- Greece

- /

- Construction

- /

- ATSE:ELLAKTOR

Ellaktor (ATH:ELLAKTOR) shareholder returns have been strong, earning 110% in 5 years

When we invest, we're generally looking for stocks that outperform the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Ellaktor share price has climbed 78% in five years, easily topping the market return of 24% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 26%.

The past week has proven to be lucrative for Ellaktor investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Ellaktor

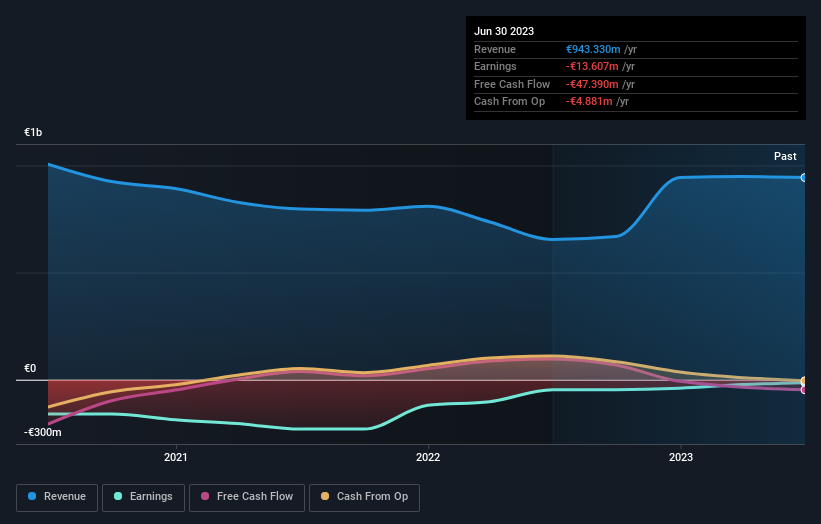

Given that Ellaktor didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade Ellaktor's revenue has actually been trending down at about 21% per year. Despite the lack of revenue growth, the stock has returned a respectable 12%, compound, over that time. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Ellaktor's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Ellaktor shareholders, and that cash payout contributed to why its TSR of 110%, over the last 5 years, is better than the share price return.

A Different Perspective

Ellaktor shareholders gained a total return of 26% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 16% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Ellaktor that you should be aware of.

But note: Ellaktor may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ellaktor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELLAKTOR

Ellaktor

Through its subsidiaries, operates as an infrastructure company in Greece, other European countries, Gulf countries, and the Americas.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives