- United Kingdom

- /

- Software

- /

- AIM:BIRD

If You Had Bought Blackbird (LON:BIRD) Shares Three Years Ago You'd Have Earned 393% Returns

It hasn't been the best quarter for Blackbird plc (LON:BIRD) shareholders, since the share price has fallen 15% in that time. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 393%. As long term investors the recent fall doesn't detract all that much from the longer term story. The thing to consider is whether there is still too much elation around the company's prospects.

Check out our latest analysis for Blackbird

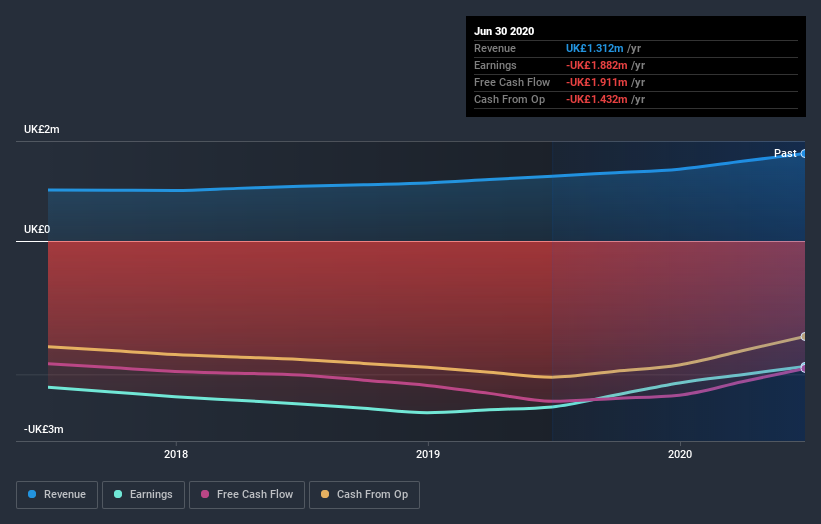

Given that Blackbird didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Blackbird saw its revenue grow at 18% per year. That's pretty nice growth. Some shareholders might think that the share price rise of 70% per year is a lucky result, considering the level of revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Blackbird's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Blackbird shareholders have received a total shareholder return of 17% over the last year. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Blackbird you should be aware of.

Blackbird is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Blackbird or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Blackbird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BIRD

Blackbird

Develops and operates a cloud-based video editing and publishing software platform under the Blackbird name in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives