- United Kingdom

- /

- Aerospace & Defense

- /

- AIM:MSI

Unveiling Three Promising Small Cap Gems in the United Kingdom

Reviewed by Simply Wall St

As the United Kingdom's major indices, such as the FTSE 100 and FTSE 250, face headwinds from global economic challenges, particularly those stemming from China's sluggish recovery and its impact on commodity markets, investors are increasingly shifting their focus towards small-cap opportunities that may offer resilience amidst broader market volatility. In this environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can weather external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| AltynGold | 44.83% | 26.53% | 33.23% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Value Rating: ★★★★★★

Overview: AdvancedAdvT Limited provides software solutions across Europe, the United Kingdom, North America, and internationally, with a market capitalization of £259.21 million.

Operations: AdvancedAdvT Limited generates revenue primarily from its Internet Software & Services segment, amounting to £43.27 million.

AdvancedAdvT, a nimble player in the UK market, showcases robust financial health with no debt for five years. Its earnings surged 53.6% last year, outpacing the software industry's 18.5% growth. Despite this impressive performance, future earnings are expected to dip by an average of 5.6% annually over the next three years, though revenue is projected to rise by 11.41%. The company reported sales of £43.27 million and net income of £10.88 million for the fiscal year ended February 2025, with basic EPS at £0.0817 and diluted EPS at £0.0812, illustrating its profitability and value relative to peers.

- Get an in-depth perspective on AdvancedAdvT's performance by reading our health report here.

Assess AdvancedAdvT's past performance with our detailed historical performance reports.

MS INTERNATIONAL (AIM:MSI)

Simply Wall St Value Rating: ★★★★★★

Overview: MS INTERNATIONAL plc is involved in the design, manufacture, construction, and servicing of various engineering products and structures across multiple regions including the UK, Europe, the USA, Asia, and South America with a market cap of £222.94 million.

Operations: The company generates revenue primarily through its Defence and Security segment (£82.45 million), followed by Forgings (£13.77 million), Petrol Station Superstructures (£13.24 million), and Corporate Branding (£8.60 million). The Defence and Security segment is the largest contributor to revenue, indicating a significant focus in this area.

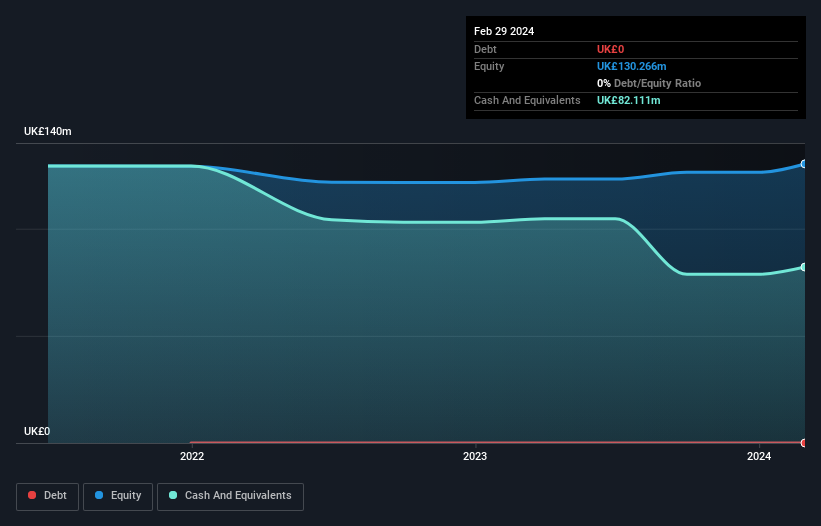

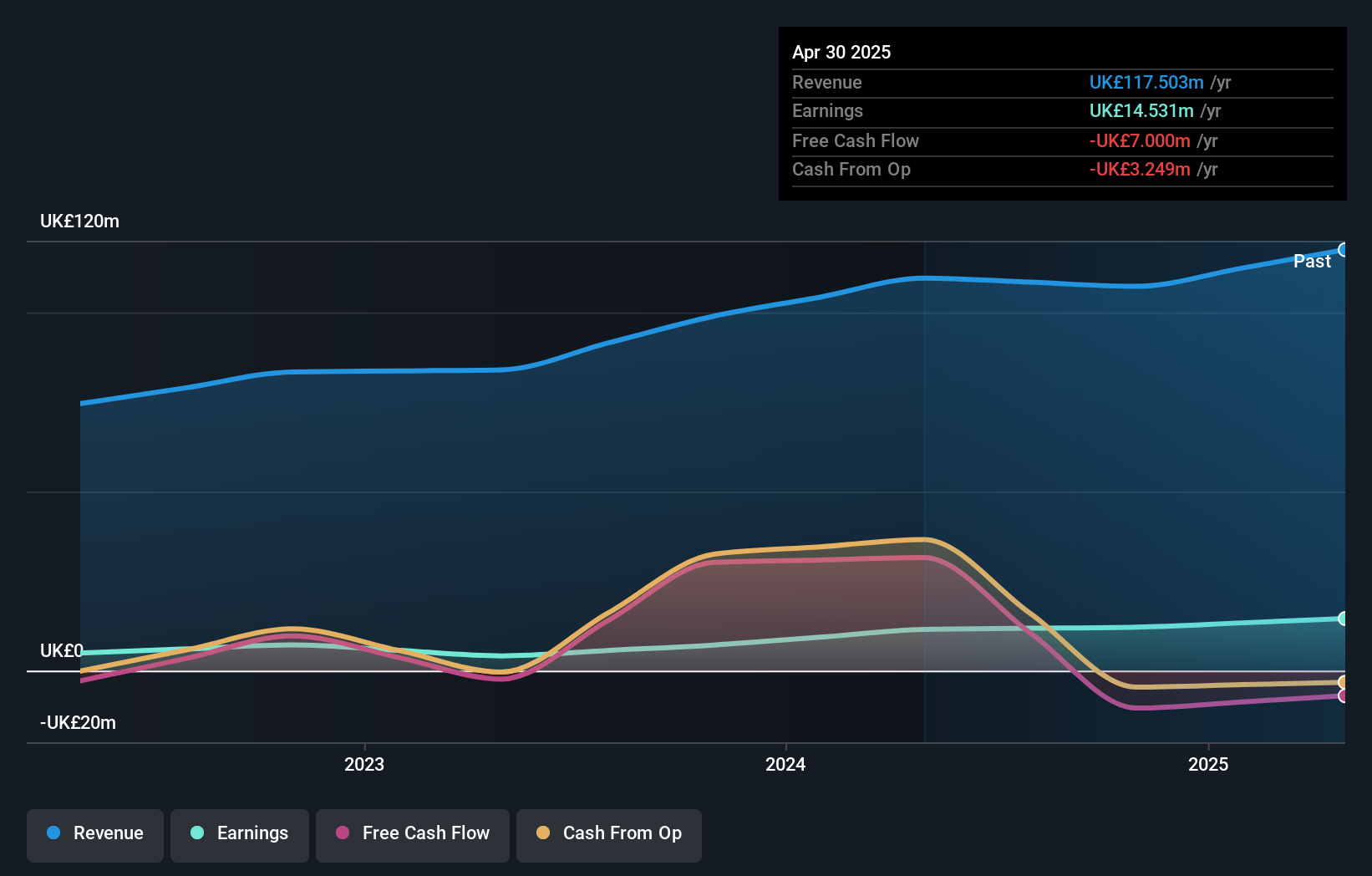

MS International, a niche player in the UK market, showcases a robust financial profile with no debt over the past five years and earnings growth averaging 53.2% annually. Despite recent volatility in its share price and significant insider selling, the company remains attractive with a P/E ratio of 15.3x, undercutting the broader UK market's 16.6x. Recent board changes saw John Meldrum join as Executive Director, adding stability given his long tenure at MSI. The company's latest earnings report highlighted sales of £117.5 million and net income of £14.53 million for the year ending April 2025, underscoring its solid performance trajectory despite industry challenges.

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Value Rating: ★★★★★★

Overview: Anglo-Eastern Plantations Plc, along with its subsidiaries, focuses on owning, operating, and developing oil palm plantations in Indonesia and Malaysia with a market cap of £547.79 million.

Operations: Anglo-Eastern Plantations generates revenue primarily from the cultivation of oil palm plantations, with reported earnings of $436.63 million. The company's financial performance is characterized by its gross profit margin, which reflects the efficiency of its core operations.

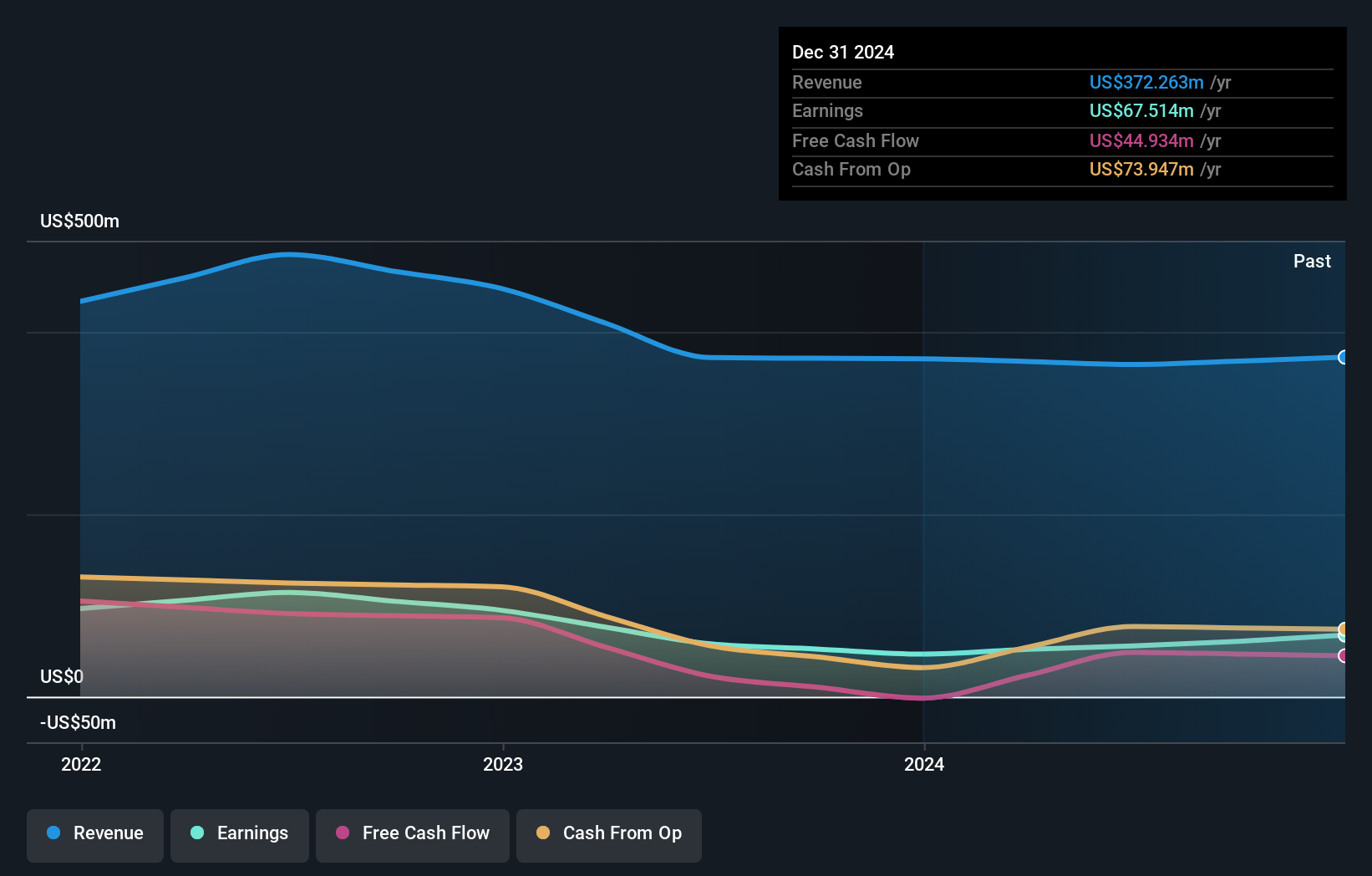

Anglo-Eastern Plantations, a UK-listed company operating in Indonesia and Malaysia, has shown impressive financial health with earnings surging 63.4% over the past year, significantly outpacing the industry's 11.2%. The firm is debt-free and trades at nearly 79.2% below its estimated fair value, indicating potential undervaluation. Recent developments include its addition to multiple FTSE indices and an interim dividend of 37 cents per share, equating to about 30% of net profit for the first half of 2025. Additionally, AEP repurchased shares worth £0.72 million this year under its buyback program initiated in March.

- Navigate through the intricacies of Anglo-Eastern Plantations with our comprehensive health report here.

Gain insights into Anglo-Eastern Plantations' past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 67 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MSI

MS INTERNATIONAL

Engages in the design, manufacture, construction, and servicing various engineering products and structures in the United Kingdom, Europe, the United States of America, Asia, South America, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives