Investors Who Bought CPI Computer Peripherals International (ATH:CPI) Shares Three Years Ago Are Now Up 113%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. To wit, the CPI Computer Peripherals International (ATH:CPI) share price has flown 113% in the last three years. How nice for those who held the stock! It's also up 37% in about a month.

View our latest analysis for CPI Computer Peripherals International

CPI Computer Peripherals International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

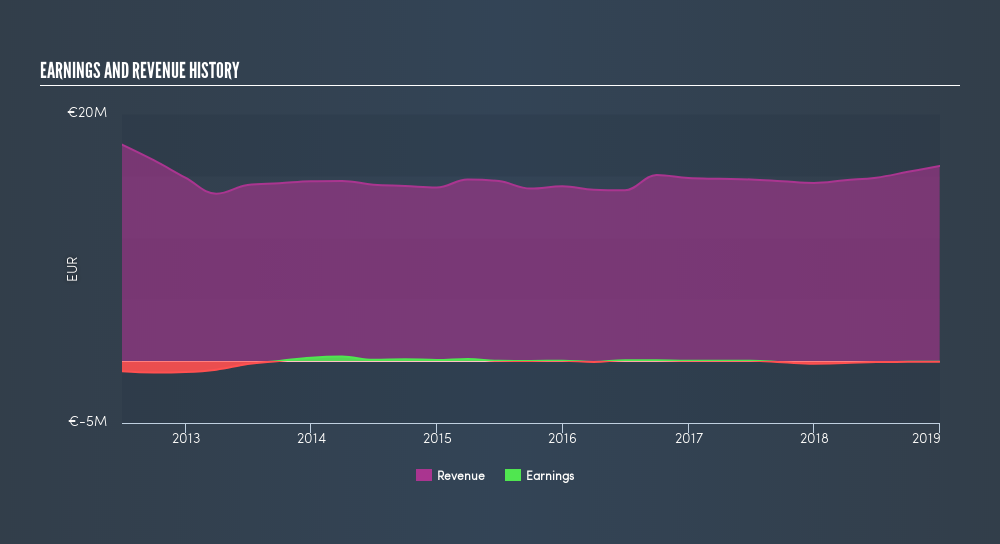

In the last 3 years CPI Computer Peripherals International saw its revenue grow at 2.8% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In contrast, the stock has popped 29% per year in that time - an impressive result. We'd need to take a closer look at the revenue and profit trends to see whether the improvements might justify that sort of increase. It may be that the market is pretty optimistic about CPI Computer Peripherals International if you look to the bottom line.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that CPI Computer Peripherals International shareholders have received a total shareholder return of 7.5% over one year. There's no doubt those recent returns are much better than the TSR loss of 0.5% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ATSE:CPI

CPI Computer Peripherals International

Provides IT products and services for small, medium, and large businesses in Greece.

Slight risk with questionable track record.

Market Insights

Community Narratives