- United Kingdom

- /

- Software

- /

- AIM:SAAS

Fewer Investors Than Expected Jumping On Microlise Group plc (LON:SAAS)

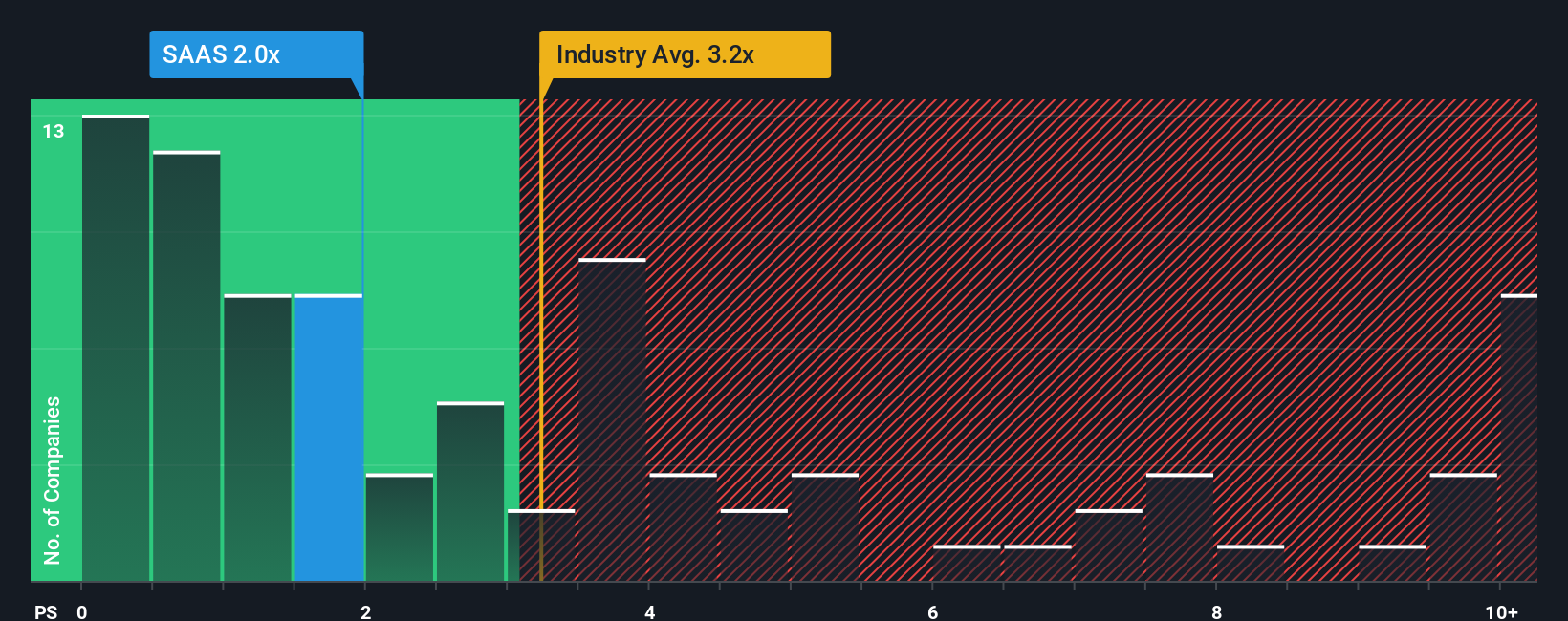

Microlise Group plc's (LON:SAAS) price-to-sales (or "P/S") ratio of 2x might make it look like a buy right now compared to the Software industry in the United Kingdom, where around half of the companies have P/S ratios above 3.2x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Microlise Group

How Microlise Group Has Been Performing

Microlise Group's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Microlise Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Microlise Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 12% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 9.4%, which is noticeably less attractive.

With this information, we find it odd that Microlise Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Microlise Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Microlise Group with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SAAS

Microlise Group

Provides transport management technology solutions in the United Kingdom, Rest of Europe, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives