- Greece

- /

- Basic Materials

- /

- ATSE:MATHIO

Even With A 26% Surge, Cautious Investors Are Not Rewarding Mathios Refractories S.A.'s (ATH:MATHIO) Performance Completely

Mathios Refractories S.A. (ATH:MATHIO) shareholders have had their patience rewarded with a 26% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

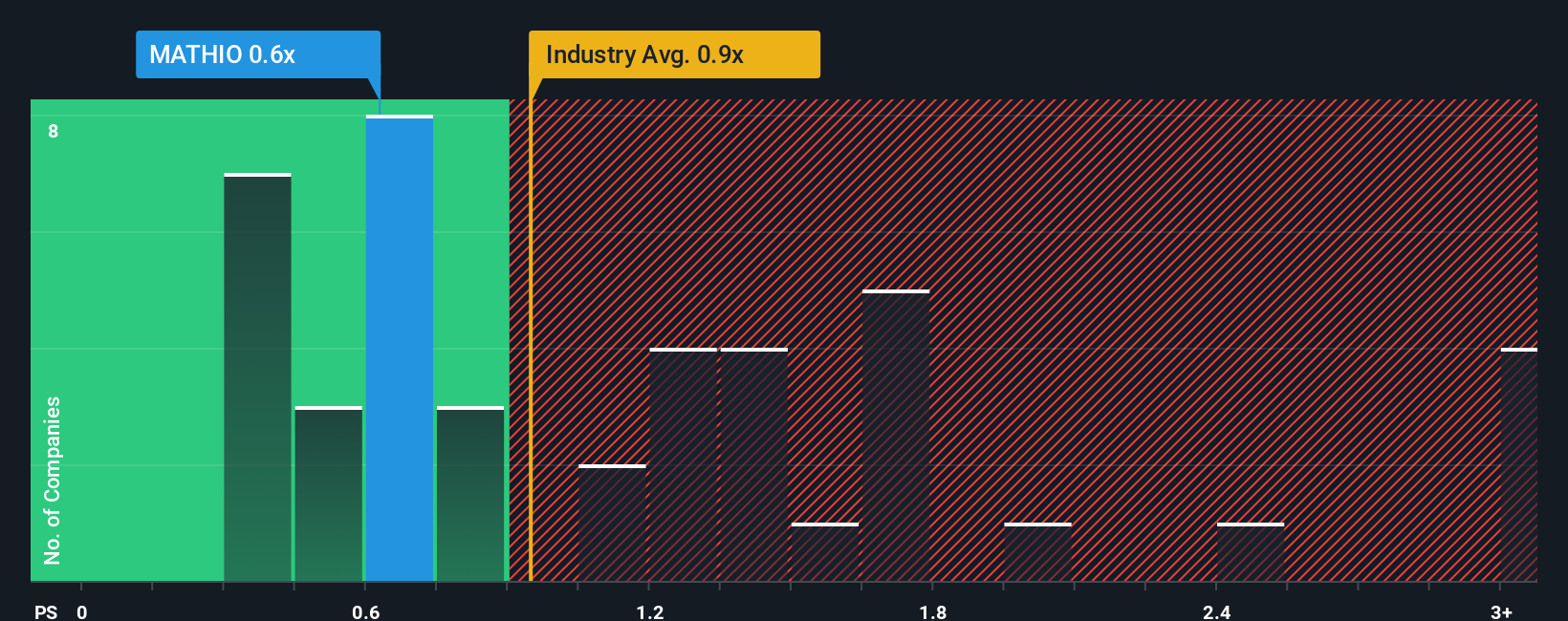

In spite of the firm bounce in price, it's still not a stretch to say that Mathios Refractories' price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Basic Materials industry in Greece, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Mathios Refractories

How Mathios Refractories Has Been Performing

For instance, Mathios Refractories' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Mathios Refractories will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mathios Refractories' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 12% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

This is in contrast to the rest of the industry, which is expected to decline by 8.1% over the next year, even worse than the company's recent medium-term annualised revenue decline.

With this information, it's perhaps curious but not a major surprise that Mathios Refractories is trading at a fairly similar P/S in comparison. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Mathios Refractories' P/S?

Mathios Refractories' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Mathios Refractories revealed its narrower three-year contraction in revenue isn't contributing to its P/S as much as we would have predicted, given the industry is set to shrink even more. There could be some unobserved threats to revenue preventing the P/S ratio from matching this more attractive performance. Perhaps there is some hesitation about the company's ability to deviate from the industry's dismal performance and maintain a relatively smaller revenue decline. While the chance of a downward share price shock is quite unlikely, there does seem to be something concerning shareholders as the relative performance would usually justify a higher price.

Before you take the next step, you should know about the 3 warning signs for Mathios Refractories that we have uncovered.

If you're unsure about the strength of Mathios Refractories' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:MATHIO

Mathios Refractories

Develops, manufactures, and sells refractory products and lining solutions in Greece, Other European Union, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success