Stock Analysis

- United Kingdom

- /

- Media

- /

- LSE:INF

Tracsis And 2 Other High Growth Tech Stocks To Watch In The UK

Reviewed by Simply Wall St

The market in the United Kingdom has been flat in the last week, but it has risen 9.5% over the past 12 months with earnings expected to grow by 14% per annum over the next few years. In such a dynamic environment, identifying high growth tech stocks like Tracsis and others can be crucial for investors looking to capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.83% | 33.45% | ★★★★★★ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

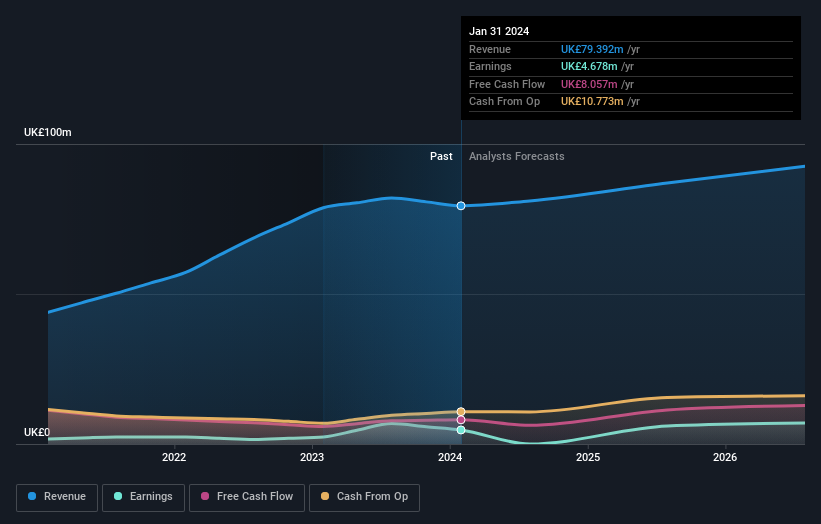

Tracsis (AIM:TRCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tracsis plc, with a market cap of £209.33 million, offers software and hardware solutions as well as data analytics/GIS services for the rail, traffic data, and transportation sectors.

Operations: Tracsis generates revenue primarily from two segments: Rail Technology & Services (£34.59 million) and Data, Analytics, Consultancy & Events (£44.80 million). The company operates in the rail, traffic data, and transportation industries through a combination of software/hardware solutions and data analytics services.

Tracsis, a standout in the UK tech sector, is experiencing significant growth with its earnings forecasted to increase by 40.6% annually over the next three years. The company has shown impressive performance, with earnings growing by 99.1% last year, far outpacing the software industry's 16.2%. Tracsis’s revenue is projected to grow at 6.3% per year, faster than the UK market's average of 3.7%. Their strategic investments in R&D underscore their commitment to innovation and future growth potential.

- Click here to discover the nuances of Tracsis with our detailed analytical health report.

Explore historical data to track Tracsis' performance over time in our Past section.

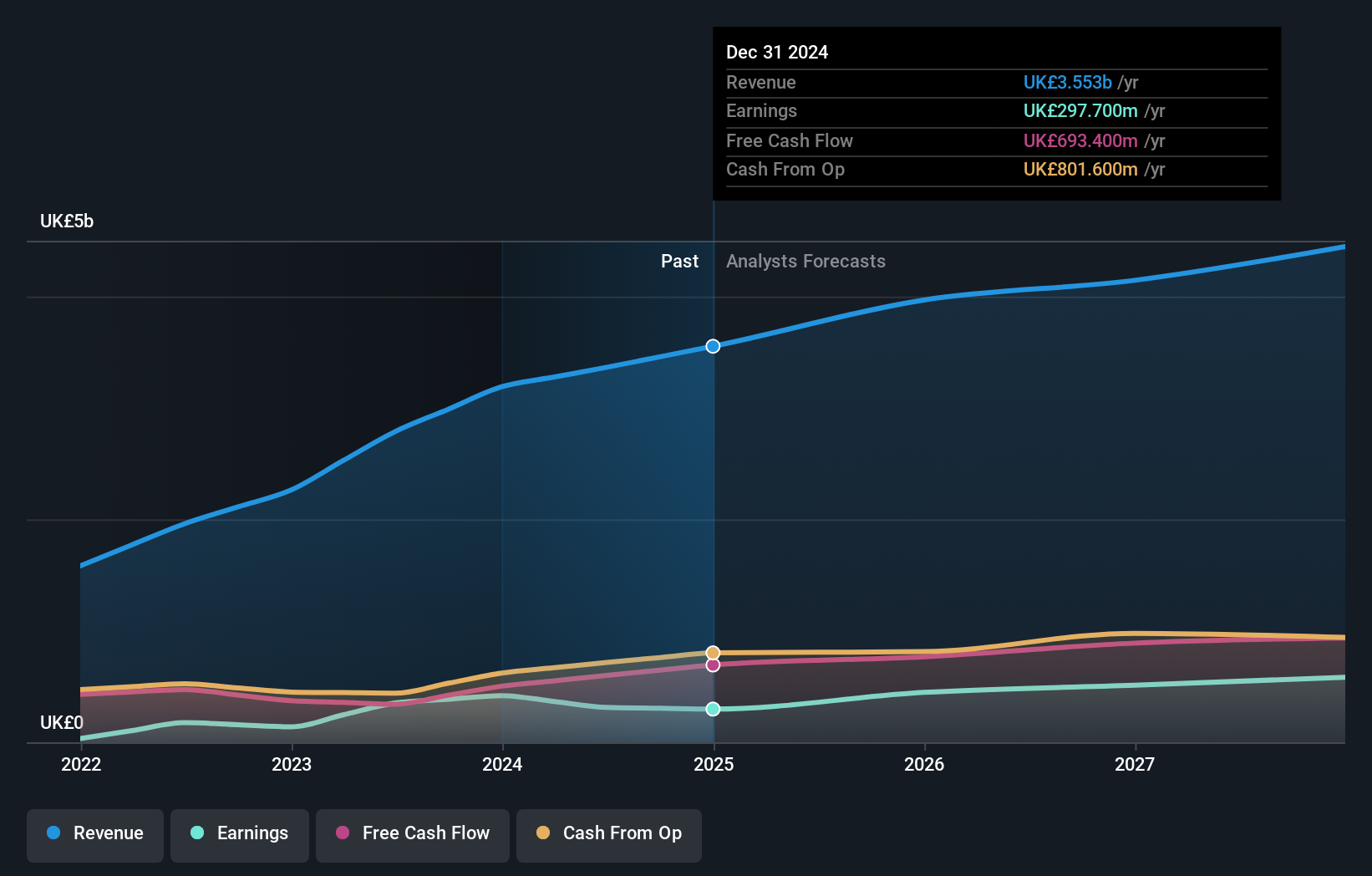

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.02 billion.

Operations: Informa generates revenue through its four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates in the events, digital services, and academic research sectors across various regions including the UK, Continental Europe, the US, and China.

Informa's strategic focus on digital transformation and event management has driven its revenue to £1.70 billion for the first half of 2024, up from £1.52 billion a year ago. Despite a net income dip to £147.3 million, the company's R&D expenses reflect a commitment to innovation, with significant investments enhancing future prospects. A notable share repurchase program saw 41.67 million shares bought back in H1 2024 for £338.9 million, signaling confidence in long-term growth potential.

- Get an in-depth perspective on Informa's performance by reading our health report here.

Gain insights into Informa's past trends and performance with our Past report.

Trustpilot Group (LSE:TRST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £877.35 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company focuses on developing and hosting an online review platform for businesses and consumers across various regions globally.

Trustpilot Group's revenue is projected to grow at 16.2% annually, significantly outpacing the UK market's 3.7% growth rate. The company has recently turned profitable and expects earnings to rise by 31.98% per year over the next three years, reflecting strong future prospects in the interactive media sector. With an R&D expenditure of £15 million in H1 2024, Trustpilot demonstrates a commitment to innovation that could drive further advancements and customer engagement on its platform.

Taking Advantage

- Get an in-depth perspective on all 46 UK High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.