Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Quality & Reliability A.B.E.E (ATH:QUAL) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Quality & ReliabilityE.E

What Is Quality & ReliabilityE.E's Net Debt?

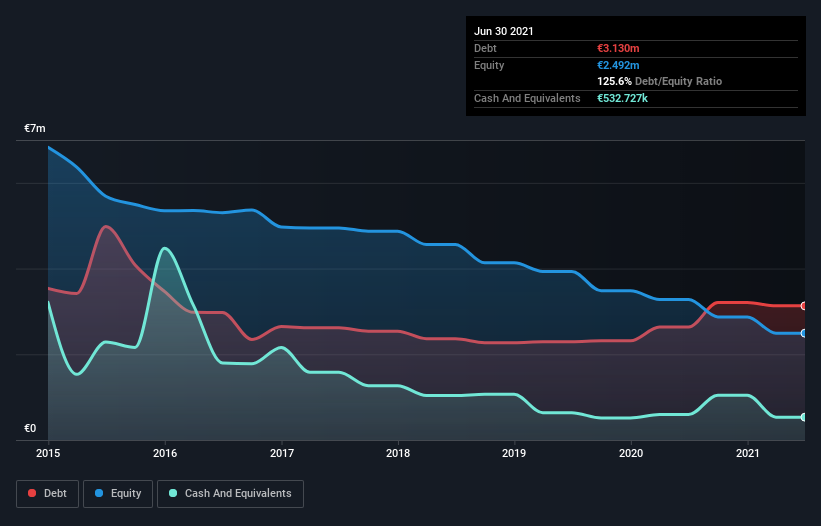

The image below, which you can click on for greater detail, shows that at June 2021 Quality & ReliabilityE.E had debt of €3.13m, up from €2.63m in one year. However, it does have €532.7k in cash offsetting this, leading to net debt of about €2.60m.

A Look At Quality & ReliabilityE.E's Liabilities

Zooming in on the latest balance sheet data, we can see that Quality & ReliabilityE.E had liabilities of €2.36m due within 12 months and liabilities of €2.18m due beyond that. On the other hand, it had cash of €532.7k and €3.79m worth of receivables due within a year. So its liabilities total €216.1k more than the combination of its cash and short-term receivables.

Since publicly traded Quality & ReliabilityE.E shares are worth a total of €9.02m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Quality & ReliabilityE.E will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Quality & ReliabilityE.E wasn't profitable at an EBIT level, but managed to grow its revenue by 32%, to €2.9m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly appreciate Quality & ReliabilityE.E's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost €249k at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled €562k in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Quality & ReliabilityE.E is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Quality & ReliabilityE.E might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:QUAL

Quality & ReliabilityE.E

Quality & Reliability A.B.E.E, together with its subsidiaries, delivers integrated information systems for large and mid-size enterprises in the public and private sector in Greece and internationally.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Very Bullish

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

This strategic transformation of TTE? Significant re-rating potential

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.