- United Kingdom

- /

- Software

- /

- AIM:ADVT

Uncovering 3 Undiscovered Gems In The United Kingdom Market

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces downward pressure from weak trade data out of China, investors are increasingly looking beyond blue-chip stocks to uncover opportunities within smaller companies. In this challenging environment, identifying promising small-cap stocks that demonstrate resilience and potential for growth can be crucial for navigating market volatility and diversifying investment portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anglo-Eastern Plantations | NA | 5.55% | 5.38% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Value Rating: ★★★★★★

Overview: AdvancedAdvT Limited provides software solutions across Europe, the United Kingdom, North America, and other international markets with a market cap of £252.39 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling £43.27 million.

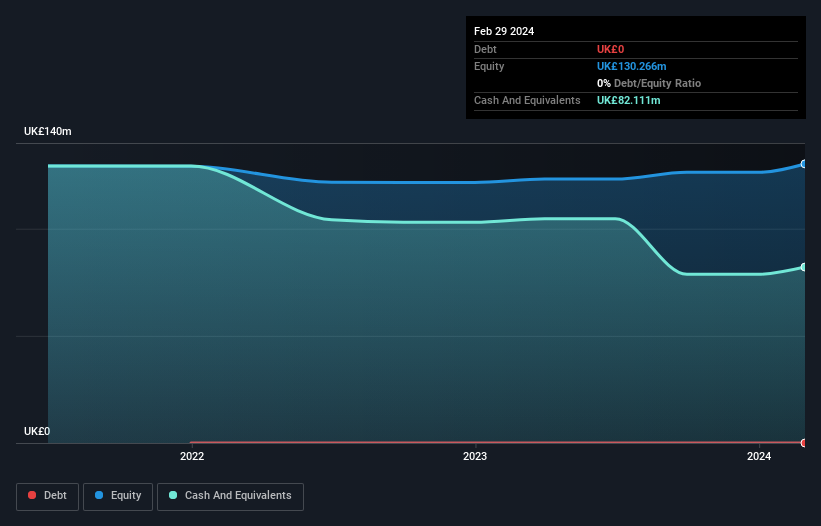

AdvancedAdvT, a nimble player in the UK market, shines with its debt-free status over the past five years and high-quality earnings. Its recent performance is notable, with earnings surging by 54% last year, outpacing the software industry's 17% growth. The company trades at a modest 4.1% below estimated fair value, suggesting potential upside. Despite negative levered free cash flow in previous years, it turned positive recently at £7.71 million as of February 2025. With revenue projected to grow annually by 11%, AdvancedAdvT seems poised for continued expansion within its industry context.

- Delve into the full analysis health report here for a deeper understanding of AdvancedAdvT.

Understand AdvancedAdvT's track record by examining our Past report.

MS INTERNATIONAL (AIM:MSI)

Simply Wall St Value Rating: ★★★★★★

Overview: MS INTERNATIONAL plc is involved in the design, manufacture, construction, and servicing of various engineering products and structures across multiple regions worldwide, with a market capitalization of £253.37 million.

Operations: MS INTERNATIONAL generates revenue primarily from its Defence and Security segment, which accounts for £82.45 million, followed by Forgings at £13.77 million and Petrol Station Superstructures at £13.24 million. The Corporate Branding segment contributes £8.60 million to the overall revenue stream.

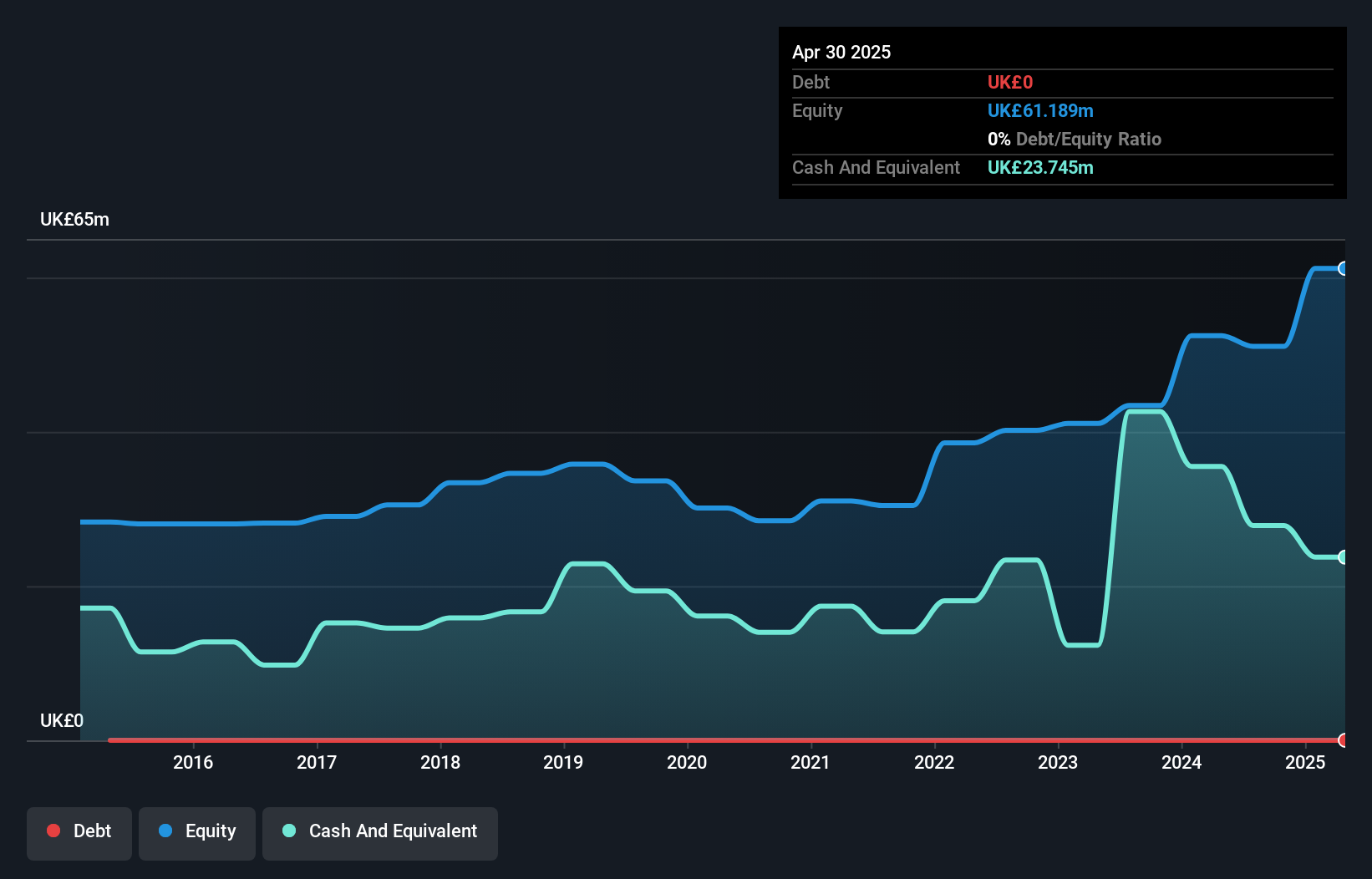

MS International, a nimble player in the Aerospace & Defense sector, has seen its earnings soar by 53% annually over the last five years. Despite this impressive growth, its recent annual earnings increase of 26% lagged behind the industry's 28%. The company boasts a debt-free balance sheet for five years running and trades at a favorable price-to-earnings ratio of 17.4x compared to the industry average of 25.1x. However, significant insider selling in recent months could be cause for caution among potential investors. Additionally, it recently concluded a buyback plan on August 6, indicating strategic financial maneuvers.

- Click here to discover the nuances of MS INTERNATIONAL with our detailed analytical health report.

Explore historical data to track MS INTERNATIONAL's performance over time in our Past section.

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Value Rating: ★★★★★★

Overview: Anglo-Eastern Plantations Plc, along with its subsidiaries, is engaged in the ownership, operation, and development of oil palm plantations in Indonesia and Malaysia with a market capitalization of £508.58 million.

Operations: Anglo-Eastern Plantations generates revenue primarily from the cultivation of plantations, amounting to $436.63 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

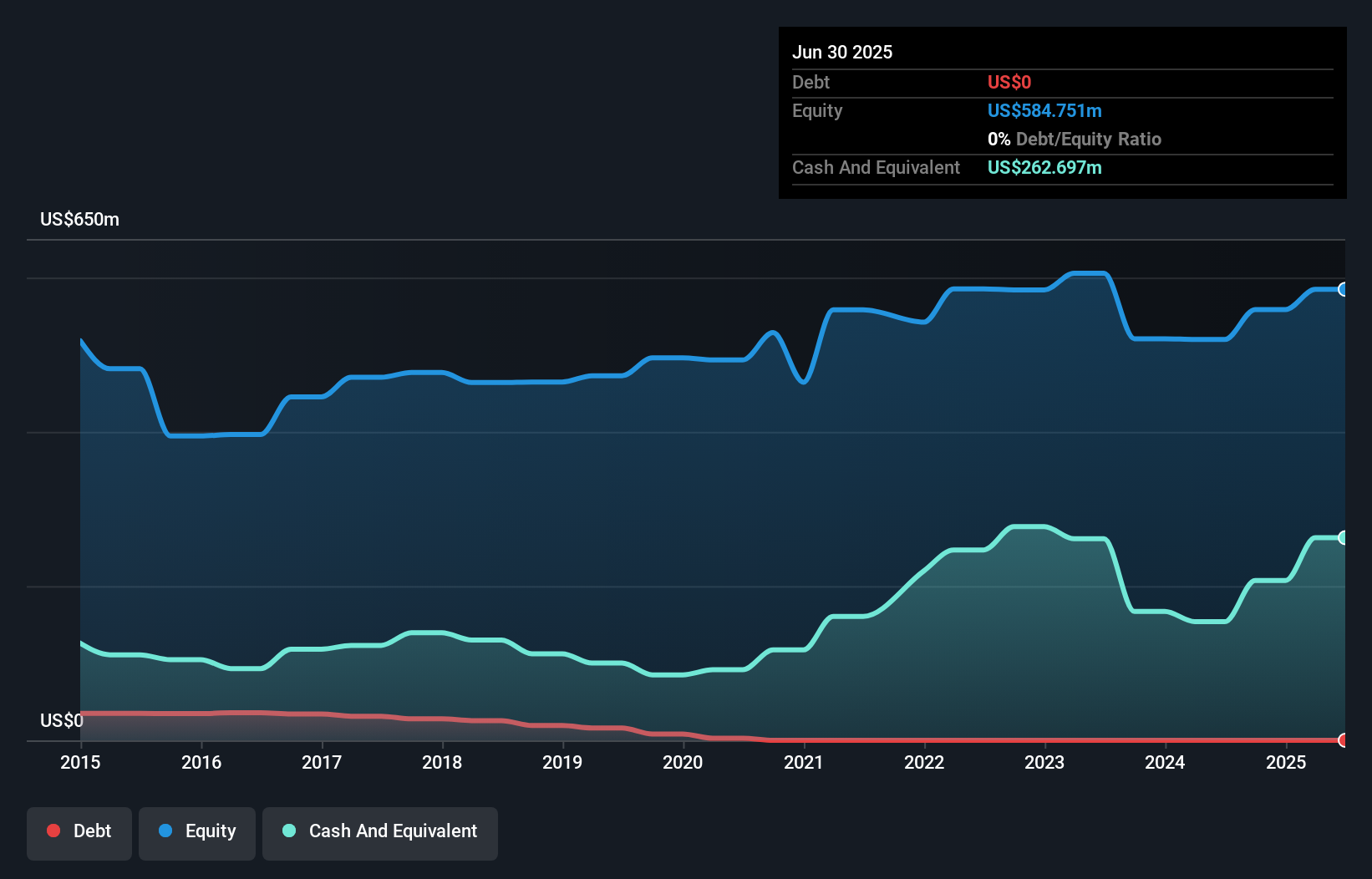

Anglo-Eastern Plantations, a player in the plantation sector, is making waves with its robust financial health and strategic moves. Recently added to the FTSE 250 and FTSE 350 indices, it showcases strong growth potential. The company reported impressive earnings growth of 63% over the past year, outpacing industry peers significantly. With no debt on its books and trading at nearly 81% below estimated fair value, it presents an intriguing opportunity for investors. AEP's recent share repurchase program further underscores confidence in its prospects, having bought back shares worth £0.72 million this year alone.

- Dive into the specifics of Anglo-Eastern Plantations here with our thorough health report.

Learn about Anglo-Eastern Plantations' historical performance.

Where To Now?

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 UK Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ADVT

AdvancedAdvT

Engages in the provision of software solutions in Europe, the United Kingdom, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives