- United Kingdom

- /

- Transportation

- /

- LSE:ZIG

Redde Northgate plc's (LON:REDD) Low P/E No Reason For Excitement

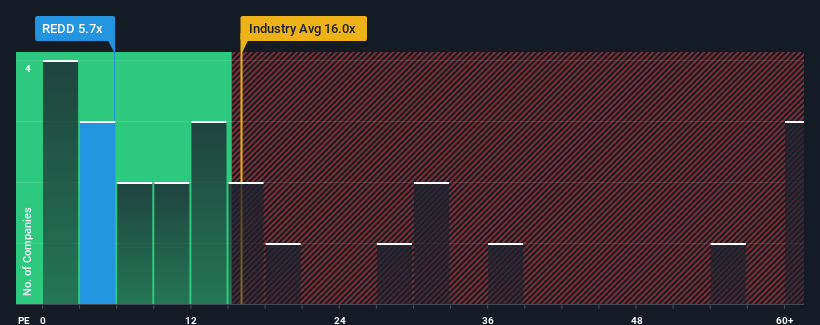

Redde Northgate plc's (LON:REDD) price-to-earnings (or "P/E") ratio of 5.7x might make it look like a strong buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 16x and even P/E's above 28x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Redde Northgate as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Redde Northgate

Does Growth Match The Low P/E?

Redde Northgate's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. Pleasingly, EPS has also lifted 1,593% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 13% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 11% per year, which paints a poor picture.

With this information, we are not surprised that Redde Northgate is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Redde Northgate's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Redde Northgate (2 make us uncomfortable!) that we have uncovered.

If you're unsure about the strength of Redde Northgate's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zigup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ZIG

Zigup

Engages in the provision of mobility solutions and automotive services to business and personal customers in the United Kingdom, Spain, and Ireland.

Very undervalued average dividend payer.

Market Insights

Community Narratives