- Greece

- /

- Metals and Mining

- /

- ATSE:IKTIN

Is Iktinos Hellas Greek Marble Industry Technical and Touristic (ATH:IKTIN) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company (ATH:IKTIN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Iktinos Hellas Greek Marble Industry Technical and Touristic

What Is Iktinos Hellas Greek Marble Industry Technical and Touristic's Debt?

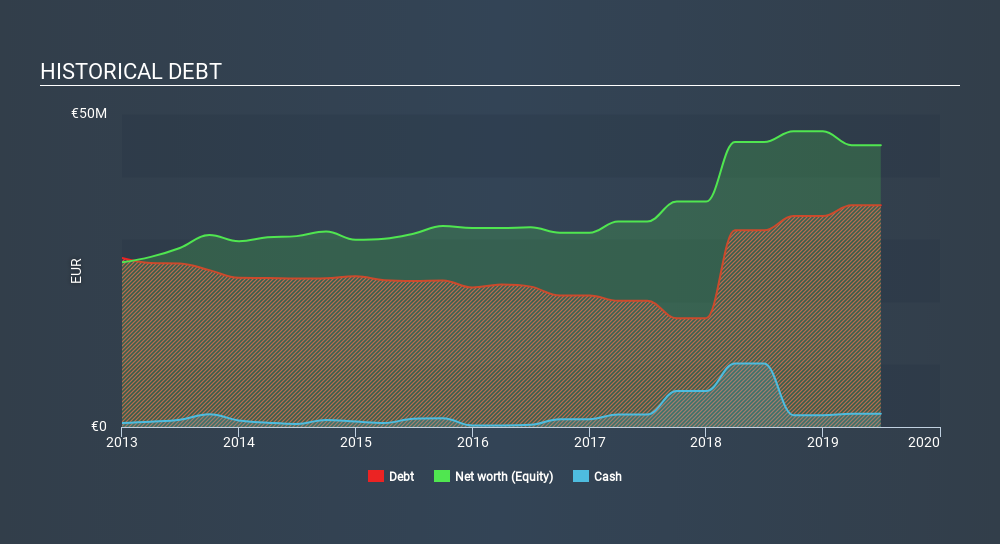

As you can see below, at the end of June 2019, Iktinos Hellas Greek Marble Industry Technical and Touristic had €35.4m of debt, up from €31.4 a year ago. Click the image for more detail. However, it does have €2.12m in cash offsetting this, leading to net debt of about €33.3m.

A Look At Iktinos Hellas Greek Marble Industry Technical and Touristic's Liabilities

We can see from the most recent balance sheet that Iktinos Hellas Greek Marble Industry Technical and Touristic had liabilities of €45.3m falling due within a year, and liabilities of €33.4m due beyond that. Offsetting this, it had €2.12m in cash and €18.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €58.0m.

This deficit isn't so bad because Iktinos Hellas Greek Marble Industry Technical and Touristic is worth €127.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a debt to EBITDA ratio of 1.9, Iktinos Hellas Greek Marble Industry Technical and Touristic uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 8.8 times its interest expenses harmonizes with that theme. Importantly, Iktinos Hellas Greek Marble Industry Technical and Touristic's EBIT fell a jaw-dropping 42% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Iktinos Hellas Greek Marble Industry Technical and Touristic's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Iktinos Hellas Greek Marble Industry Technical and Touristic's free cash flow amounted to 31% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

We'd go so far as to say Iktinos Hellas Greek Marble Industry Technical and Touristic's EBIT growth rate was disappointing. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Iktinos Hellas Greek Marble Industry Technical and Touristic stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Iktinos Hellas Greek Marble Industry Technical and Touristic (of which 2 are major) which any shareholder or potential investor should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:IKTIN

Iktinos Hellas Greek Marble Industry Technical and Touristic

Engages in the quarrying, processing, and trading in marbles and granites in Greece, the Euro Area, and internationally.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives