What are the early trends we should look for to identify a stock that could multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating ScS Group (LON:SCS), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for ScS Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.034 = UK£4.7m ÷ (UK£244m - UK£105m) (Based on the trailing twelve months to July 2020).

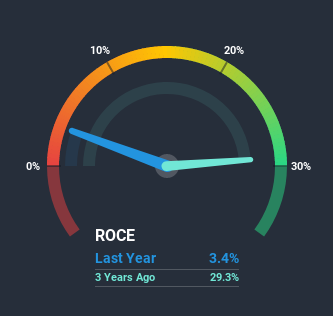

Thus, ScS Group has an ROCE of 3.4%. In absolute terms, that's a low return and it also under-performs the Specialty Retail industry average of 12%.

Check out our latest analysis for ScS Group

Above you can see how the current ROCE for ScS Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering ScS Group here for free.

What Can We Tell From ScS Group's ROCE Trend?

Unfortunately, the trend isn't great with ROCE falling from 20% five years ago, while capital employed has grown 323%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. ScS Group probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

On a related note, ScS Group has decreased its current liabilities to 43% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE. Keep in mind 43% is still pretty high, so those risks are still somewhat prevalent.In Conclusion...

From the above analysis, we find it rather worrisome that returns on capital and sales for ScS Group have fallen, meanwhile the business is employing more capital than it was five years ago. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 66% return. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

While ScS Group doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation on our platform.

While ScS Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading ScS Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SCS

ScS Group

ScS Group plc, together with its subsidiaries, engages in the retail of upholstered furniture, flooring, and related products in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives