- Greece

- /

- Basic Materials

- /

- ATSE:TITC

Analyst Forecasts For Titan Cement International S.A. (ATH:TITC) Are Surging Higher

Celebrations may be in order for Titan Cement International S.A. (ATH:TITC) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

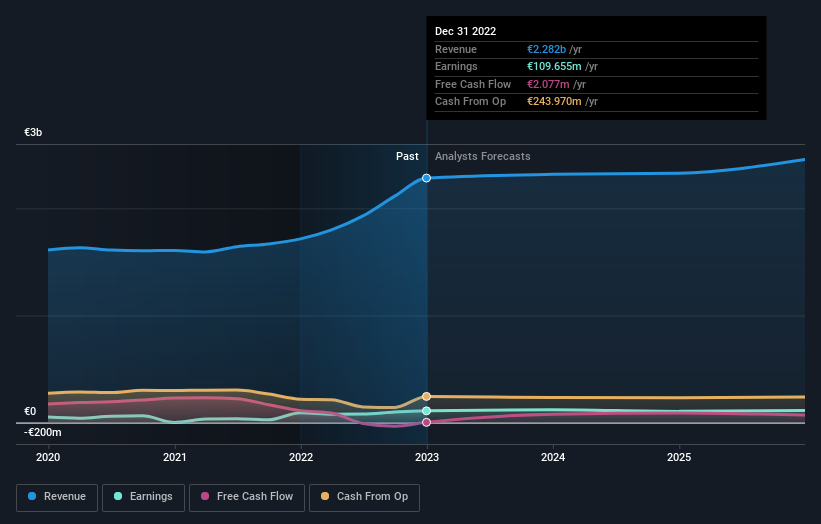

Following the latest upgrade, Titan Cement International's twin analysts currently expect revenues in 2023 to be €2.3b, approximately in line with the last 12 months. Statutory earnings per share are presumed to step up 14% to €1.67. Prior to this update, the analysts had been forecasting revenues of €2.0b and earnings per share (EPS) of €0.92 in 2023. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Titan Cement International

With these upgrades, we're not surprised to see that the analysts have lifted their price target 6.6% to €16.18 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Titan Cement International analyst has a price target of €23.70 per share, while the most pessimistic values it at €10.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Titan Cement International's revenue growth is expected to slow, with the forecast 1.5% annualised growth rate until the end of 2023 being well below the historical 6.9% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 2.7% per year. Factoring in the forecast slowdown in growth, it seems obvious that Titan Cement International is also expected to grow slower than other industry participants.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Titan Cement International.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

You can also see our analysis of Titan Cement International's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

Valuation is complex, but we're here to simplify it.

Discover if Titan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:TITC

Titan

Engages in the production, trade, and distribution of construction materials in Greece, the Balkans, Egypt, Türkiye, the United States, and Brazil.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success