Solid State (LON:SOLI) Has Announced That It Will Be Increasing Its Dividend To £0.1325

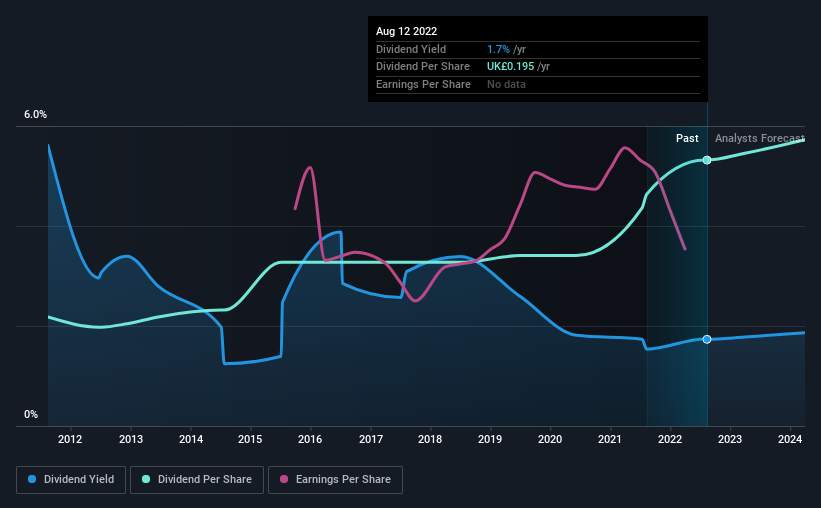

Solid State plc's (LON:SOLI) dividend will be increasing from last year's payment of the same period to £0.1325 on 5th of October. This takes the annual payment to 1.7% of the current stock price, which is about average for the industry.

View our latest analysis for Solid State

Solid State's Earnings Easily Cover The Distributions

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, Solid State was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

The next year is set to see EPS grow by 109.8%. Assuming the dividend continues along recent trends, we think the payout ratio could be 44% by next year, which is in a pretty sustainable range.

Solid State Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2012, the dividend has gone from £0.08 total annually to £0.195. This works out to be a compound annual growth rate (CAGR) of approximately 9.3% a year over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Over the past five years, it looks as though Solid State's EPS has declined at around 3.9% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

We should note that Solid State has issued stock equal to 32% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Solid State's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Solid State that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SOLI

Solid State

Designs, manufactures, distributes and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and Internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion