Stock Analysis

- United Kingdom

- /

- Hospitality

- /

- LSE:ROO

UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The UK stock market has been facing challenges, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting concerns over global economic recovery. Despite these broader market pressures, penny stocks—often representing smaller or newer companies—continue to offer unique growth opportunities at lower price points. By focusing on those with strong financial health and solid fundamentals, investors can potentially uncover hidden gems in this niche area of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.12 | £95.58M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.302 | £200.81M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.30 | £427.66M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.436 | $253.46M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.07 | £81.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.18 | £480.53M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Brand Architekts Group (AIM:BAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brand Architekts Group plc is a company in the beauty sector with operations in the United Kingdom, other European Union countries, and internationally, holding a market cap of £13.05 million.

Operations: The company generates revenue from Innovaderma Brands, contributing £3.16 million, and Brand Architekt Brands, which accounts for £13.87 million.

Market Cap: £13.05M

Brand Architekts Group plc, with a market cap of £13.05 million, recently announced an acquisition agreement with Warpaint London PLC for £13.4 million. Despite unprofitability and declining earnings over the past five years, the company maintains a debt-free status and has sufficient cash runway exceeding three years based on current free cash flow. Revenues from Innovaderma Brands and Brand Architekt Brands total £17.03 million for the year ended June 2024, down from £20.09 million previously, while net losses have narrowed to £1.46 million from £6.59 million last year amidst high share price volatility and negative return on equity at -5.62%.

- Jump into the full analysis health report here for a deeper understanding of Brand Architekts Group.

- Explore historical data to track Brand Architekts Group's performance over time in our past results report.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market cap of £284.14 million.

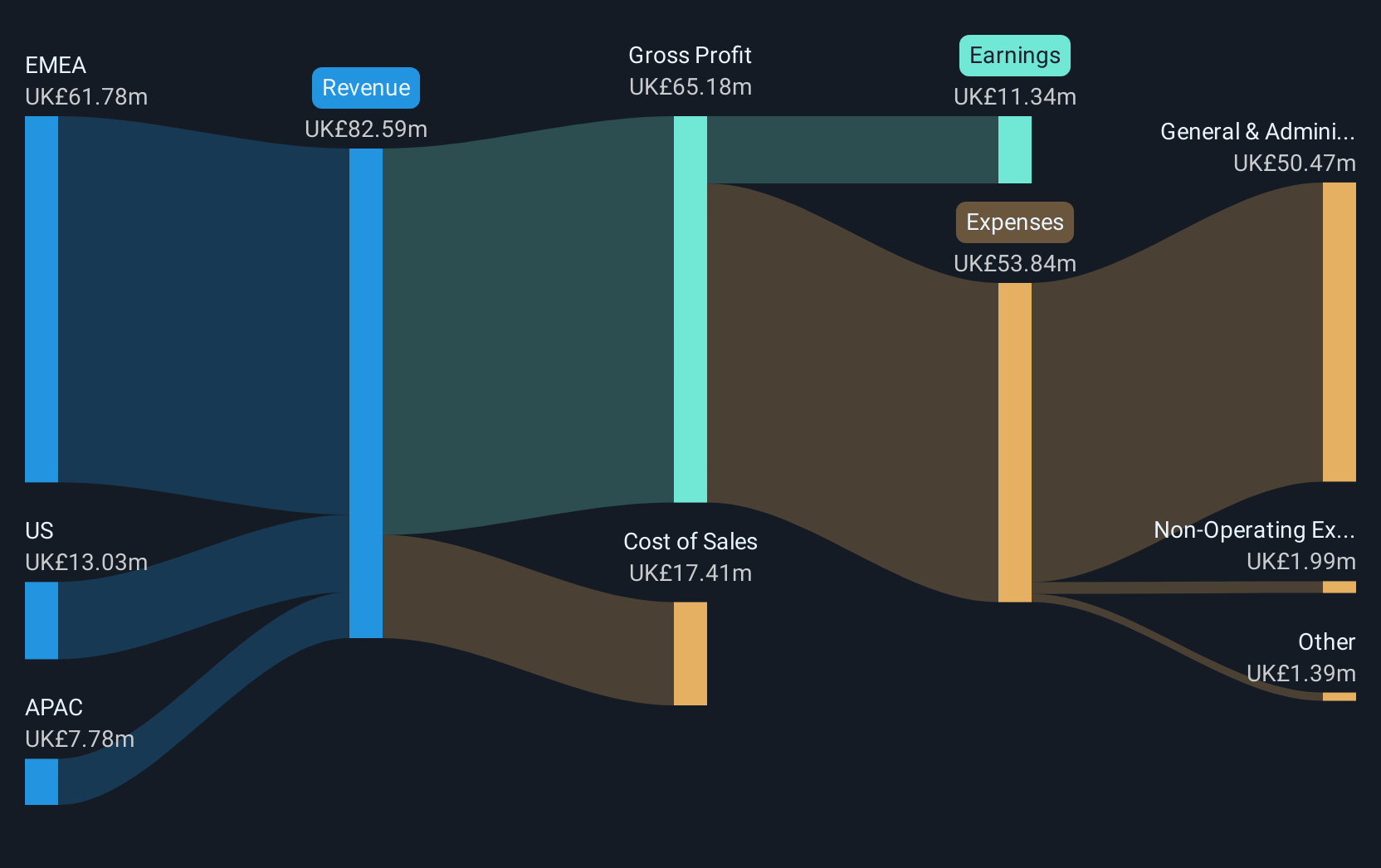

Operations: The company generates £78.97 million in revenue from its data-driven omni-channel marketing automation services.

Market Cap: £284.14M

dotdigital Group Plc, with a market cap of £284.14 million, reported revenue growth to £78.97 million for the year ended June 2024 but experienced a decline in net income to £11.07 million from the previous year. Despite this, it maintains a strong financial position with short-term assets exceeding both short and long-term liabilities and remains debt-free. The company offers high-quality earnings and is trading below its estimated fair value, although recent negative earnings growth contrasts with industry averages. Analysts expect future earnings growth, while the board and management team are seasoned with significant tenure experience.

- Take a closer look at dotdigital Group's potential here in our financial health report.

- Gain insights into dotdigital Group's future direction by reviewing our growth report.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online food delivery platform across several countries including the United Kingdom, Ireland, and France, with a market cap of £2.31 billion.

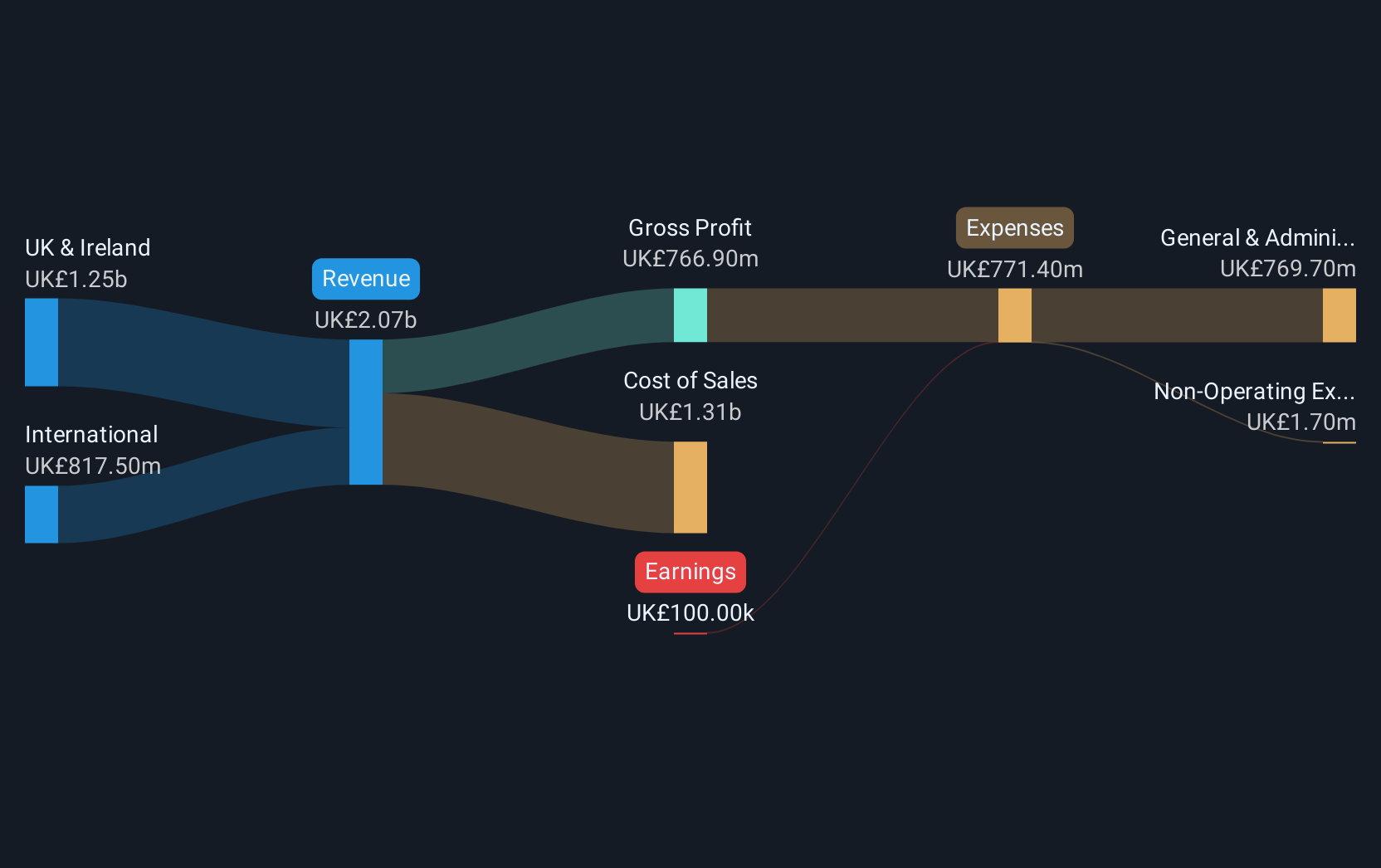

Operations: The company's revenue is primarily generated from the operation of its on-demand food delivery platform, totaling £2.04 billion.

Market Cap: £2.31B

Deliveroo plc, with a market cap of £2.31 billion, has recently achieved profitability, marking a significant shift in its financial trajectory. The company operates debt-free, with short-term assets (£834.5M) comfortably exceeding both short and long-term liabilities. Despite this strong balance sheet position, Deliveroo's Return on Equity remains low at 9.9%, and recent insider selling raises concerns about potential future performance. The board is experienced; however, the management team lacks tenure depth, indicating recent changes in leadership structure. Trading significantly below its estimated fair value suggests potential undervaluation opportunities for investors considering penny stocks.

- Click to explore a detailed breakdown of our findings in Deliveroo's financial health report.

- Review our growth performance report to gain insights into Deliveroo's future.

Next Steps

- Access the full spectrum of 470 UK Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ROO

Deliveroo

A holding company, operates an online food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.