- United Kingdom

- /

- Specialty Stores

- /

- LSE:SCS

Did You Participate In Any Of ScS Group's (LON:SCS) Respectable 53% Return?

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the ScS Group plc (LON:SCS) share price is up 12% in the last five years, that's less than the market return. However, if you include the dividends then the return is market beating. The last year hasn't been great either, with the stock up just 1.7%.

View our latest analysis for ScS Group

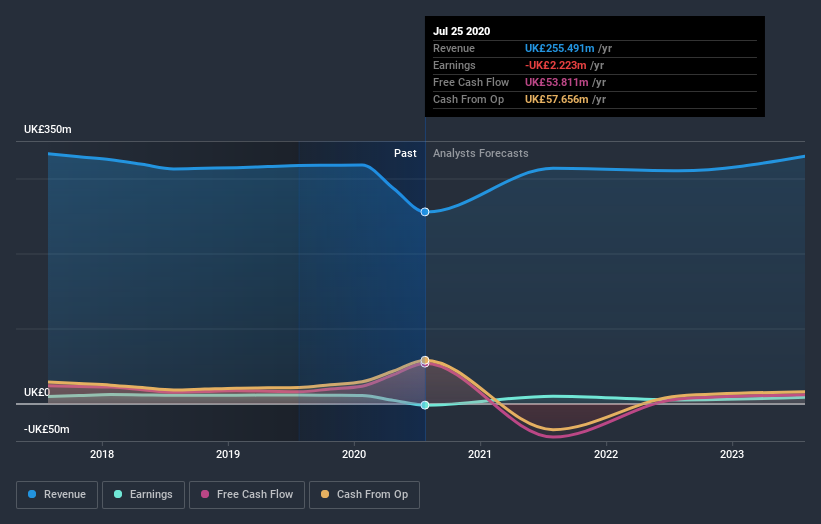

Because ScS Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years ScS Group saw its revenue shrink by 0.2% per year. The stock is only up 2% for each year during the period. That's pretty decent given the top line decline, and lack of profits. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on ScS Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between ScS Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for ScS Group shareholders, and that cash payout contributed to why its TSR of 53%, over the last 5 years, is better than the share price return.

A Different Perspective

ScS Group shareholders gained a total return of 1.7% during the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 9% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for ScS Group you should know about.

Of course ScS Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade ScS Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SCS

ScS Group

ScS Group plc, together with its subsidiaries, engages in the retail of upholstered furniture, flooring, and related products in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives