- Greece

- /

- Specialty Stores

- /

- ATSE:MODA

N. Varveris-Moda Bagno S.A. (ATH:MODA) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

N. Varveris-Moda Bagno S.A. (ATH:MODA) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days were the cherry on top of the stock's 369% gain in the last year, which is nothing short of spectacular.

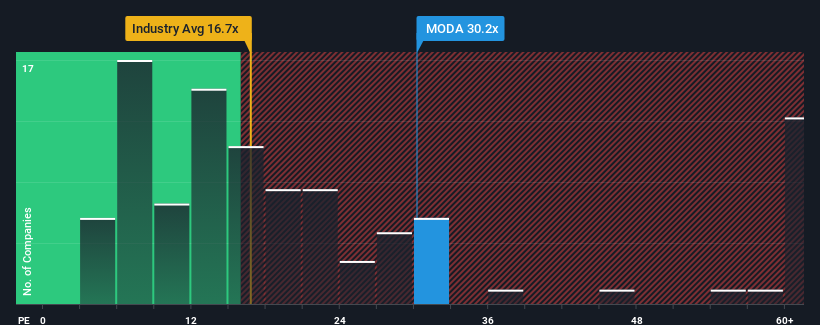

Following the firm bounce in price, given close to half the companies in Greece have price-to-earnings ratios (or "P/E's") below 12x, you may consider N. Varveris-Moda Bagno as a stock to avoid entirely with its 30.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

N. Varveris-Moda Bagno has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for N. Varveris-Moda Bagno

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like N. Varveris-Moda Bagno's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.7% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that N. Varveris-Moda Bagno is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On N. Varveris-Moda Bagno's P/E

N. Varveris-Moda Bagno's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of N. Varveris-Moda Bagno revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for N. Varveris-Moda Bagno (of which 1 is a bit concerning!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if N. Varveris-Moda Bagno might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MODA

N. Varveris-Moda Bagno

Engages in the retail trade of bathroom and kitchen products in Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives