- United Kingdom

- /

- Software

- /

- LSE:ARB

Argo Blockchain plc (LON:ARB) Looks Inexpensive After Falling 31% But Perhaps Not Attractive Enough

Argo Blockchain plc (LON:ARB) shares have had a horrible month, losing 31% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 10% share price drop.

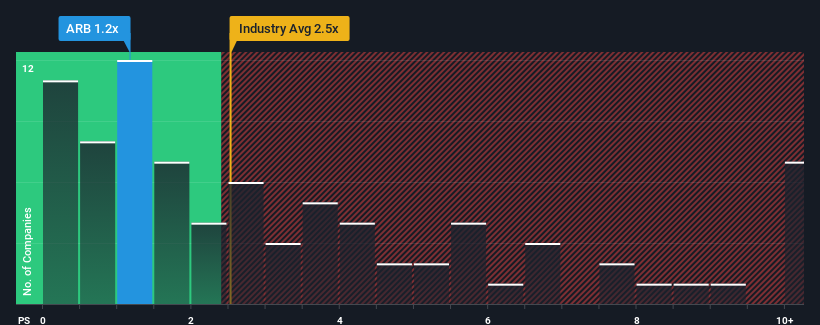

After such a large drop in price, Argo Blockchain may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Software industry in the United Kingdom have P/S ratios greater than 2.5x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Argo Blockchain

How Argo Blockchain Has Been Performing

With revenue growth that's superior to most other companies of late, Argo Blockchain has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Argo Blockchain's future stacks up against the industry? In that case, our free report is a great place to start.How Is Argo Blockchain's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Argo Blockchain's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Still, revenue has fallen 28% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 26% over the next year. With the industry predicted to deliver 9.8% growth, that's a disappointing outcome.

With this information, we are not surprised that Argo Blockchain is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Argo Blockchain's P/S

The southerly movements of Argo Blockchain's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Argo Blockchain maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Argo Blockchain's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Argo Blockchain (2 are a bit concerning!) that you need to be mindful of.

If you're unsure about the strength of Argo Blockchain's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ARB

Argo Blockchain

Engages in the bitcoin and other cryptocurrencies mining activities.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives