- United Kingdom

- /

- Infrastructure

- /

- LSE:FSJ

James Fisher and Sons plc (LON:FSJ) Not Doing Enough For Some Investors As Its Shares Slump 26%

James Fisher and Sons plc (LON:FSJ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

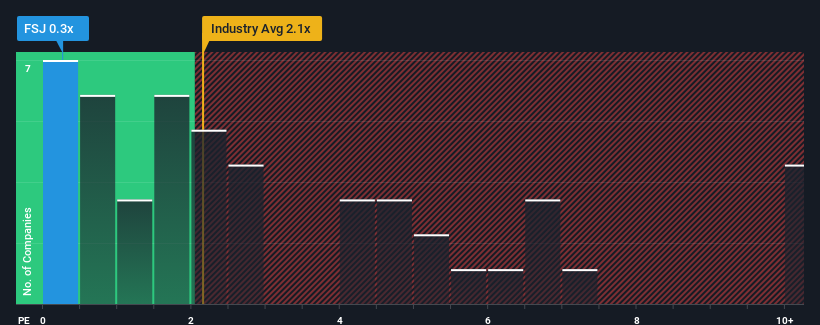

Even after such a large drop in price, when close to half the companies operating in the United Kingdom's Infrastructure industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider James Fisher and Sons as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for James Fisher and Sons

What Does James Fisher and Sons' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, James Fisher and Sons has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think James Fisher and Sons' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like James Fisher and Sons' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 12% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 0.7% each year over the next three years. That's shaping up to be materially lower than the 3.5% per year growth forecast for the broader industry.

With this in consideration, its clear as to why James Fisher and Sons' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On James Fisher and Sons' P/S

James Fisher and Sons' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of James Fisher and Sons' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with James Fisher and Sons (including 1 which is significant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FSJ

James Fisher and Sons

Operates as an engineering services company worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives