- United Kingdom

- /

- Software

- /

- LSE:BYIT

Bytes Technology Group (LON:BYIT) Could Be A Buy For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Bytes Technology Group plc (LON:BYIT) is about to trade ex-dividend in the next 2 days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. In other words, investors can purchase Bytes Technology Group's shares before the 10th of July in order to be eligible for the dividend, which will be paid on the 25th of July.

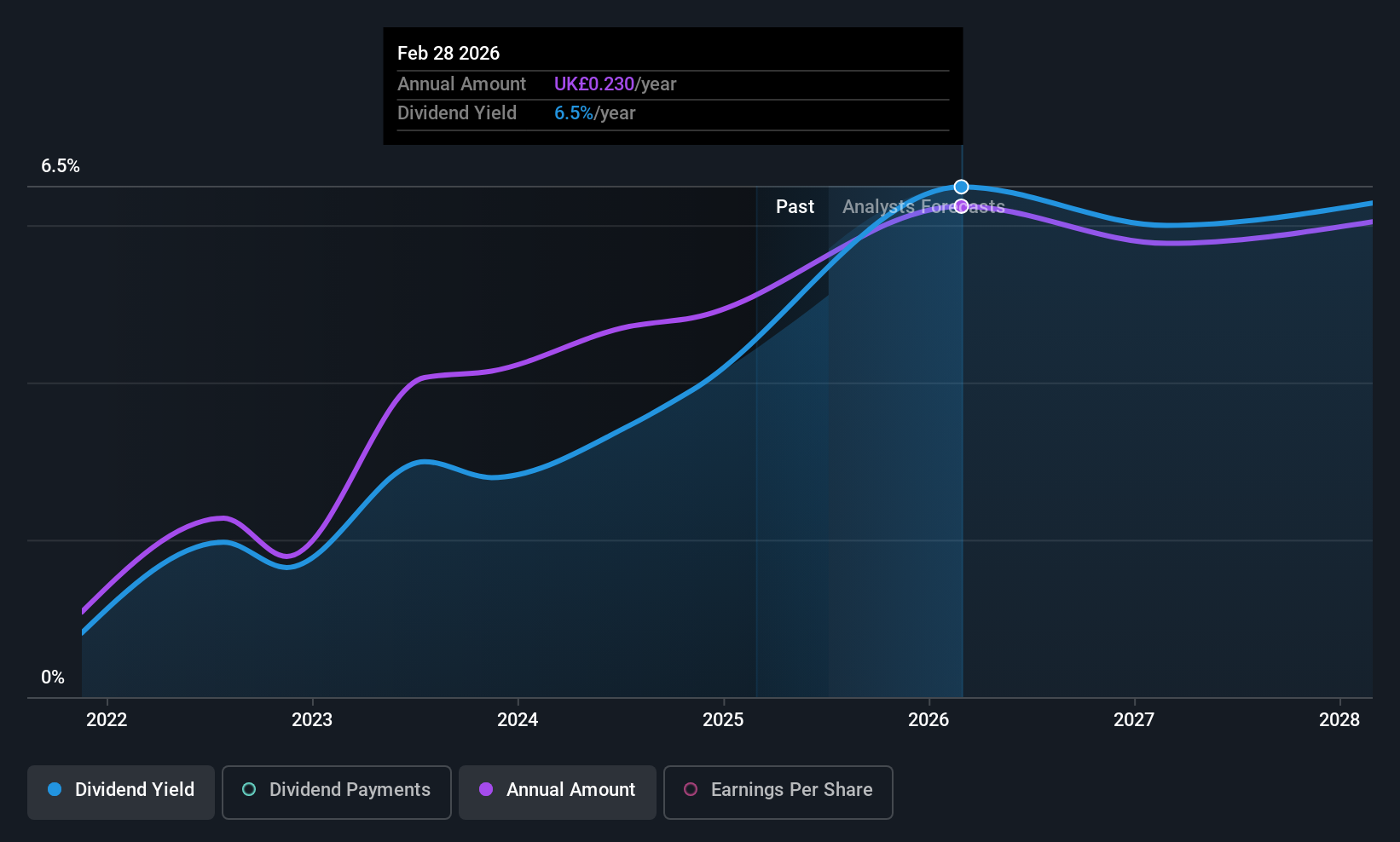

The company's next dividend payment will be UK£0.169 per share, and in the last 12 months, the company paid a total of UK£0.20 per share. Last year's total dividend payments show that Bytes Technology Group has a trailing yield of 5.6% on the current share price of UK£3.552. If you buy this business for its dividend, you should have an idea of whether Bytes Technology Group's dividend is reliable and sustainable. As a result, readers should always check whether Bytes Technology Group has been able to grow its dividends, or if the dividend might be cut.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Bytes Technology Group's payout ratio is modest, at just 44% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Thankfully its dividend payments took up just 34% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

See our latest analysis for Bytes Technology Group

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Bytes Technology Group's earnings per share have risen 17% per annum over the last five years. Earnings per share have been growing rapidly and the company is retaining a majority of its earnings within the business. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Bytes Technology Group has delivered an average of 50% per year annual increase in its dividend, based on the past four years of dividend payments. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Should investors buy Bytes Technology Group for the upcoming dividend? It's great that Bytes Technology Group is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. Bytes Technology Group looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

So while Bytes Technology Group looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. For example, we've found 2 warning signs for Bytes Technology Group that we recommend you consider before investing in the business.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BYIT

Bytes Technology Group

Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.

Nedbank please contact me,l need guidance step by step, please