- United Kingdom

- /

- Construction

- /

- LSE:COST

Undiscovered Gems In The United Kingdom Featuring Andrews Sykes Group And Two Promising Small Caps

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced headwinds, closing lower due to weak trade data from China and declining commodity prices. Amid this broader market turbulence, discerning investors often seek out smaller-cap stocks that demonstrate resilience and potential for growth. Identifying such undiscovered gems can offer unique opportunities in a challenging economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and internationally with a market cap of £249.06 million.

Operations: The company generates revenue primarily from the hire and sale of environmental control equipment, with significant contributions from the UK (£44.61 million) and Europe (£27.59 million), along with additional income from the Middle East (£5.71 million) and installation and maintenance services (£2.11 million).

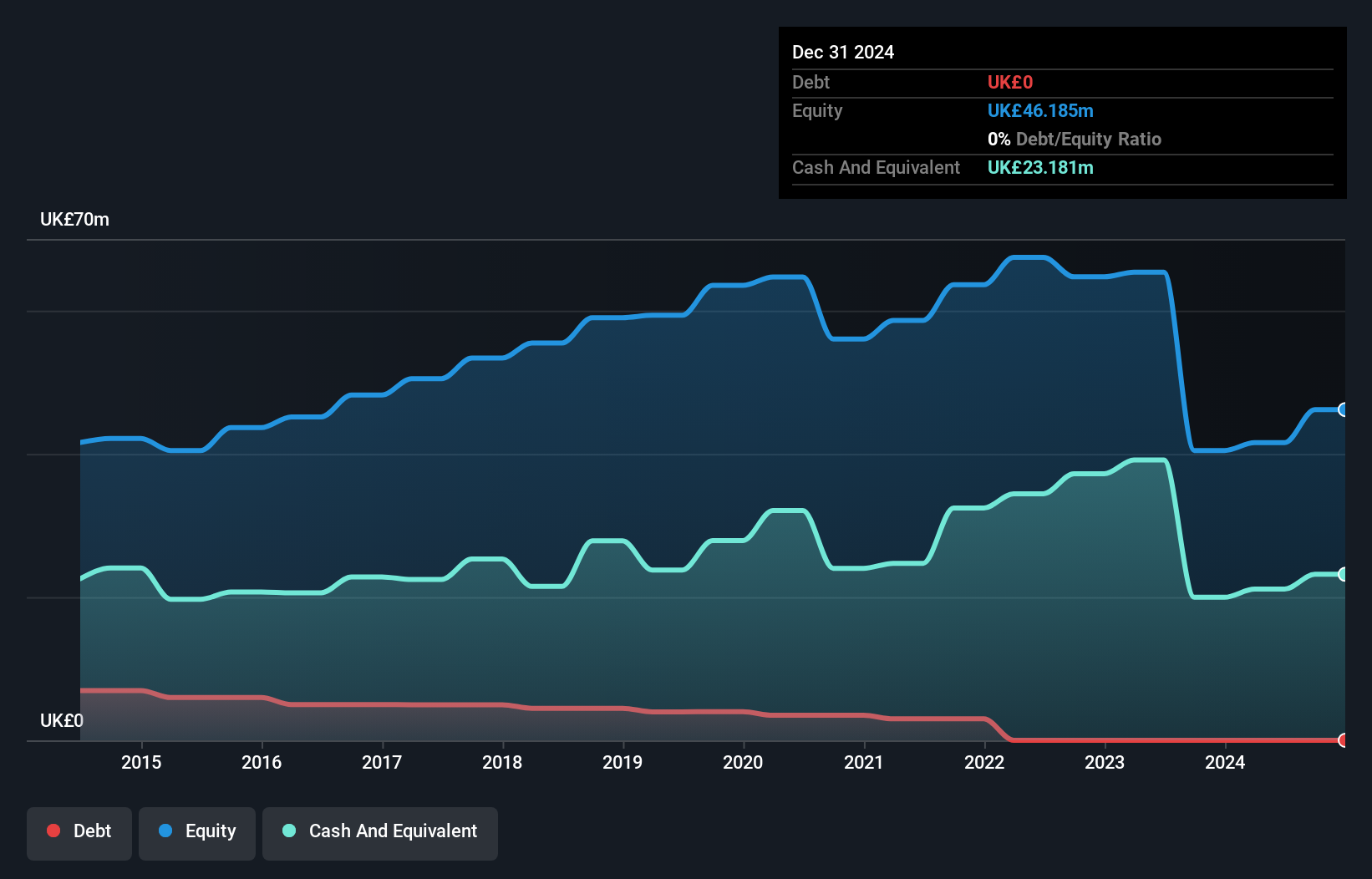

Andrews Sykes Group, a notable player in the UK market, has seen its earnings grow by 4.3% over the past year, outpacing the Trade Distributors industry which saw a -6.5% change. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 7.6%. Trading at 27% below estimated fair value, it offers potential upside for investors. Recently, it declared a final dividend of £0.14 per share to be paid on June 21, 2024.

- Unlock comprehensive insights into our analysis of Andrews Sykes Group stock in this health report.

Gain insights into Andrews Sykes Group's past trends and performance with our Past report.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and extraction of mineral properties, with a market cap of £236.47 million.

Operations: The primary revenue stream for Griffin Mining Limited comes from the Caijiaying Zinc Gold Mine, generating $146.02 million. The company focuses on mining, exploration, and development activities within this segment.

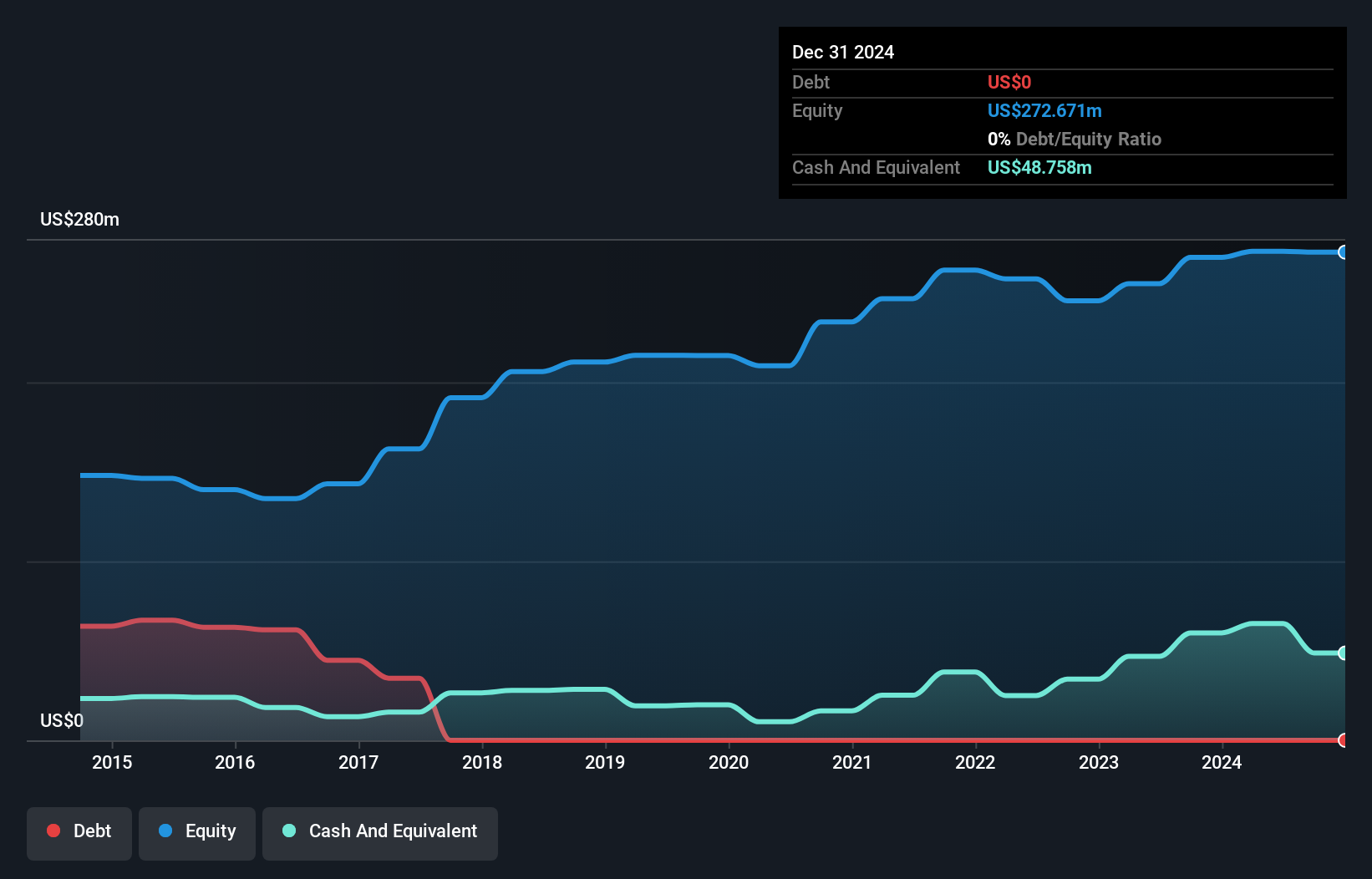

Griffin Mining shines with its impressive recent performance, reporting 429,448 tonnes of ore mined in Q2 2024, up from 366,762 tonnes last year. The company produced 14,779 tonnes of zinc concentrate and significantly increased gold output to 6,037 ounces. Trading at a substantial discount of 71% below fair value estimates and boasting earnings growth of nearly double the industry rate at 97.8%, Griffin remains debt-free and continues to generate positive free cash flow.

- Delve into the full analysis health report here for a deeper understanding of Griffin Mining.

Gain insights into Griffin Mining's historical performance by reviewing our past performance report.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC offers smart infrastructure solutions across the transportation, energy, water, and defense sectors in the United Kingdom and has a market cap of £288.21 million.

Operations: Costain Group PLC generates revenue from providing infrastructure solutions in the transportation, energy, water, and defense sectors within the United Kingdom. The company's market cap stands at £288.21 million.

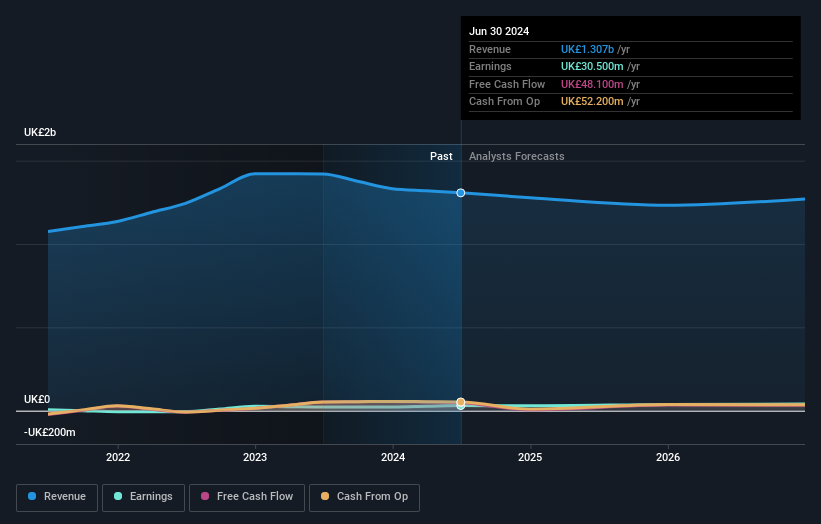

Costain Group, a UK-based construction and engineering firm, has shown robust financial health with no debt and a significant earnings growth of 39.3% over the past year, outpacing the Construction industry’s -0.7%. Trading at 50% below its estimated fair value, Costain's net income for H1 2024 was £13.5 million compared to £5.1 million last year. Additionally, an interim dividend of 0.4 pence per share was declared for shareholders as of September 13, 2024.

- Click to explore a detailed breakdown of our findings in Costain Group's health report.

Examine Costain Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Explore the 78 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COST

Costain Group

Provides smart infrastructure solutions for the transportation, energy, water, and defense markets in the United Kingdom.

Flawless balance sheet and undervalued.