- United Kingdom

- /

- Tech Hardware

- /

- LSE:XAR

Xaar plc's (LON:XAR) 26% Jump Shows Its Popularity With Investors

Xaar plc (LON:XAR) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

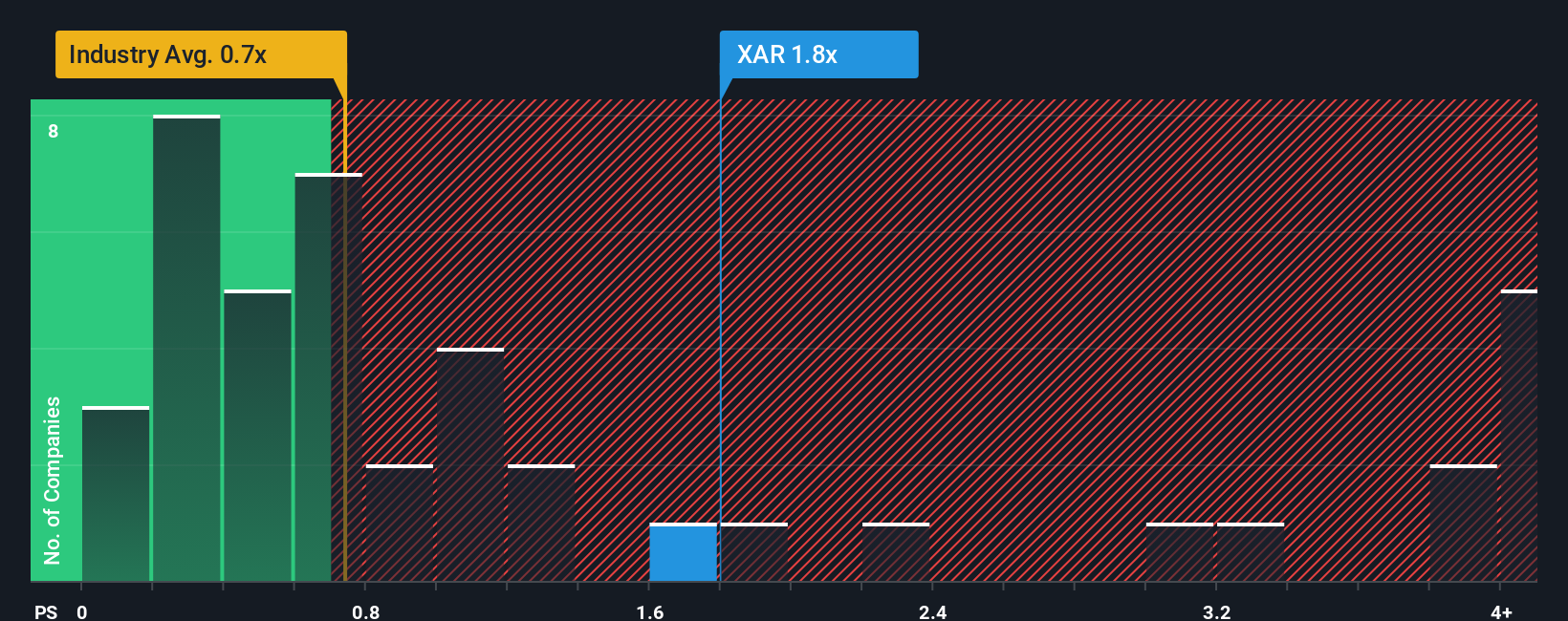

After such a large jump in price, given close to half the companies operating in the United Kingdom's Tech industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Xaar as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Xaar

What Does Xaar's P/S Mean For Shareholders?

Xaar's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Xaar will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Xaar's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. Still, lamentably revenue has fallen 9.3% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 7.3% growth forecast for the broader industry.

With this information, we can see why Xaar is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Xaar shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xaar maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Tech industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Xaar with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Xaar's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:XAR

Xaar

Designs, develops, manufactures, markets, and sells industrial printheads and print systems in Europe, the Middle East, Africa, Asia, and the Americas.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives