- United Kingdom

- /

- Software

- /

- AIM:S247

Why Investors Shouldn't Be Surprised By Smarttech247 Group plc's (LON:S247) 68% Share Price Plunge

Smarttech247 Group plc (LON:S247) shareholders that were waiting for something to happen have been dealt a blow with a 68% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 77% share price decline.

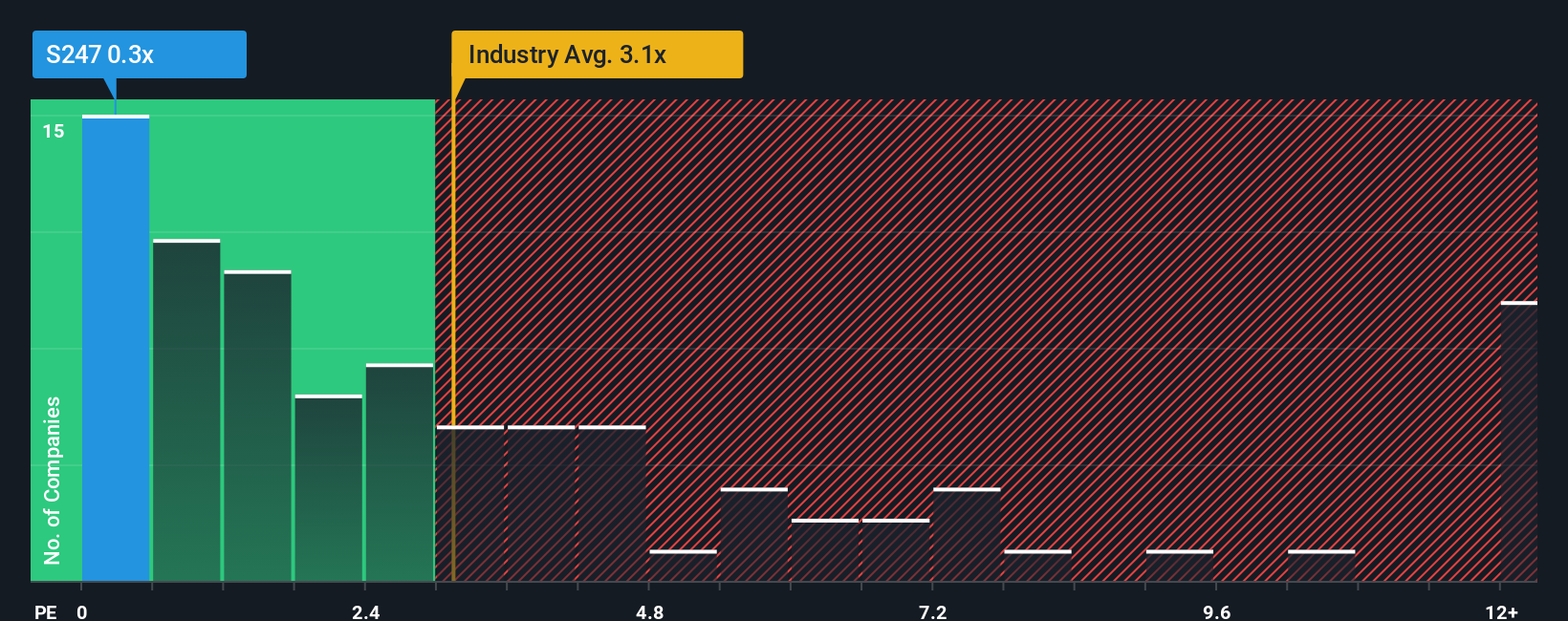

Following the heavy fall in price, Smarttech247 Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Software industry in the United Kingdom have P/S ratios greater than 3.1x and even P/S higher than 6x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Smarttech247 Group

What Does Smarttech247 Group's Recent Performance Look Like?

Recent times have been advantageous for Smarttech247 Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Smarttech247 Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Smarttech247 Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 64% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 4.4% as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 9.4% growth forecast for the broader industry.

In light of this, it's understandable that Smarttech247 Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Smarttech247 Group have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Smarttech247 Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Smarttech247 Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:S247

Smarttech247 Group

An AI-enhanced cybersecurity company that provides automated managed detection and response (MDR) services in the United Kingdom, Ireland, Romania, Poland, and the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives