- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

Pets at Home Group Plc's (LON:PETS) Subdued P/E Might Signal An Opportunity

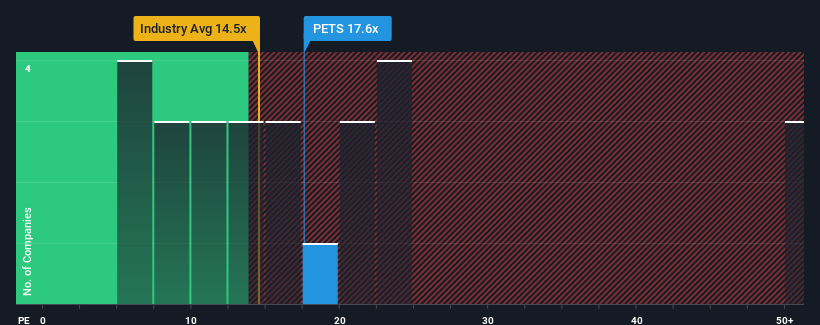

It's not a stretch to say that Pets at Home Group Plc's (LON:PETS) price-to-earnings (or "P/E") ratio of 17.6x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Pets at Home Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Pets at Home Group

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Pets at Home Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 19%. The last three years don't look nice either as the company has shrunk EPS by 5.3% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 14% per annum, which is noticeably less attractive.

With this information, we find it interesting that Pets at Home Group is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Pets at Home Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Pets at Home Group with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Pets at Home Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PETS

Pets at Home Group

Engages in the omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

6 star dividend payer with solid track record.

Market Insights

Community Narratives