- United Kingdom

- /

- Communications

- /

- AIM:MWE

M.T.I Wireless Edge Ltd. (LON:MWE) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, M.T.I Wireless Edge Ltd. (LON:MWE) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

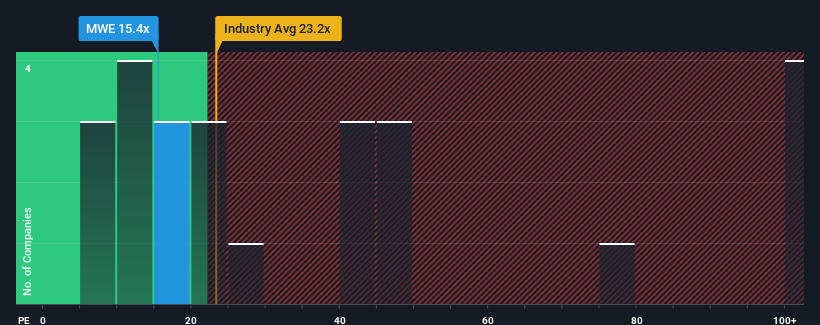

Although its price has surged higher, it's still not a stretch to say that M.T.I Wireless Edge's price-to-earnings (or "P/E") ratio of 15.4x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, M.T.I Wireless Edge has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for M.T.I Wireless Edge

How Is M.T.I Wireless Edge's Growth Trending?

The only time you'd be comfortable seeing a P/E like M.T.I Wireless Edge's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen a 22% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 5.3% during the coming year according to the dual analysts following the company. That's not great when the rest of the market is expected to grow by 17%.

With this information, we find it concerning that M.T.I Wireless Edge is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

M.T.I Wireless Edge appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that M.T.I Wireless Edge currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for M.T.I Wireless Edge that you should be aware of.

If these risks are making you reconsider your opinion on M.T.I Wireless Edge, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MWE

M.T.I Wireless Edge

Designs, develops, manufactures, and markets antennas for the military and civilian sectors.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives