- United Kingdom

- /

- Software

- /

- AIM:GETB

If You Had Bought GetBusy (LON:GETB) Shares Three Years Ago You'd Have Earned 137% Returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the GetBusy Plc (LON:GETB) share price is 137% higher than it was three years ago. That sort of return is as solid as granite. We note the stock price is up 8.9% in the last seven days.

View our latest analysis for GetBusy

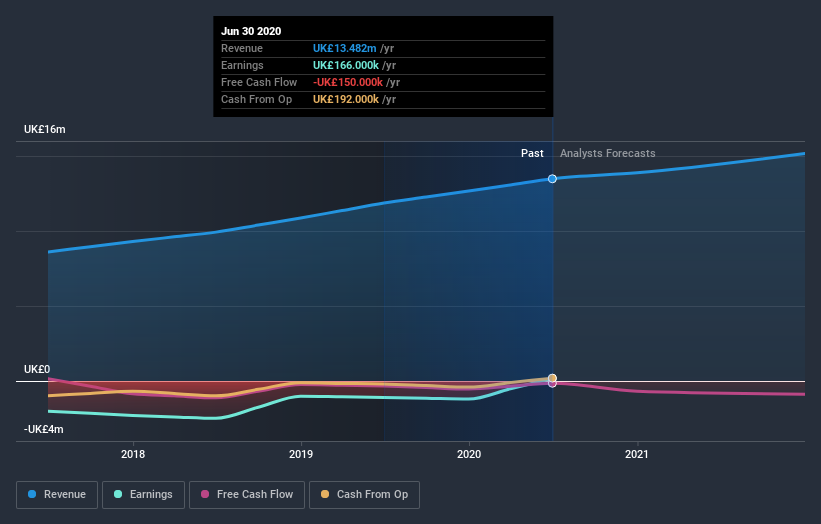

Given that GetBusy only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

GetBusy's revenue trended up 15% each year over three years. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 33% per year. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling GetBusy stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that GetBusy shareholders have gained 67% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 33%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand GetBusy better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for GetBusy you should know about.

GetBusy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading GetBusy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:GETB

GetBusy

Provides productivity software for professional and financial services in the United Kingdom, the United States, Australia, and New Zealand.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives