Does Gooch & Housego's (LON:GHH) Statutory Profit Adequately Reflect Its Underlying Profit?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Gooch & Housego (LON:GHH).

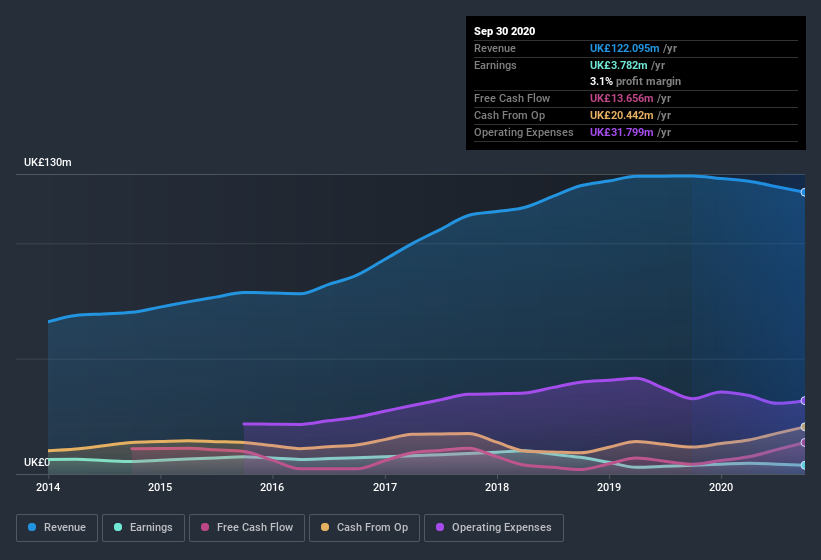

It's good to see that over the last twelve months Gooch & Housego made a profit of UK£3.78m on revenue of UK£122.1m. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

View our latest analysis for Gooch & Housego

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. This article will discuss how unusual items have impacted Gooch & Housego's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Gooch & Housego's profit was reduced by UK£1.4m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Gooch & Housego doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Gooch & Housego's Profit Performance

Because unusual items detracted from Gooch & Housego's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Gooch & Housego's earnings potential is at least as good as it seems, and maybe even better! At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. While conducting our analysis, we found that Gooch & Housego has 1 warning sign and it would be unwise to ignore it.

This note has only looked at a single factor that sheds light on the nature of Gooch & Housego's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Gooch & Housego or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:GHH

Gooch & Housego

Engages in the manufacture and sale of acousto-optics, electro-optics, fiber optics, and precision optics and systems in the United Kingdom, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives