Bigblu Broadband (LON:BBB) Is In A Strong Position To Grow Its Business

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Bigblu Broadband (LON:BBB) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Bigblu Broadband

SWOT Analysis for Bigblu Broadband

- Currently debt free.

- No major weaknesses identified for BBB.

- Expected to breakeven next year.

- Good value based on P/S ratio and estimated fair value.

- Has less than 3 years of cash runway based on current free cash flow.

When Might Bigblu Broadband Run Out Of Money?

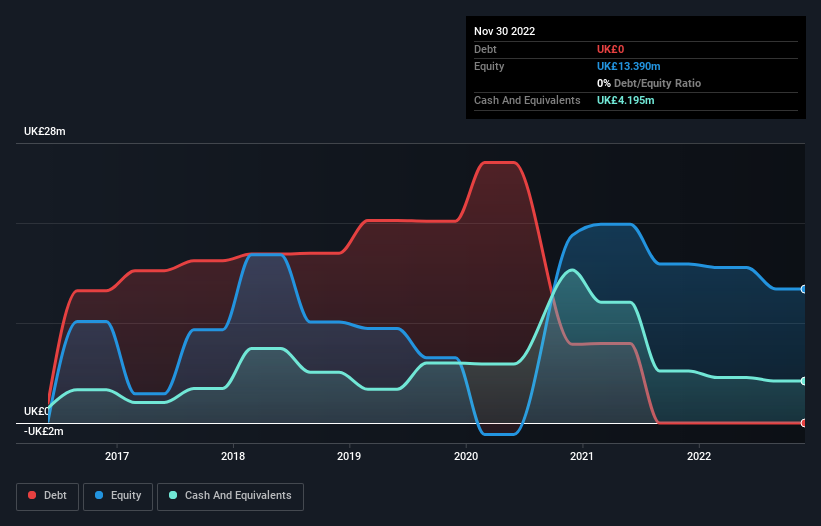

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In November 2022, Bigblu Broadband had UK£4.2m in cash, and was debt-free. Importantly, its cash burn was UK£1.9m over the trailing twelve months. That means it had a cash runway of about 2.2 years as of November 2022. Importantly, though, the one analyst we see covering the stock thinks that Bigblu Broadband will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. The image below shows how its cash balance has been changing over the last few years.

How Well Is Bigblu Broadband Growing?

Happily, Bigblu Broadband is travelling in the right direction when it comes to its cash burn, which is down 75% over the last year. And it could also show revenue growth of 15% in the same period. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Bigblu Broadband Raise Cash?

There's no doubt Bigblu Broadband seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of UK£32m, Bigblu Broadband's UK£1.9m in cash burn equates to about 6.2% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Bigblu Broadband's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Bigblu Broadband is burning through its cash. In particular, we think its cash burn reduction stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! There's no doubt that shareholders can take a lot of heart from the fact that at least one analyst is forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 1 warning sign for Bigblu Broadband that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Bigblu Broadband might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BBB

Bigblu Broadband

Provides satellite and wireless broadband telecommunications and related products and services in the United Kingdom and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives