- United Kingdom

- /

- Media

- /

- AIM:NEXN

High Growth Tech Stocks To Watch In The UK August 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China and broader global economic concerns. Despite these challenges, high-growth tech stocks in the UK continue to attract attention as investors seek opportunities that can thrive even amid uncertain market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 81.57% | 89.13% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

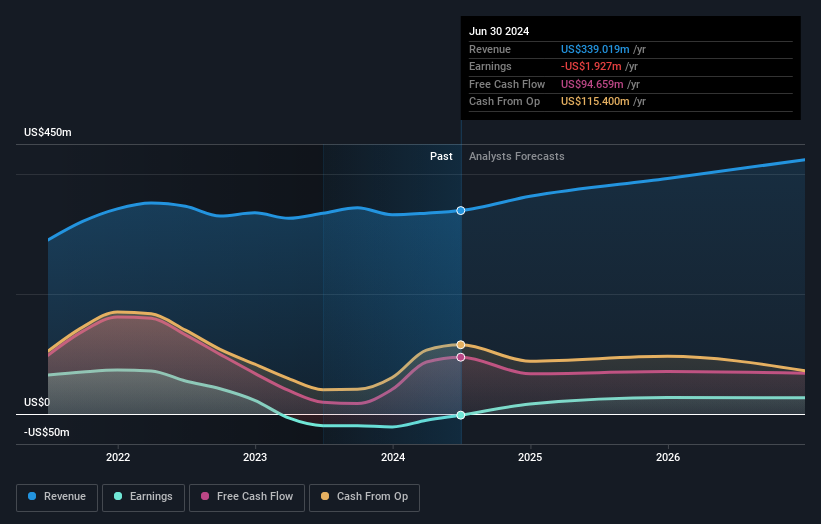

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel and has a market cap of £412.35 million.

Operations: Nexxen International Ltd. generates $334.69 million in revenue from its marketing services segment, providing an end-to-end software platform for advertisers to reach publishers in Israel.

Nexxen International's recent earnings report highlights a notable turnaround, with Q2 sales reaching $88.58 million and net income at $2.92 million compared to a net loss of $5.61 million last year. The company's strategic data partnership with The Trade Desk enhances cross-channel targeting capabilities, leveraging Nexxen's unique automatic content recognition (ACR) data segments for efficient media investments. With R&D expenses reflecting significant investment in innovation, Nexxen's revenue is forecasted to grow 8.5% annually, outpacing the UK market’s 3.7%.

Tracsis (AIM:TRCS)

Simply Wall St Growth Rating: ★★★★☆☆

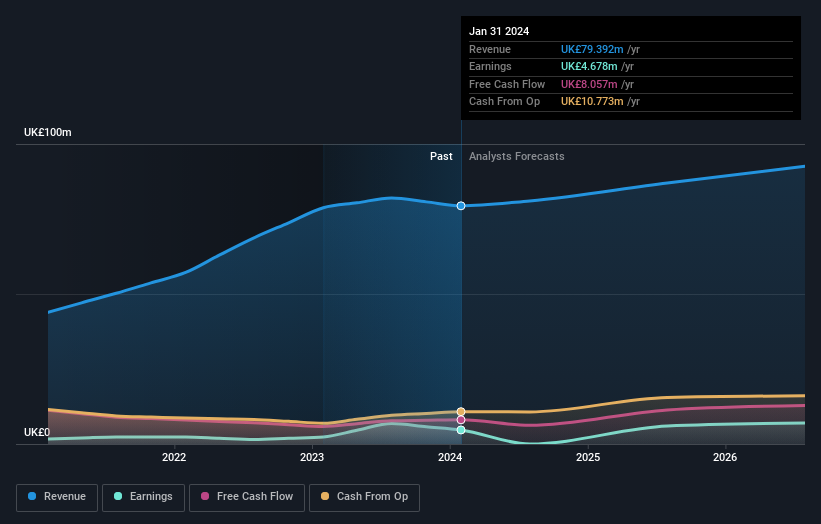

Overview: Tracsis plc, with a market cap of £197.12 million, provides software and hardware solutions along with data analytics/GIS services for the rail, traffic data, and transportation industry.

Operations: Tracsis generates revenue primarily from two segments: Rail Technology & Services (£34.59 million) and Data, Analytics, Consultancy & Events (£44.80 million). The company focuses on providing specialized software, hardware, and data analytics solutions tailored to the rail and transportation sectors.

Tracsis, a UK-based tech firm specializing in transport analytics and software, is poised for substantial growth with earnings forecasted to increase by 45.4% annually, significantly outpacing the UK market's 14.4%. The company’s recent annual revenue growth rate of 9.1% also exceeds the broader market's 3.7%. Notably, Tracsis has invested heavily in R&D, spending £6 million last year to drive innovation and maintain its competitive edge in the industry.

- Get an in-depth perspective on Tracsis' performance by reading our health report here.

Explore historical data to track Tracsis' performance over time in our Past section.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

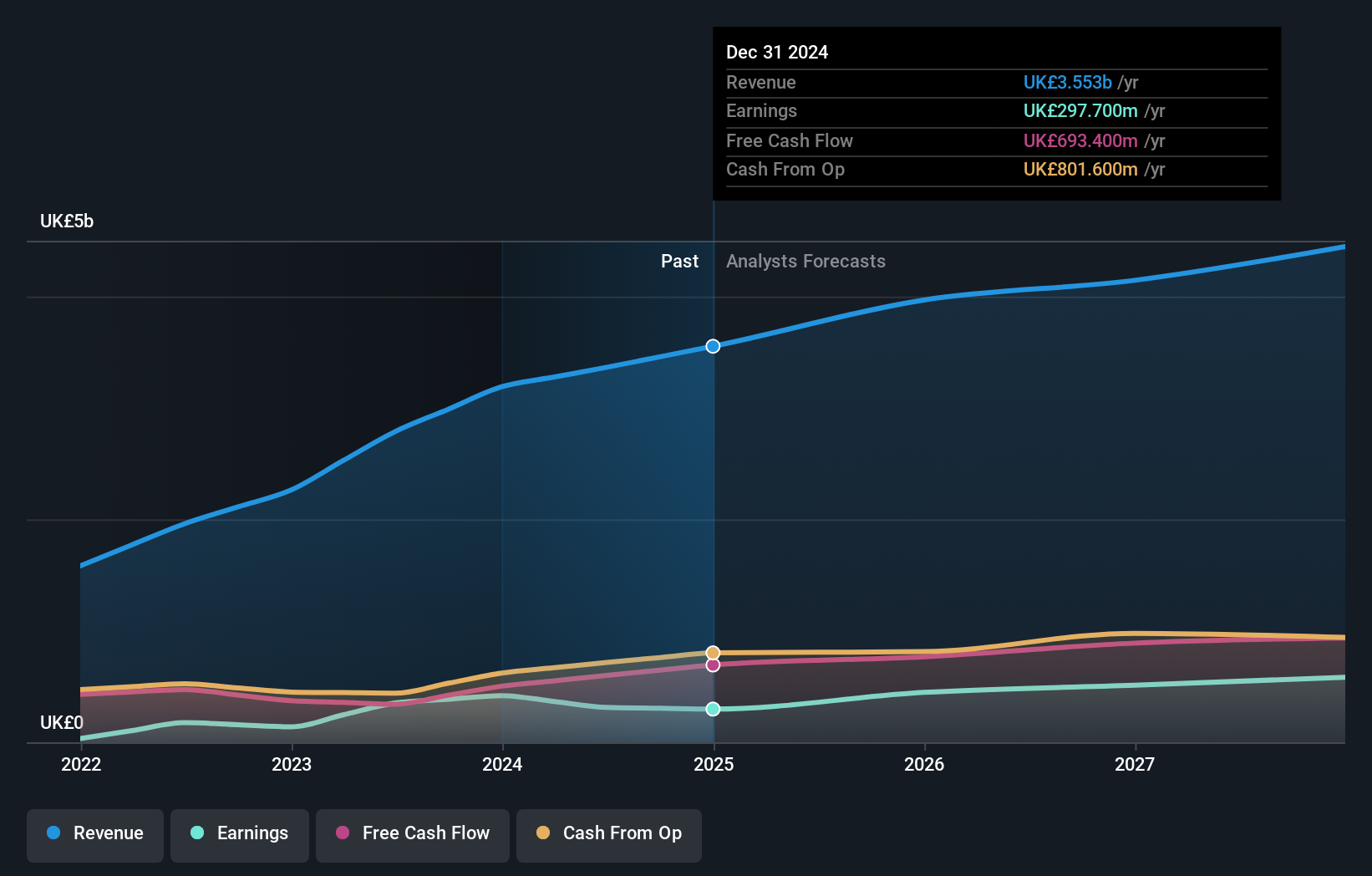

Overview: Informa plc operates as an international events, digital services, and academic research company across the United Kingdom, Continental Europe, the United States, China, and other global markets with a market cap of £10.89 billion.

Operations: Informa generates revenue from four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across various global markets, including the UK, Continental Europe, the US, and China.

Informa's earnings are expected to grow at 21.5% annually, outpacing the UK market's 14.4%, despite a recent one-off loss of £213.5 million impacting its financial results. The company’s revenue is forecasted to grow by 6.7% per year, faster than the broader market’s 3.7%. Informa has repurchased 41,673,066 shares for £338.9 million in H1 2024 and invested significantly in R&D to drive future growth and innovation within its media and events segments.

Key Takeaways

- Explore the 47 names from our UK High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexxen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NEXN

Nexxen International

Provides end-to-end software platform that enables advertisers to reach publishers Israel.

Reasonable growth potential with adequate balance sheet.