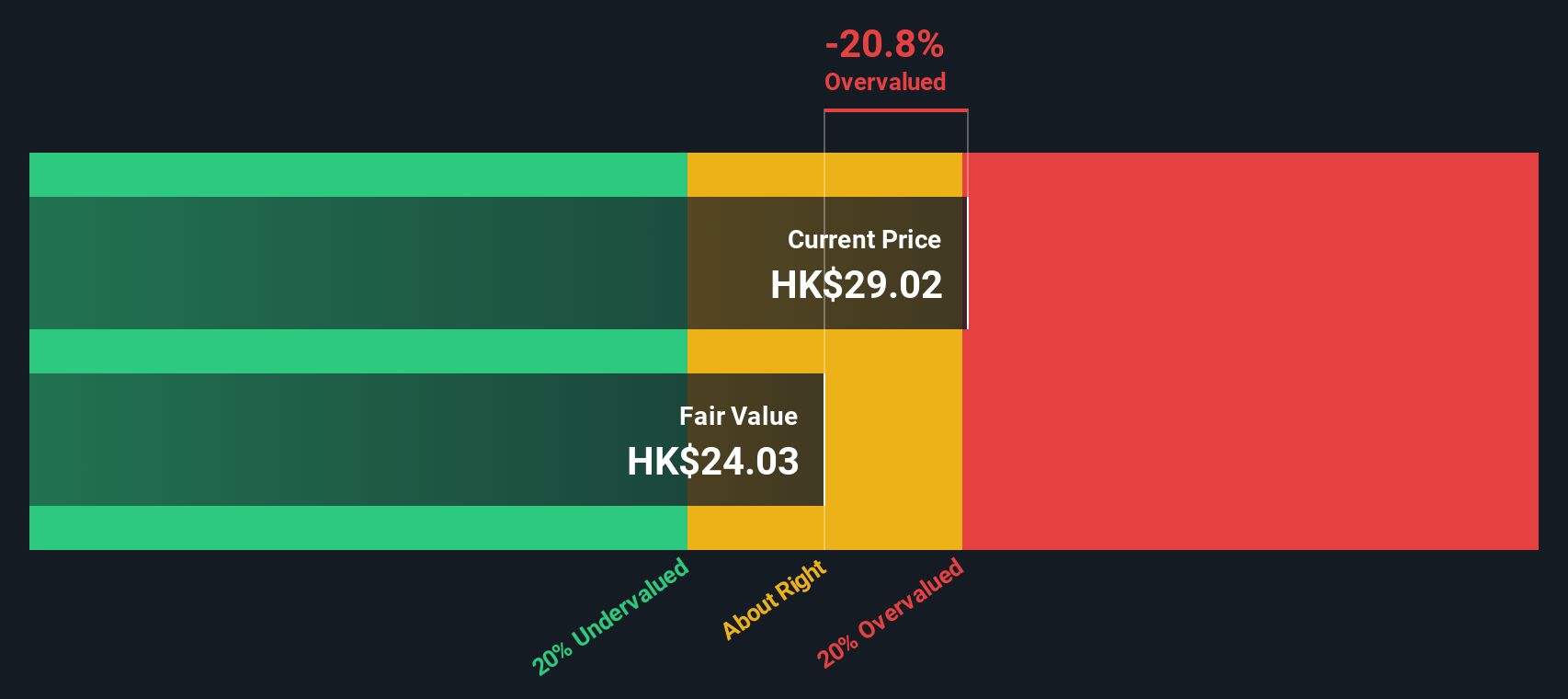

While the current price-to-earnings ratio implies Johnson Electric might be undervalued, our DCF model tells a different story. Based on the SWS DCF model, the estimated fair value is HK$24.01, which suggests the shares could actually be trading above their true worth. Is the market too optimistic here, or is it simply betting on future surprises?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Johnson Electric Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Johnson Electric Holdings Narrative

If you have a different perspective or want to dig deeper, you can craft your own view of Johnson Electric in just a few minutes. Do it your way

A great starting point for your Johnson Electric Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. Maximize your portfolio’s potential by tapping into tomorrow’s market winners and uncovering what others might overlook right now.

- Capitalize on the next wave of healthcare innovation by investigating these 30 healthcare AI stocks, which is making breakthroughs in patient care and artificial intelligence integration.

- Boost your passive income by reviewing these 15 dividend stocks with yields > 3%, offering solid yields above 3 percent and sustainable payout records.

- Ride the fastest trends in digital finance and technology with a look at these 81 cryptocurrency and blockchain stocks, unlocking opportunity in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:179

Johnson Electric Holdings

An investment holding company, manufactures and sells motion systems the Americas, the Asia-Pacific, Europe, the Middle East, Africa, and the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives