The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Wizz Air Holdings Plc (LON:WIZZ) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Wizz Air Holdings

How Much Debt Does Wizz Air Holdings Carry?

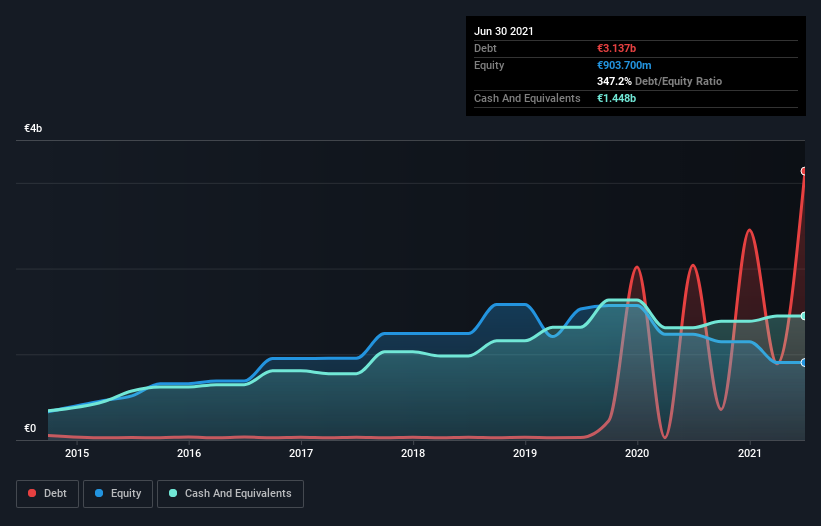

The image below, which you can click on for greater detail, shows that at March 2021 Wizz Air Holdings had debt of €3.14b, up from €2.04b in one year. However, because it has a cash reserve of €1.45b, its net debt is less, at about €1.69b.

A Look At Wizz Air Holdings' Liabilities

According to the last reported balance sheet, Wizz Air Holdings had liabilities of €1.30b due within 12 months, and liabilities of €2.52b due beyond 12 months. On the other hand, it had cash of €1.45b and €66.2m worth of receivables due within a year. So its liabilities total €2.31b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Wizz Air Holdings has a market capitalization of €6.13b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Wizz Air Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Wizz Air Holdings made a loss at the EBIT level, and saw its revenue drop to €847m, which is a fall of 61%. That makes us nervous, to say the least.

Caveat Emptor

While Wizz Air Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at €477m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled €640m in negative free cash flow over the last twelve months. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Wizz Air Holdings (1 is potentially serious!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Wizz Air Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wizz Air Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:WIZZ

Wizz Air Holdings

Engages in the provision of passenger air transportation services in Europe, Iceland, Liechtenstein, Norway, and Switzerland, the United Kingdom, and Other European countries.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives