- United Kingdom

- /

- Software

- /

- AIM:PEB

Pebble Beach Systems Group plc (LON:PEB) Soars 32% But It's A Story Of Risk Vs Reward

Pebble Beach Systems Group plc (LON:PEB) shares have continued their recent momentum with a 32% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

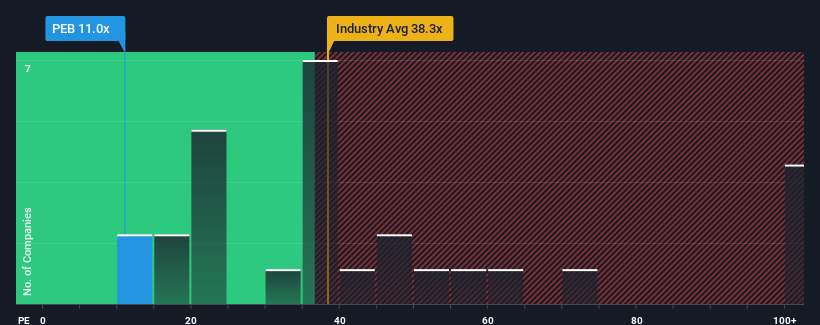

Even after such a large jump in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Pebble Beach Systems Group as an attractive investment with its 11x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Pebble Beach Systems Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Pebble Beach Systems Group

Does Growth Match The Low P/E?

Pebble Beach Systems Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 57%. Still, incredibly EPS has fallen 15% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 24% per year over the next three years. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Pebble Beach Systems Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Pebble Beach Systems Group's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Pebble Beach Systems Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Pebble Beach Systems Group (including 1 which is potentially serious).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:PEB

Pebble Beach Systems Group

Designs and delivers automation, integrated channel, and virtualized playout software solutions to the broadcast and streaming service markets.

Good value with moderate growth potential.

Market Insights

Community Narratives