- United Kingdom

- /

- Software

- /

- AIM:ALT

We Ran A Stock Scan For Earnings Growth And Altitude Group (LON:ALT) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Altitude Group (LON:ALT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Altitude Group

How Fast Is Altitude Group Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Altitude Group to have grown EPS from UK£0.0014 to UK£0.0055 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

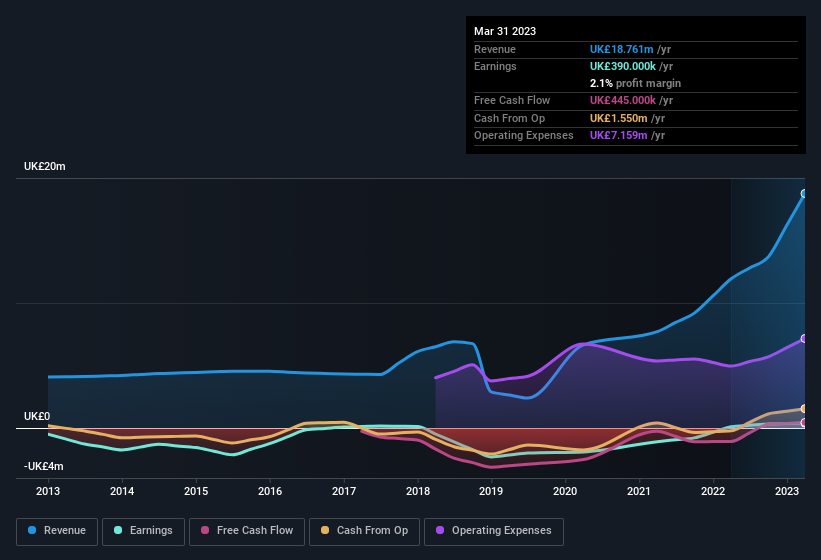

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Altitude Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 57% to UK£19m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Altitude Group is no giant, with a market capitalisation of UK£31m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Altitude Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold Altitude Group shares in the last year, but the good news is they spent UK£20k more buying than they netted selling. So, on balance, the insider transactions are mildly encouraging. We also note that it was the company insider, Simon Taylor, who made the biggest single acquisition, paying UK£552k for shares at about UK£0.46 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Altitude Group will reveal that insiders own a significant piece of the pie. In fact, they own 41% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at UK£13m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Altitude Group Worth Keeping An Eye On?

Altitude Group's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Altitude Group deserves timely attention. You should always think about risks though. Case in point, we've spotted 2 warning signs for Altitude Group you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Altitude Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ALT

Altitude Group

Provides end-to-end solutions for branded merchandise in corporate promotional products industry, print vertical markets, and the higher-education sector in North America, the United Kingdom, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives