- United Kingdom

- /

- IT

- /

- AIM:TPX

Industry Analysts Just Made A Sizeable Upgrade To Their The Panoply Holdings plc (LON:TPX) Revenue Forecasts

The Panoply Holdings plc (LON:TPX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline. Panoply Holdings has also found favour with investors, with the stock up a noteworthy 11% to UK£2.75 over the past week. Could this upgrade be enough to drive the stock even higher?

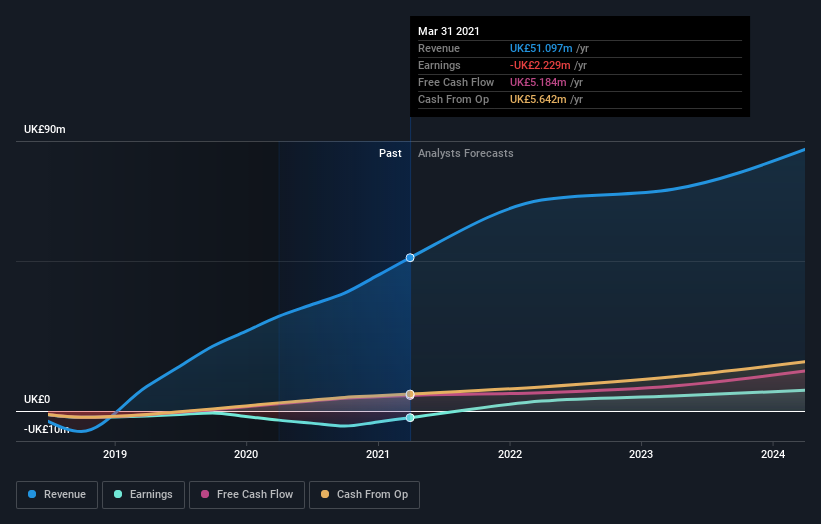

Following the upgrade, the latest consensus from Panoply Holdings' twin analysts is for revenues of UK£70m in 2022, which would reflect a major 38% improvement in sales compared to the last 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of UK£0.036 per share this year. Prior to this update, the analysts had been forecasting revenues of UK£63m and earnings per share (EPS) of UK£0.066 in 2022. Although sales sentiment looks to be improving, the analysts have made a pretty serious decline to per-share earnings estimates, showing a sharp increase in pessimism recently.

View our latest analysis for Panoply Holdings

Curiously, the consensus price target rose 12% to UK£3.06. We can only conclude that the forecast revenue growth is expected to offset the impact of the expected fall in earnings.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Panoply Holdings' revenue growth is expected to slow, with the forecast 38% annualised growth rate until the end of 2022 being well below the historical 82% p.a. growth over the last three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 9.2% per year. So it's pretty clear that, while Panoply Holdings' revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Panoply Holdings. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Panoply Holdings.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Panoply Holdings going out as far as 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Panoply Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TPXimpact Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:TPX

TPXimpact Holdings

Provides digital native technology services in the United Kingdom, Switzerland, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success