Market Cool On Solid State plc's (LON:SOLI) Earnings Pushing Shares 46% Lower

Solid State plc (LON:SOLI) shareholders that were waiting for something to happen have been dealt a blow with a 46% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

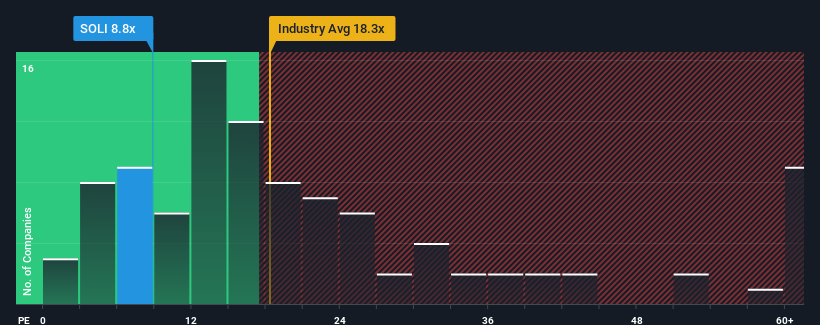

Following the heavy fall in price, Solid State may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 28x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Solid State has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Solid State

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Solid State's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 21% last year. The latest three year period has also seen an excellent 68% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 19% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Solid State is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Solid State's P/E

The softening of Solid State's shares means its P/E is now sitting at a pretty low level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Solid State revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Solid State (1 can't be ignored!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SOLI

Solid State

Designs, manufactures, distributes and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and Internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Increasing revenue at high costs relies on membership to convert to spend

Google - The world's first "Full Stack AI Sovereign"

Substantial founder ownership speaks to the strength of its business

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks