Is Geely a Bargain After 8% Pullback and Global EV Expansion Headlines?

Reviewed by Bailey Pemberton

- Wondering if Geely Automobile Holdings is really a bargain or just looks like one? Let’s break down what’s driving its current price and see if there’s a hidden opportunity for investors like you.

- Geely’s shares have powered ahead with a 24.4% gain so far this year and are up 22.7% over the last 12 months, but have recently pulled back by around 8% in the past month. This might catch the attention of value hunters or raise questions about changing risks.

- This recent price drop comes on the heels of industry headlines highlighting Geely’s push into electric vehicles and its growing footprint in international markets, with new models grabbing attention from both consumers and analysts. These developments add more context to the stock’s recent volatility and set the stage for a deeper dive into what’s driving expectations.

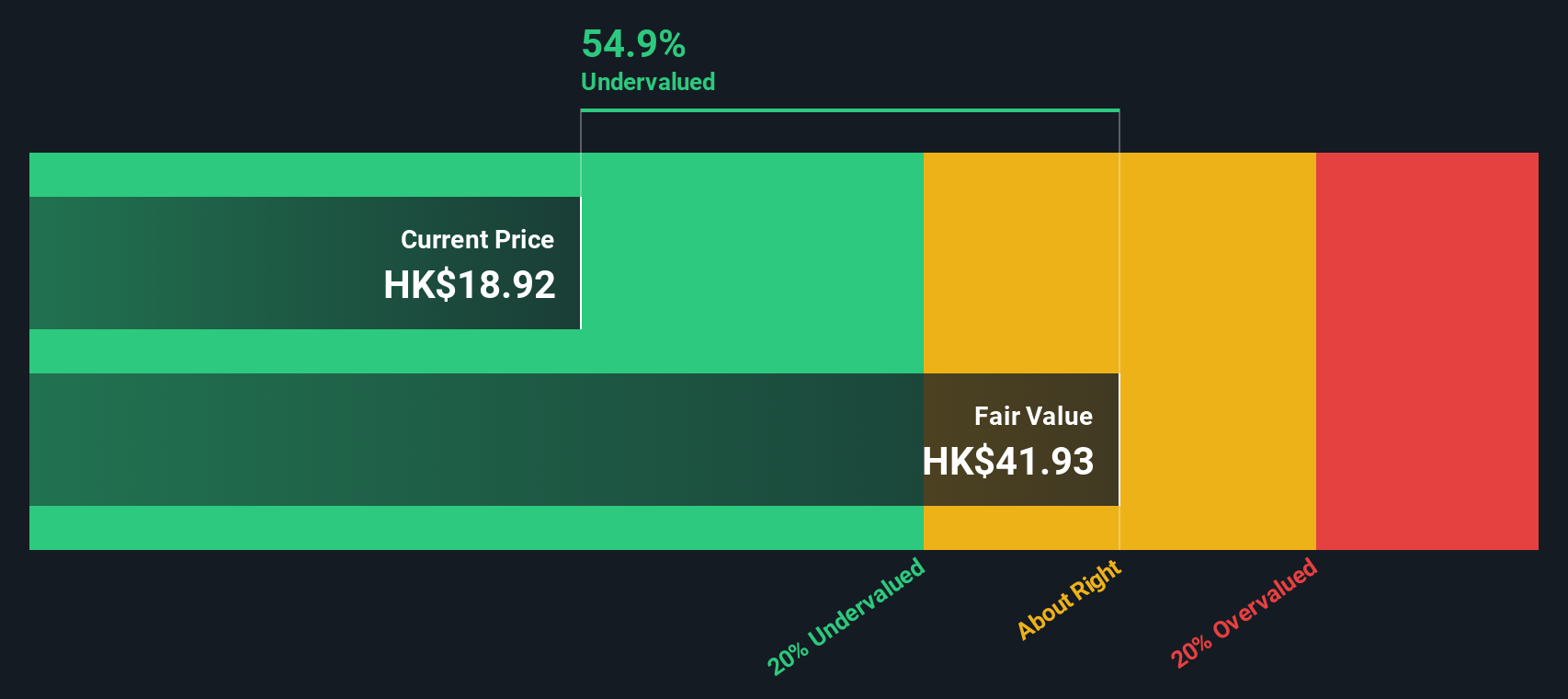

- Based on our valuation checks, Geely scores a solid 5 out of 6 for being undervalued. There is more than one way to value a stock, so read on as we compare these approaches and reveal another way to assess what Geely may truly be worth.

Approach 1: Geely Automobile Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to today's value so investors can estimate what the business is truly worth. For Geely Automobile Holdings, this involves analyzing both its current cash generation and forecasts for future growth in free cash flow.

According to Geely’s latest financials, its trailing twelve-month free cash flow stands at roughly CN¥5.33 billion. Analyst consensus projects free cash flow to rise steadily, with estimates reaching about CN¥33.25 billion by the end of 2027. Beyond this point, projections are extrapolated, suggesting free cash flow could reach around CN¥44.37 billion by 2035. These figures highlight expectations for robust growth over the next decade.

By discounting all these future cash flows back to their present value, the DCF analysis estimates Geely’s intrinsic value per share at HK$45.03. When compared to its current share price, this suggests the stock is trading at a 61.1% discount, indicating it is significantly undervalued based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Geely Automobile Holdings is undervalued by 61.1%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Geely Automobile Holdings Price vs Earnings

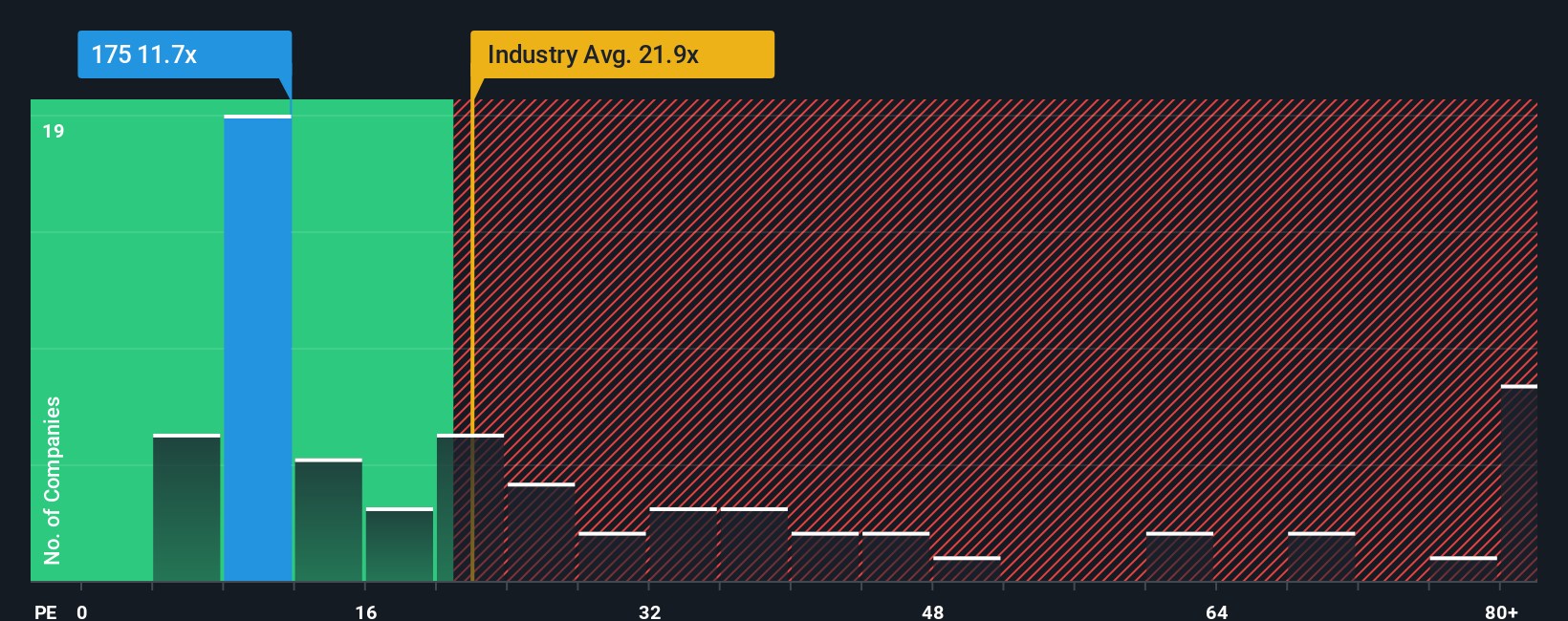

The Price-to-Earnings (PE) ratio is a widely used way to value profitable companies like Geely Automobile Holdings, as it reflects how much investors are willing to pay for each dollar of the company’s earnings. A company with good earnings growth and relatively low risk typically deserves a higher PE ratio; in contrast, sluggish growth or higher risk can justify a lower one.

Geely currently trades at a PE ratio of 10.8x. Compared to the auto industry average of 17.9x and its peers' average of 11.6x, Geely is trading at a noticeable discount. While these benchmarks provide useful context, they do not account for the company’s specific growth prospects, risk profile, margins, and market size. All of these are important in judging what a "fair" PE should be.

This is where Simply Wall St's proprietary “Fair Ratio” metric offers a more tailored perspective. The Fair Ratio considers not just industry averages, but also Geely’s expected earnings growth, profit margins, market cap, and risk factors. For Geely, the Fair Ratio is assessed at 14.3x, suggesting that the market is undervaluing the stock’s true earnings power and future prospects at its current price.

With Geely’s current PE of 10.8x well below the Fair Ratio of 14.3x, the stock appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Geely Automobile Holdings Narrative

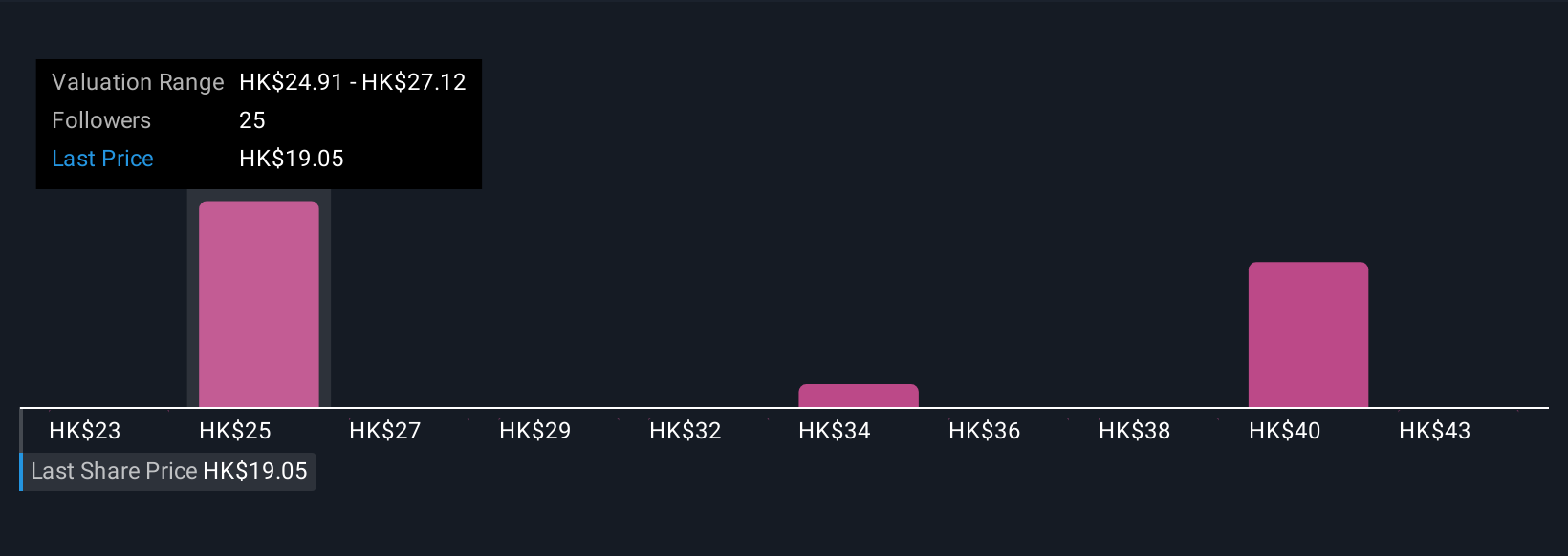

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In essence, a Narrative is your personal story or viewpoint on a company, where you link potential catalysts and risks to your own forecasts for revenue growth, earnings, and margins. This process helps you arrive at what you believe the company's fair value should be.

Narratives bridge the gap between a company’s story and the numbers, translating your perspective and expectations into a concrete financial forecast and a fair value estimate. This approach is intuitive and accessible, and millions of investors use it daily on Simply Wall St's Community page to guide their investment decisions.

By developing a Narrative, you can compare your calculated fair value against the market price in real time. This makes it easier to decide when to buy or sell, as you rely not just on static ratios but on your dynamic understanding of the business. Whenever new information such as news or earnings is released, Narratives update automatically to reflect the latest data.

For example, among Geely investors, one Narrative expects robust sales from new NEV models and global expansion to push fair value as high as HK$42.17. Another perspective, factoring in industry headwinds, sees fair value closer to HK$20.07.

Do you think there's more to the story for Geely Automobile Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives