- United Kingdom

- /

- Software

- /

- LSE:BYIT

Top Three Undervalued Small Caps With Insider Buying In September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, small-cap stocks have shown notable resilience, with the Russell 2000 Index outperforming larger counterparts despite remaining below previous peaks. This environment of lower interest rates and positive economic indicators presents a unique opportunity for investors to explore undervalued small-cap stocks. In such a dynamic market, identifying good stocks often involves looking at companies with strong fundamentals and insider buying activity, which can signal confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.8x | 1.0x | 11.72% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 22.66% | ★★★★★☆ |

| Bytes Technology Group | 26.4x | 6.0x | 6.15% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.9x | 3.8x | 19.74% | ★★★★☆☆ |

| MYR Group | 34.1x | 0.5x | 42.55% | ★★★★☆☆ |

| CVS Group | 24.2x | 1.3x | 36.74% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 40.29% | ★★★★☆☆ |

| Studsvik | 19.3x | 1.2x | 44.82% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -51.03% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

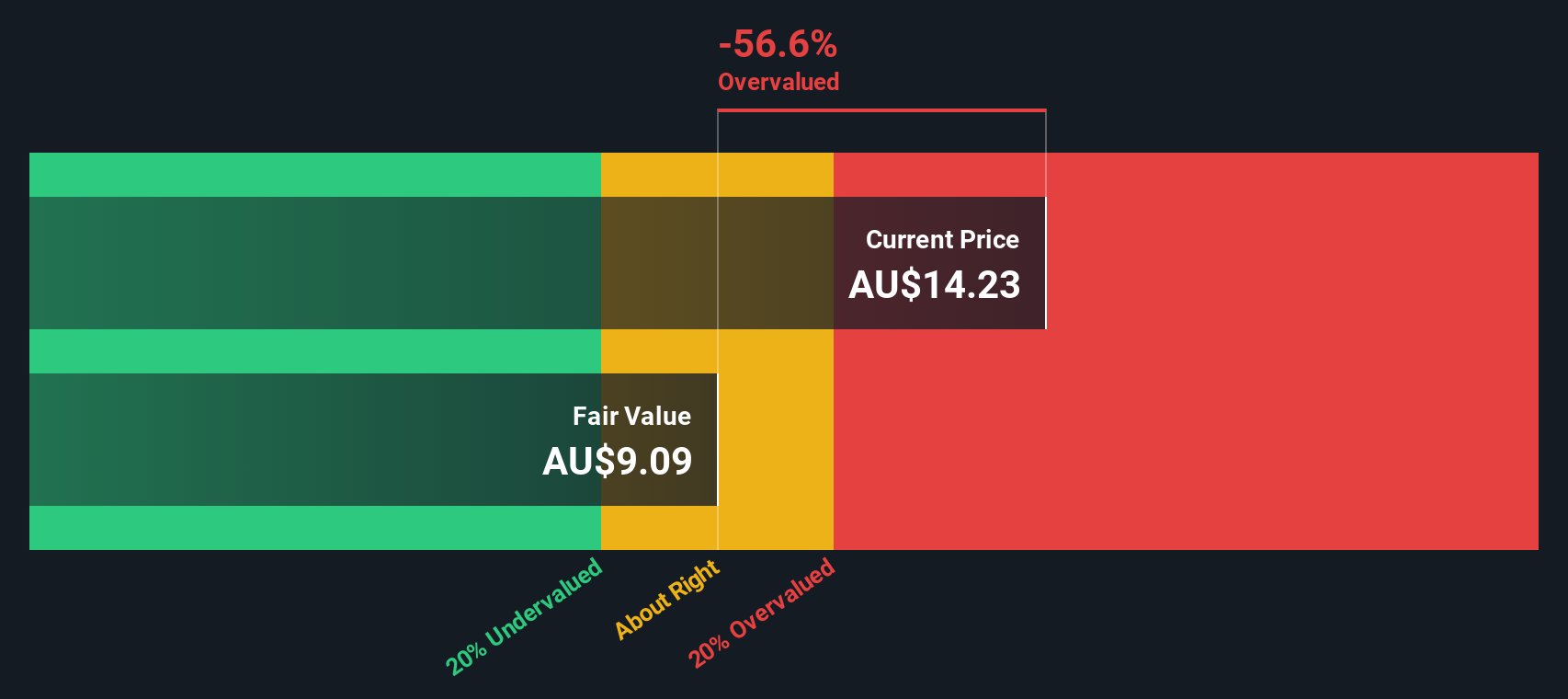

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sims is a global leader in metal and electronics recycling with diversified operations across North America, Australia/New Zealand, and other regions, boasting a market cap of A$2.50 billion.

Operations: The company's revenue streams primarily come from North America Metals (A$4.49 billion), Australia/New Zealand Metals (A$1.60 billion), and Global Trading (A$771.2 million). The cost of goods sold (COGS) significantly impacts the gross profit, which was A$744.40 million for the period ending 2024-09-23, resulting in a gross profit margin of 10.30%.

PE: 1297.1x

Sims Limited, a small cap stock, reported sales of A$7.22 billion for the year ending June 30, 2024, up from A$6.66 billion the previous year. Despite this growth, they faced a net loss of A$57.8 million compared to last year's net income of A$181.1 million due to one-off items impacting results and lower profit margins (0.02% vs 3% last year). Insider confidence is evident with recent share purchases in July 2024, indicating potential future value despite current challenges in profitability and funding risks from external borrowing sources only.

- Dive into the specifics of Sims here with our thorough valuation report.

Evaluate Sims' historical performance by accessing our past performance report.

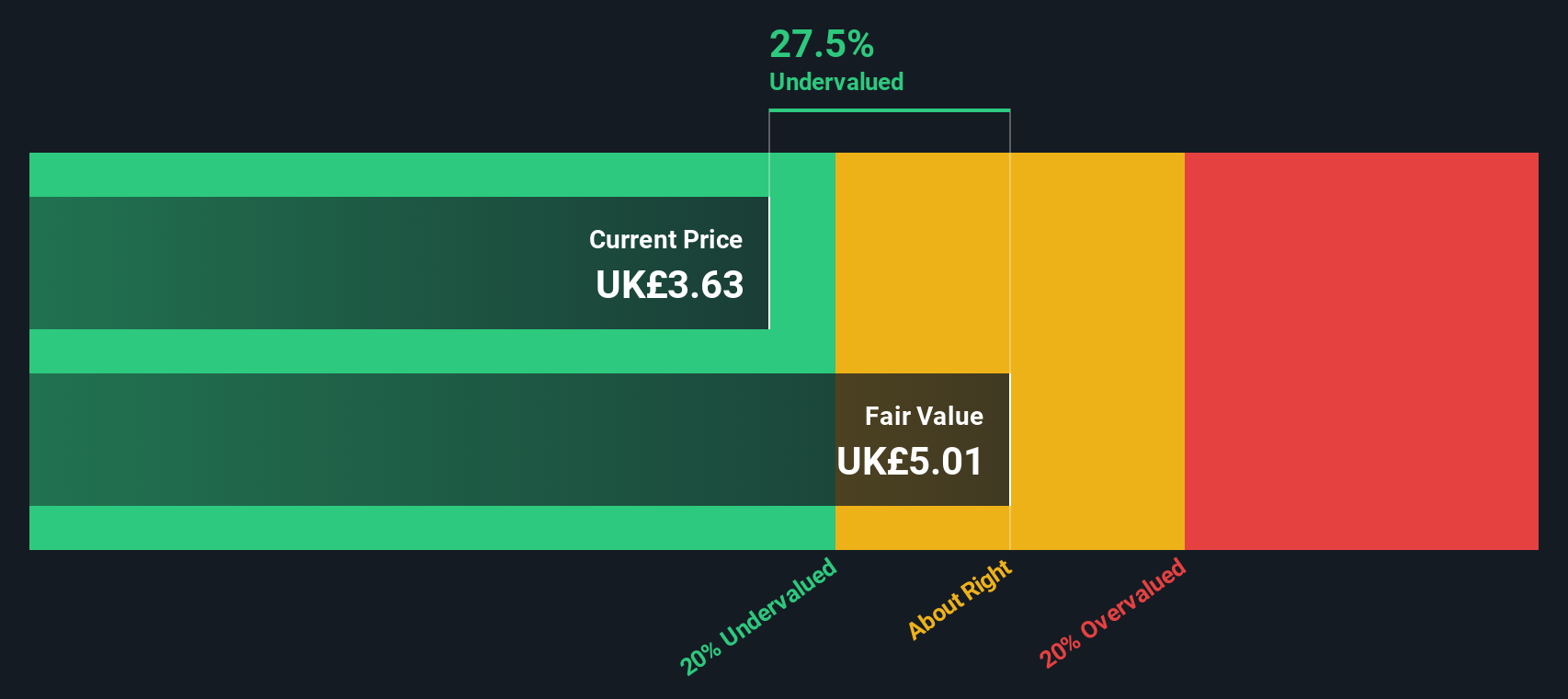

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of £1.10 billion.

Operations: Bytes Technology Group generates revenue primarily from IT solutions, with a recent figure of £207.02 million. The company has seen fluctuations in its gross profit margin, which was 70.42% as of February 2024. Operating expenses have also varied, reaching £89.07 million in the same period.

PE: 26.4x

Bytes Technology Group, a small cap stock, has shown significant insider confidence with share purchases over the past six months. The company’s recent approval of a special dividend of 8.7 pence per share and a final dividend of 6.0 pence per share at its AGM in July 2024 highlights its solid financial health. Additionally, Bytes' participation in Smarter Working Live 2024 underscores its proactive industry engagement. Earnings are projected to grow by 9% annually, indicating potential for future growth despite reliance on external borrowing for funding.

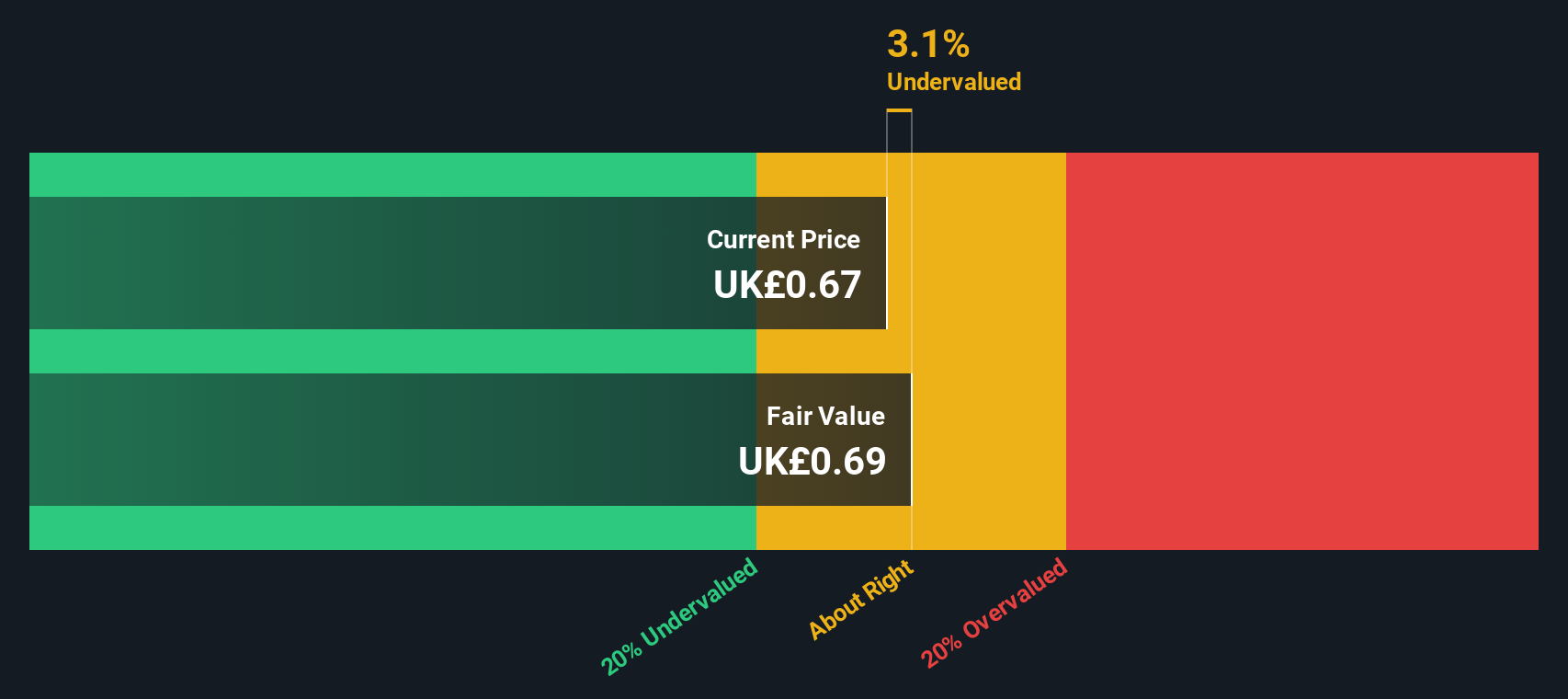

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment with a market cap of £1.52 billion.

Operations: Hays generates revenue primarily from qualified, professional, and skilled recruitment services. The company's net income margin has varied significantly over the periods, reaching as high as 2.94% in September 2018 and dropping to -0.07% by June 2024.

PE: -303.5x

Hays, a smaller player in the recruitment sector, reported a drop in sales to £6.95 billion for the year ending June 30, 2024, down from £7.58 billion the previous year. They posted a net loss of £4.9 million compared to a net income of £138.3 million previously. Despite this downturn, insider confidence is evident with recent share purchases by executives over the past quarter. The company anticipates earnings growth at 62% annually and has appointed Rachel Ford as General Counsel and Company Secretary starting August 26, 2024, bringing extensive legal expertise from her tenure at Gatwick Airport and Capita plc.

- Delve into the full analysis valuation report here for a deeper understanding of Hays.

Gain insights into Hays' past trends and performance with our Past report.

Seize The Opportunity

- Access the full spectrum of 170 Undervalued Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BYIT

Bytes Technology Group

Offers software, IT security, hardware, and cloud services in the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet and undervalued.