Stock Analysis

- United Kingdom

- /

- Healthtech

- /

- AIM:IUG

3 UK Penny Stocks With Market Caps Below £200M To Consider

Reviewed by Simply Wall St

The UK market has been flat over the last week, but it is up 10% over the past year, with earnings expected to grow by 14% annually. The term 'penny stocks' might feel like a relic of past market eras, but they continue to offer potential for investors seeking affordability and growth. These stocks typically refer to smaller or newer companies that can provide an underappreciated chance for growth when paired with strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.975 | £190.6M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £794.96M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £404.29M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.525 | £176.67M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.29 | £302.86M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.51 | £196.12M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.474 | £229.49M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.39 | £121.5M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.906 | £70.43M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.464 | $265.96M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service solution across various industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific, with a market cap of £90.99 million.

Operations: ActiveOps generates revenue through its Software as a Service (SaaS) offerings, contributing £23.79 million, and Training & Implementation services, which add £2.99 million.

Market Cap: £90.99M

ActiveOps, with a market cap of £90.99 million, has shown financial stability and growth potential as a penny stock. The company became profitable this year, with revenues from SaaS offerings (£23.79 million) and Training & Implementation services (£2.99 million). It is debt-free, with short-term assets exceeding both short-term and long-term liabilities. Revenue is forecasted to grow by 7.97% annually despite earnings expected to decline by 4% over the next three years. Recent board changes aim to enhance leadership depth and US market expertise, potentially supporting future strategic initiatives in financial services and healthcare sectors.

- Dive into the specifics of ActiveOps here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into ActiveOps' future.

Intelligent Ultrasound Group (AIM:IUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intelligent Ultrasound Group plc develops, markets, and distributes medical training simulators globally, with a market cap of £37.22 million.

Operations: The company's revenue is derived from two segments: Simulation, which generated £7.34 million, and Clinical AI, contributing £2.83 million.

Market Cap: £37.22M

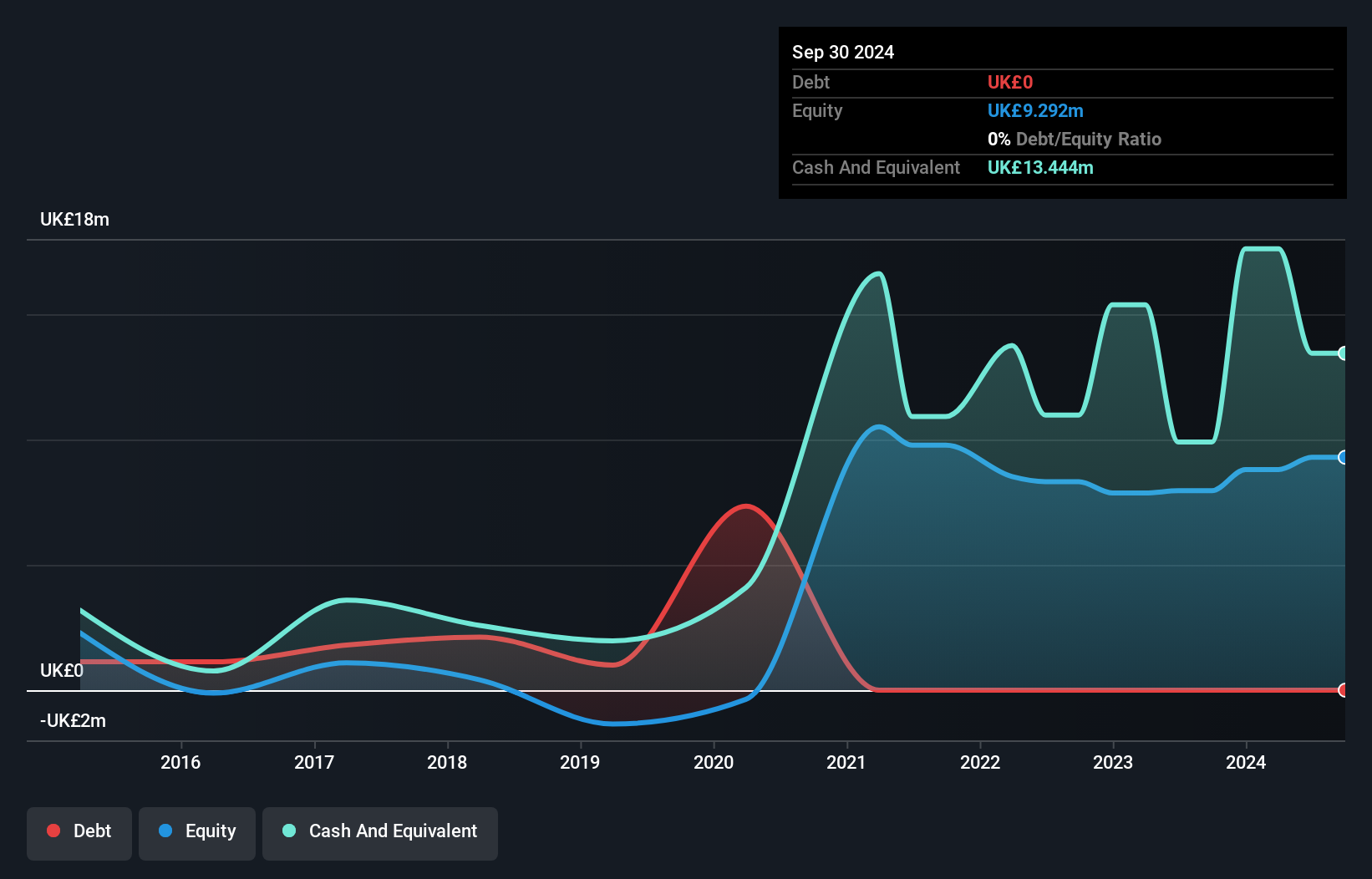

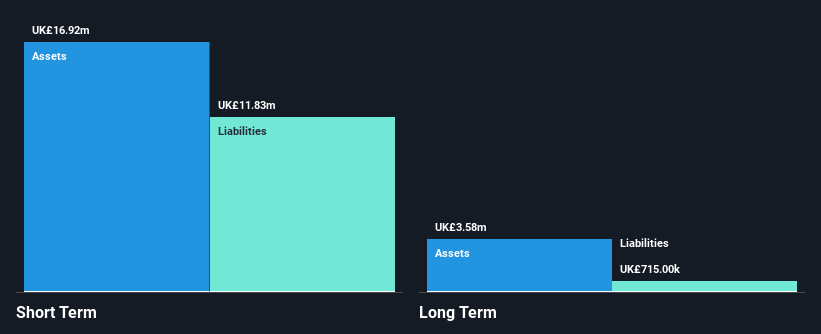

Intelligent Ultrasound Group, with a market cap of £37.22 million, operates in the medical training simulator sector and reported half-year sales of £4.54 million, down from £5.84 million the previous year. Despite being unprofitable with a net loss of £1.99 million for the period, its short-term assets (£16.9M) surpass both short-term (£11.8M) and long-term liabilities (£715K), indicating financial resilience without debt burdens. The company has less than one year of cash runway based on current free cash flow but benefits from an experienced board and management team to navigate future challenges amidst reduced weekly volatility in stock performance.

- Get an in-depth perspective on Intelligent Ultrasound Group's performance by reading our balance sheet health report here.

- Assess Intelligent Ultrasound Group's previous results with our detailed historical performance reports.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £185.14 million.

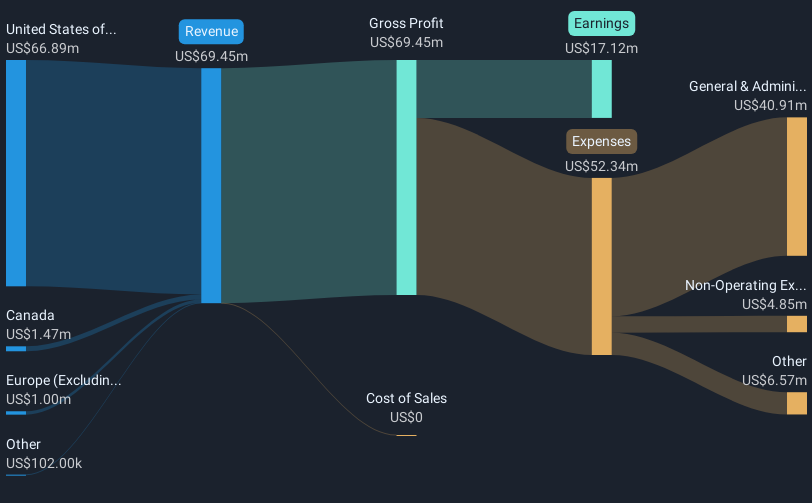

Operations: The company generates revenue primarily from its Asset Management segment, totaling $69.45 million.

Market Cap: £185.14M

City of London Investment Group, with a market cap of £185.14 million, reported stable earnings for the year ending June 30, 2024, with net income at US$17.12 million. Despite negative earnings growth over the past year and a low return on equity of 11.1%, the company benefits from an experienced management team and board. Its dividend yield of 8.71% is not well covered by earnings or free cash flow, raising sustainability concerns. However, being debt-free and having short-term assets exceeding liabilities provides financial stability as it trades below estimated fair value with high-quality earnings forecasted to grow annually by 25.37%.

- Click to explore a detailed breakdown of our findings in City of London Investment Group's financial health report.

- Assess City of London Investment Group's future earnings estimates with our detailed growth reports.

Summing It All Up

- Reveal the 467 hidden gems among our UK Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IUG

Intelligent Ultrasound Group

Through its subsidiaries, develops, markets, and distributes medical training simulators in the United Kingdom, North America, and internationally.