- United Kingdom

- /

- IT

- /

- AIM:TIA

There's Reason For Concern Over Tialis Essential IT PLC's (LON:TIA) Massive 30% Price Jump

Tialis Essential IT PLC (LON:TIA) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 36%.

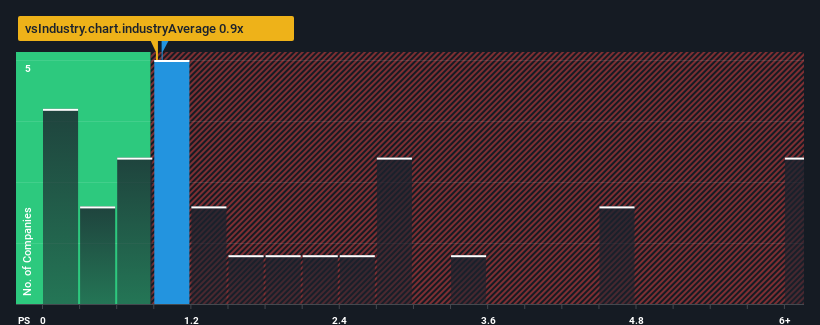

Even after such a large jump in price, there still wouldn't be many who think Tialis Essential IT's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in the United Kingdom's IT industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Tialis Essential IT

What Does Tialis Essential IT's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Tialis Essential IT's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tialis Essential IT.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Tialis Essential IT's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 7.0% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 11% over the next year. That's not great when the rest of the industry is expected to grow by 7.6%.

In light of this, it's somewhat alarming that Tialis Essential IT's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Tialis Essential IT's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Tialis Essential IT's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 3 warning signs we've spotted with Tialis Essential IT.

If these risks are making you reconsider your opinion on Tialis Essential IT, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tialis Essential IT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TIA

Tialis Essential IT

Through its subsidiaries, provides network, cloud, and IT managed services to public and private companies in the United Kingdom.

Adequate balance sheet with low risk.

Market Insights

Community Narratives