- United Kingdom

- /

- Software

- /

- AIM:IDOX

Exploring IDOX And 2 More High Growth Tech Stocks In The UK

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has experienced a slight decline of 1.0%, yet it remains up by 6.9% over the past year, with earnings projected to grow by 15% annually. In this context, identifying high growth tech stocks such as IDOX and others can be crucial for investors seeking opportunities that align with these dynamic market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Pinewood Technologies Group | 20.07% | 25.09% | ★★★★★☆ |

| Windar Photonics | 79.38% | 195.81% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Oxford Biomedica | 21.02% | 93.23% | ★★★★★☆ |

| YouGov | 8.79% | 55.39% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Seeing Machines | 21.44% | 97.40% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

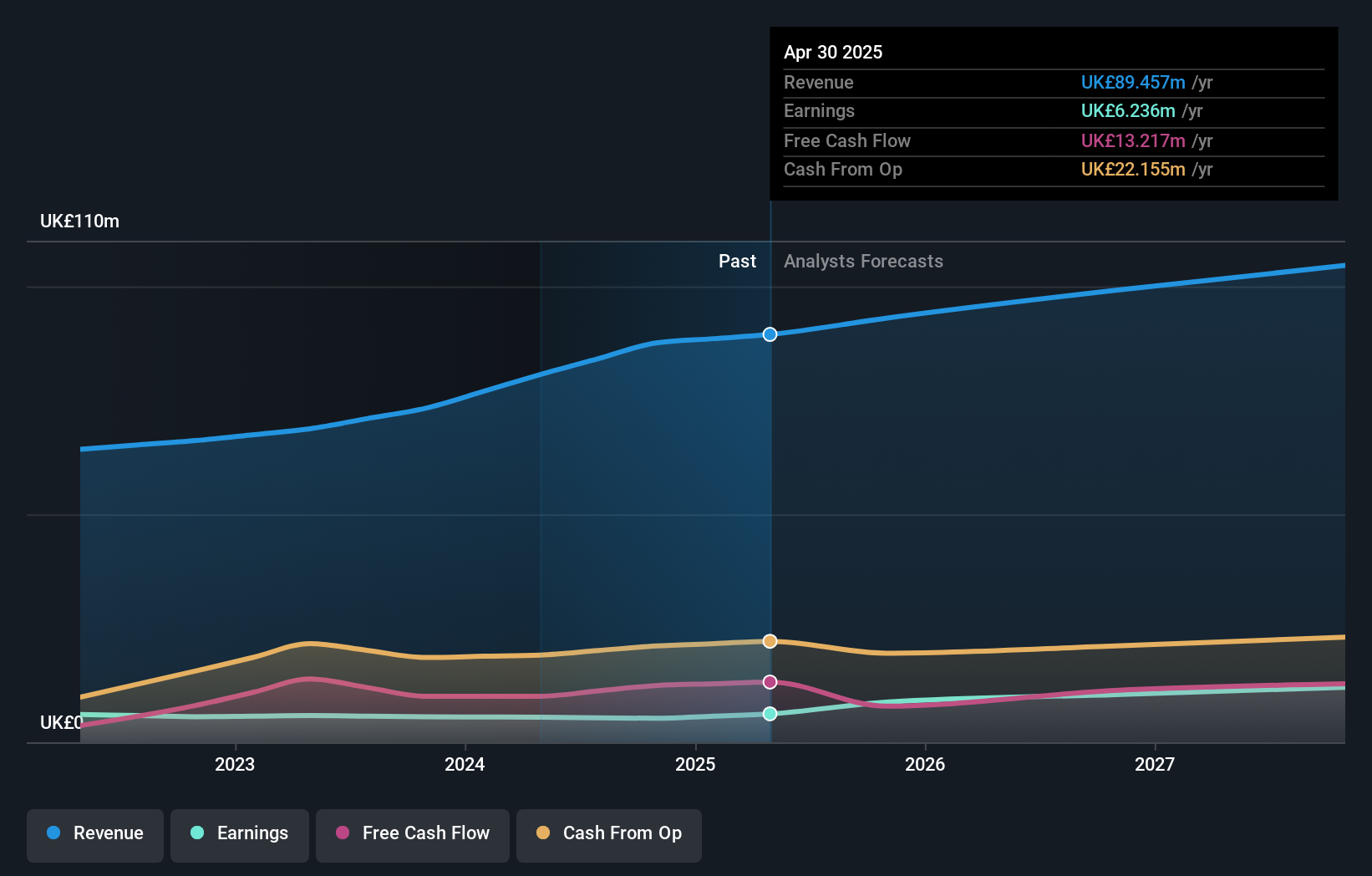

Overview: IDOX plc is a company that offers software and services for managing local government and other organizations across the UK, US, Europe, and internationally, with a market capitalization of £287.32 million.

Operations: The company generates revenue through three primary segments: Land Property & Public Protection (£50.91 million), Communities (£14.99 million), and Assets (£14.75 million).

IDOX is navigating a transformative phase with strategic executive appointments aimed at bolstering its geospatial and technology divisions, reflecting a focused drive towards digital innovation. Despite a challenging backdrop with earnings contraction of 6.4% over the past year, IDOX's revenue growth outlook remains positive at 7.4% annually, outpacing the UK market average of 3.6%. More notably, its projected earnings growth rate stands at an impressive 24.9% per year, suggesting robust future profitability aligned with strategic expansions and leadership enhancements in key business segments.

- Delve into the full analysis health report here for a deeper understanding of IDOX.

Evaluate IDOX's historical performance by accessing our past performance report.

Nexxen International (AIM:NEXN)

Simply Wall St Growth Rating: ★★★★☆☆

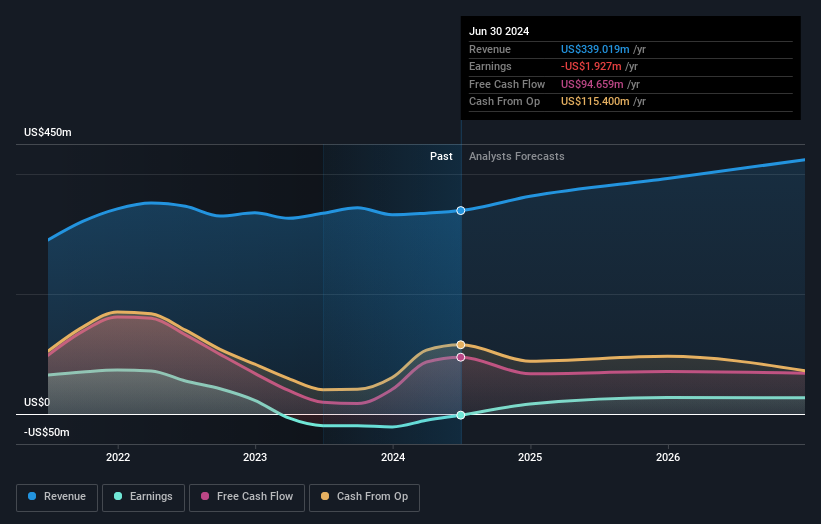

Overview: Nexxen International Ltd. offers a comprehensive software platform facilitating connections between advertisers and publishers in Israel, with a market capitalization of £388.62 million.

Operations: The company generates revenue primarily through its marketing services, amounting to $339.02 million.

Nexxen International is poised for significant growth with its expected earnings surge of 70.1% annually, outstripping the UK's average growth rate. Despite current unprofitability, its revenue growth at 8.8% per year surpasses the national market average of 3.6%, indicating a robust potential for future profitability within three years. The company recently enhanced shareholder value through an aggressive share repurchase program, buying back shares worth $50 million, which underscores management's confidence in Nexxen’s strategic direction and financial health. Additionally, the launch of Deal Marketplace demonstrates Nexxen's commitment to innovation by improving advertisers' efficiency and decision-making through advanced targeting capabilities in connected TV and online video platforms—this could redefine engagement strategies in digital advertising landscapes.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

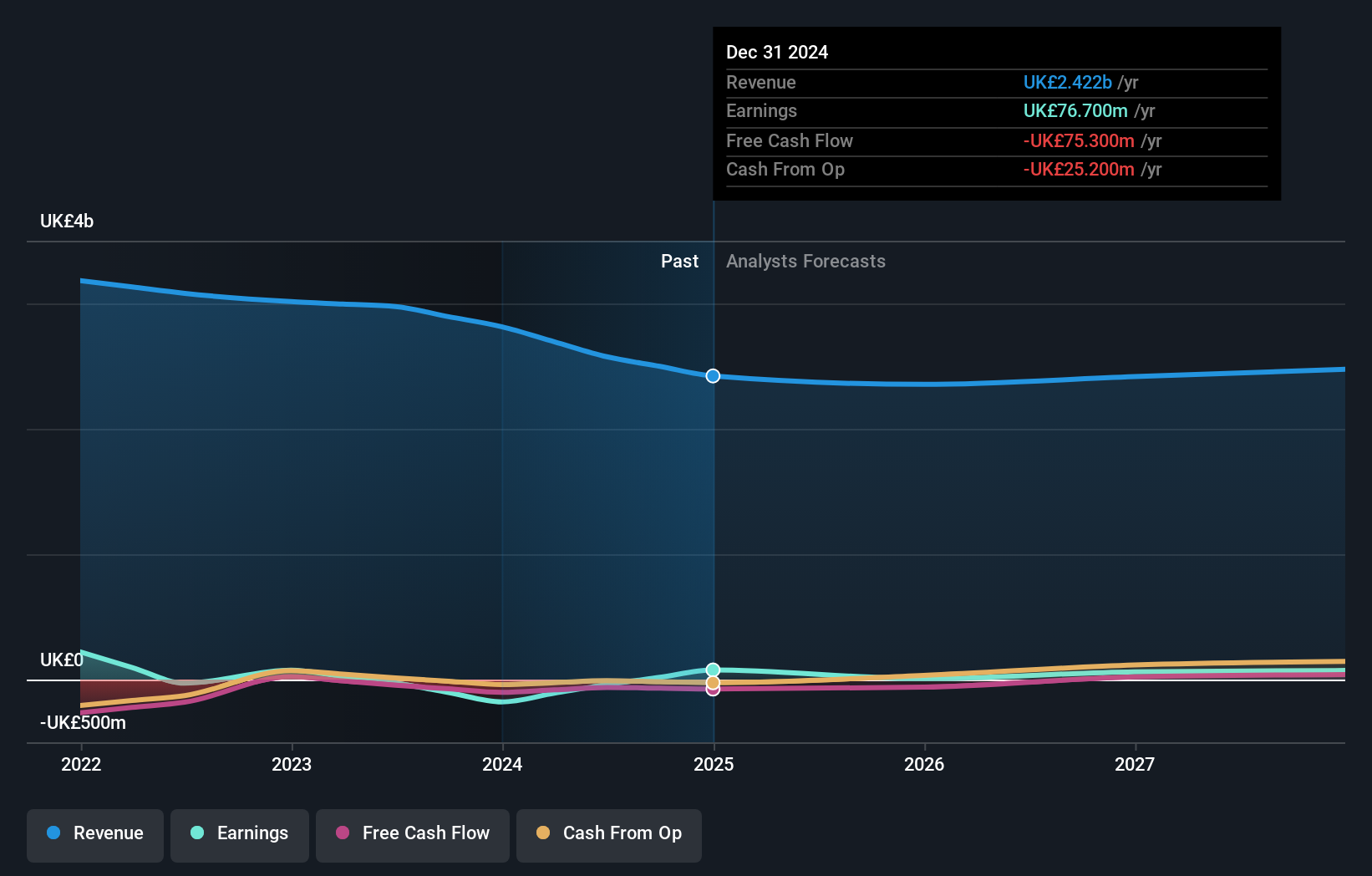

Overview: Capita plc is a company that offers consulting, digital, and software products and services to both private and public sector clients in the UK and internationally, with a market cap of £285 million.

Operations: Capita generates revenue primarily from its Capita Experience and Capita Public Service segments, with contributions of £1.12 billion and £1.49 billion respectively.

Capita, amidst a challenging landscape for UK tech firms, is showing promising signs of growth with its strategic focus on expanding smart technologies. The company's recent extension of its Data Communications Company License to manage the UK's smart meter communications highlights a significant commitment to innovation, securing a contract worth up to £135 million. This move not only strengthens Capita’s position in tech services but also ensures steady revenue flow through 2027. Furthermore, the appointment of Jack Clarke as Independent Non-Executive Director underscores a refreshed strategic direction aimed at enhancing governance and operational efficiency. With earnings forecasted to grow by 55.2% annually and R&D expenses consistently aligned with technological advancements—evidenced by an investment surge in this sector—Capita is poised to harness these developments for future growth, despite currently trailing with a modest annual revenue increase of 1.3%.

- Click to explore a detailed breakdown of our findings in Capita's health report.

Gain insights into Capita's historical performance by reviewing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 46 UK High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IDOX

IDOX

Through its subsidiaries, provides software and services for the management of local government and other organizations in the United Kingdom, the United States, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.