Getting In Cheap On Helios Towers plc (LON:HTWS) Might Be Difficult

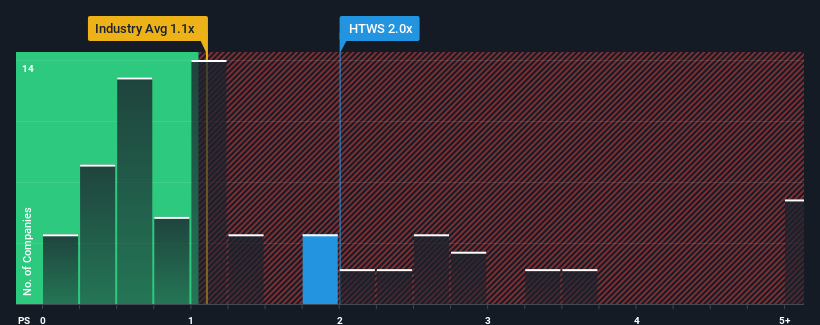

Helios Towers plc's (LON:HTWS) price-to-sales (or "P/S") ratio of 2x may not look like an appealing investment opportunity when you consider close to half the companies in the Telecom industry in the United Kingdom have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Helios Towers

What Does Helios Towers' Recent Performance Look Like?

Helios Towers certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Helios Towers' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Helios Towers' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The strong recent performance means it was also able to grow revenue by 80% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 8.6% per annum over the next three years. That's shaping up to be materially higher than the 1.9% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Helios Towers' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Helios Towers' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Helios Towers maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Telecom industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Helios Towers has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Helios Towers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HTWS

Helios Towers

An independent tower company, acquires, builds, and operates telecommunications towers.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives