- United Kingdom

- /

- IT

- /

- LSE:TRD

Most Shareholders Will Probably Find That The CEO Compensation For Triad Group plc (LON:TRD) Is Reasonable

The share price of Triad Group plc (LON:TRD) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 28 July 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Triad Group

How Does Total Compensation For Adrian Leer Compare With Other Companies In The Industry?

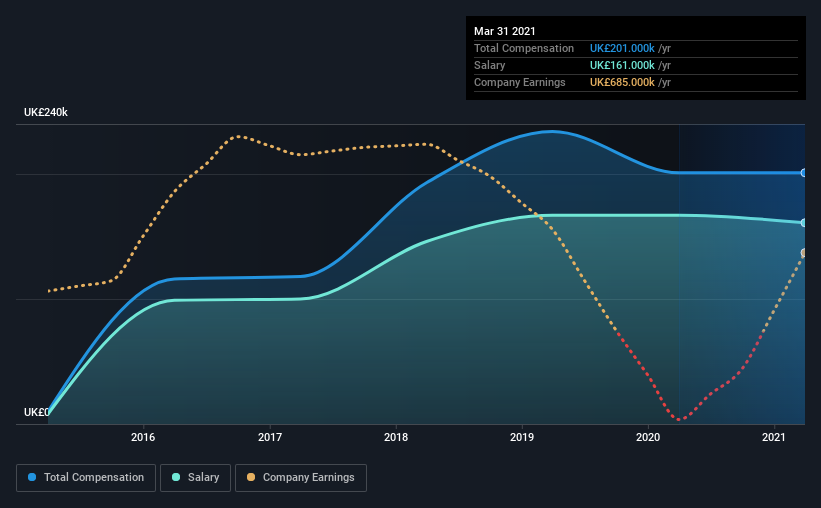

Our data indicates that Triad Group plc has a market capitalization of UK£16m, and total annual CEO compensation was reported as UK£201k for the year to March 2021. There was no change in the compensation compared to last year. We note that the salary portion, which stands at UK£161.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below UK£146m, reported a median total CEO compensation of UK£243k. So it looks like Triad Group compensates Adrian Leer in line with the median for the industry. Furthermore, Adrian Leer directly owns UK£151k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£161k | UK£167k | 80% |

| Other | UK£40k | UK£34k | 20% |

| Total Compensation | UK£201k | UK£201k | 100% |

Speaking on an industry level, nearly 66% of total compensation represents salary, while the remainder of 34% is other remuneration. According to our research, Triad Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Triad Group plc's Growth

Triad Group plc has reduced its earnings per share by 26% a year over the last three years. Its revenue is down 8.0% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Triad Group plc Been A Good Investment?

Most shareholders would probably be pleased with Triad Group plc for providing a total return of 47% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 4 warning signs (and 1 which shouldn't be ignored) in Triad Group we think you should know about.

Switching gears from Triad Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Triad Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Triad Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:TRD

Triad Group

Provides information technology consultancy services to the public, private, and not-for-profit sectors in the United Kingdom.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives