Stock Analysis

- United Kingdom

- /

- Software

- /

- LSE:PINE

High Growth Tech Stocks in the United Kingdom for October 2024

Reviewed by Simply Wall St

The United Kingdom market has remained flat over the past week but has experienced an 11% increase over the past year, with earnings projected to grow by 14% annually. In this context, a good high-growth tech stock is typically characterized by its potential to outperform market expectations and capitalize on technological advancements, offering opportunities for robust growth in an expanding economic landscape.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets with a market capitalization of £809.29 million.

Operations: GB Group generates revenue primarily through three segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million). The company's identity data intelligence services cater to various international markets, focusing on enhancing security and verification processes.

GB Group, amid its current non-profitable status, is steering towards profitability with an anticipated growth in earnings by a robust 90.6% annually. This growth trajectory starkly contrasts with the broader software industry's average, marking GB Group as a potential outlier in its sector. Despite a modest revenue increase forecast at 6.1% yearly—surpassing the UK market average of 3.5%—the company's strategic investments in R&D could catalyze further innovation and market competitiveness. Recently, GB Group has also demonstrated shareholder confidence through a dividend increase to 4.20 pence and has outlined plans to disclose semi-annual sales results soon, reflecting an active engagement with its financial growth narrative.

- Click here and access our complete health analysis report to understand the dynamics of GB Group.

Examine GB Group's past performance report to understand how it has performed in the past.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider offering solutions to the automotive industry in the UK and internationally, with a market cap of £276.76 million.

Operations: Pinewood Technologies Group PLC generates revenue primarily from its software segment, which contributes £22.62 million.

Pinewood Technologies Group's recent contract with Marshall Motor Group underscores its strategic expansion within the UK's automotive retail sector, leveraging its innovative software solutions to enhance operational efficiencies across approximately 120 dealerships. This move aligns with its reported revenue surge to £16.1 million, up from £11 million year-over-year, despite a notable dip in net income from £26.9 million to £5 million. The company's R&D investments are pivotal, fostering product development and competitive edge in a market where technological advancement is critical.

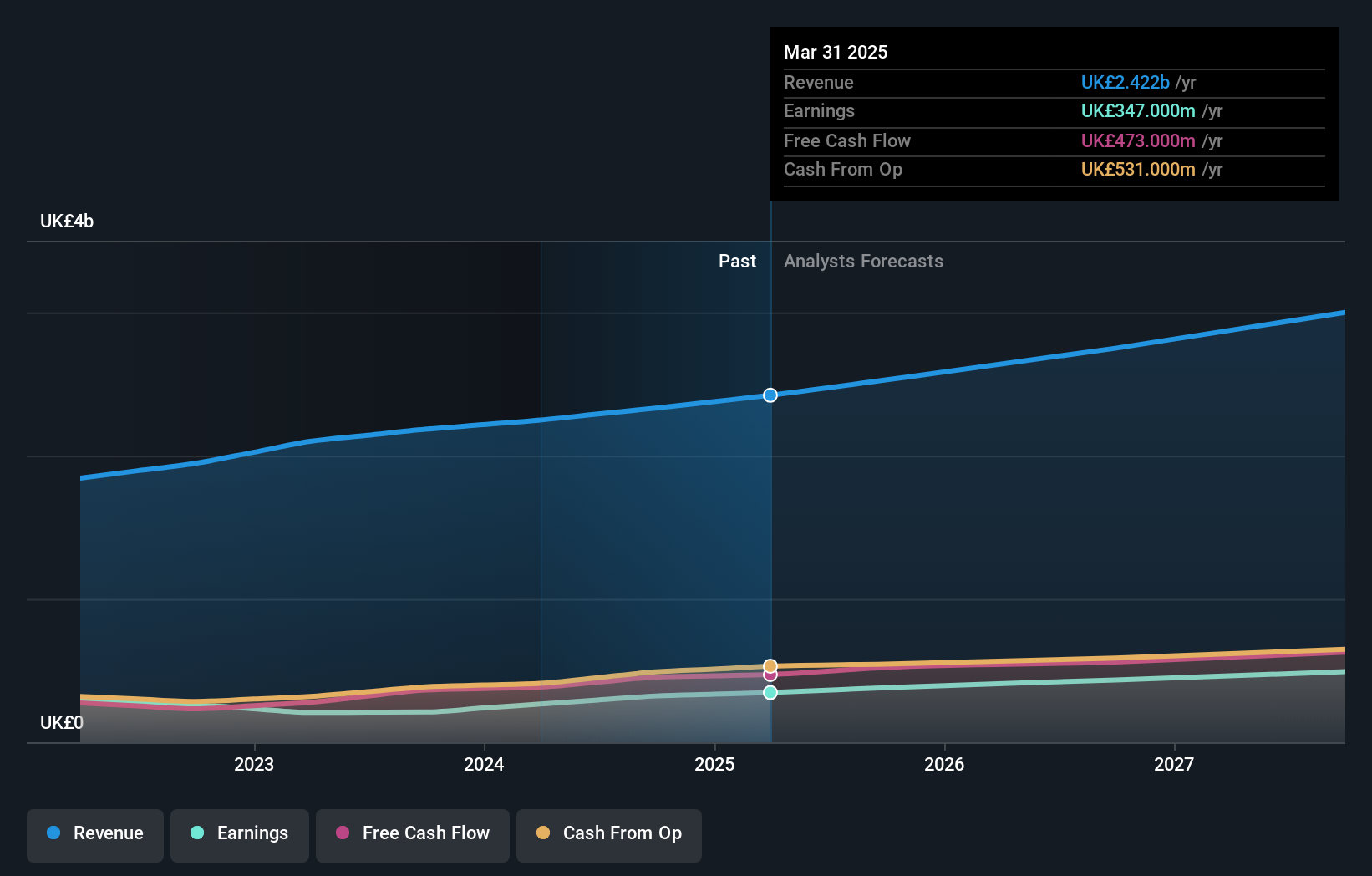

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, with a market cap of £10.26 billion, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Operations: Sage Group focuses on delivering technology solutions and services to small and medium businesses, generating significant revenue from key regions including North America (£1.01 billion) and Europe (£595 million).

Sage Group's strategic partnership with VoPay marks a significant enhancement in its payroll solutions, directly addressing the inefficiencies in SMB financial operations by integrating advanced payment technologies. This move is part of Sage's broader strategy to solidify its position within the cloud-based software market, evidenced by a robust 7.7% revenue growth projection and an impressive 15.1% anticipated annual earnings increase. The company's commitment to innovation is further underscored by R&D expenses that are strategically allocated to foster developments like these, ensuring Sage remains at the forefront of technological advancements in business software solutions.

- Navigate through the intricacies of Sage Group with our comprehensive health report here.

Evaluate Sage Group's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 49 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom and internationally.