Stock Analysis

- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

Exploring IG Group Holdings And Two More Leading Dividend Stocks

Reviewed by Simply Wall St

As the FTSE 100 shows signs of rebounding after recent losses, and with a broader optimistic outlook in European markets, investors are closely monitoring shifts in market dynamics. In this context, understanding what constitutes a strong dividend stock becomes crucial, particularly when navigating through fluctuating commodity prices and varying sector performances.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 7.88% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 6.40% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.51% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.41% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.91% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.63% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.55% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.17% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.08% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.34% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

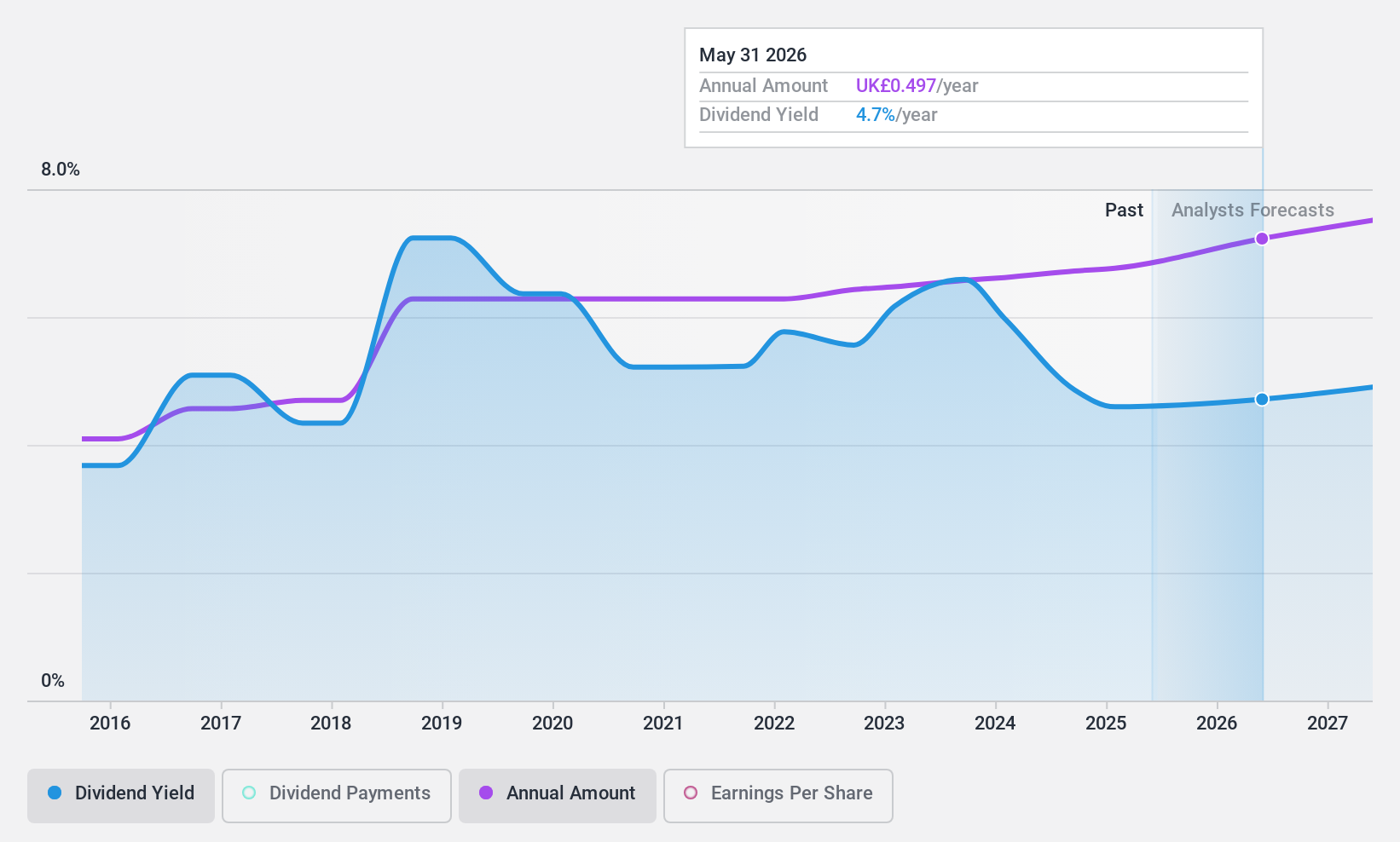

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IG Group Holdings plc is a fintech company that operates globally in the online trading sector, with a market capitalization of approximately £3.06 billion.

Operations: IG Group Holdings generates its revenue primarily through its brokerage services, amounting to £954.70 million.

Dividend Yield: 5.5%

IG Group Holdings has maintained a stable dividend over the past decade, with payments increasing despite challenges. Recent revenue results show a slight year-over-year increase for Q3 2024 but a decrease in the nine-month period compared to the previous year. While dividends are supported by earnings with a payout ratio of 61.1%, the cash payout ratio at 153% raises concerns about sustainability from cash flows alone. Upcoming executive transitions could influence future financial strategies and stability.

- Click here and access our complete dividend analysis report to understand the dynamics of IG Group Holdings.

- Our comprehensive valuation report raises the possibility that IG Group Holdings is priced lower than what may be justified by its financials.

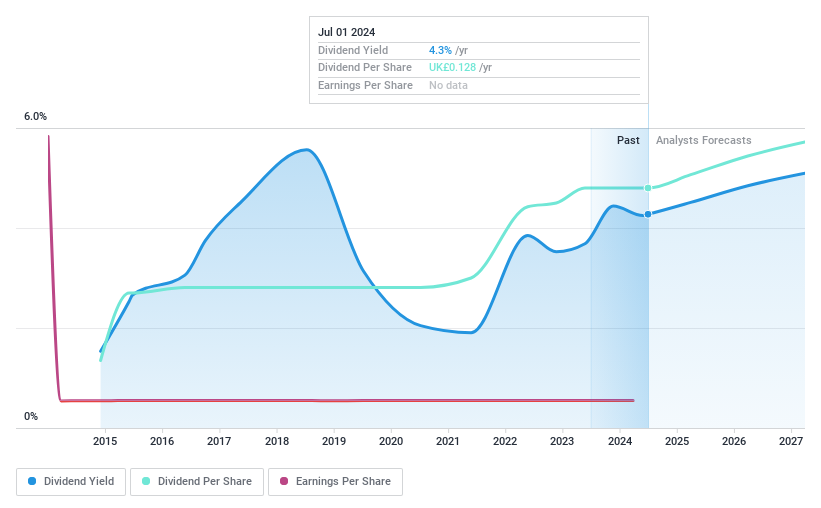

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc is a specialist omnichannel retailer based in the United Kingdom, offering pet food, related products, and accessories, with a market capitalization of approximately £1.48 billion.

Operations: Pets at Home Group Plc generates its revenue primarily through two segments: retail sales amounting to £1.33 billion and veterinary services contributing £146.50 million.

Dividend Yield: 4%

Pets at Home Group reported a year-over-year sales increase to £1.48 billion and a net income of £79.2 million for FY 2024, though earnings per share declined. Despite this, the company maintained its dividend at 12.8 pence per share with a payout ratio aiming towards 50%. The addition of Garret Turley to the board could enhance governance, focusing on ESG initiatives which may impact long-term sustainability and appeal to socially conscious investors.

- Get an in-depth perspective on Pets at Home Group's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Pets at Home Group's share price might be too optimistic.

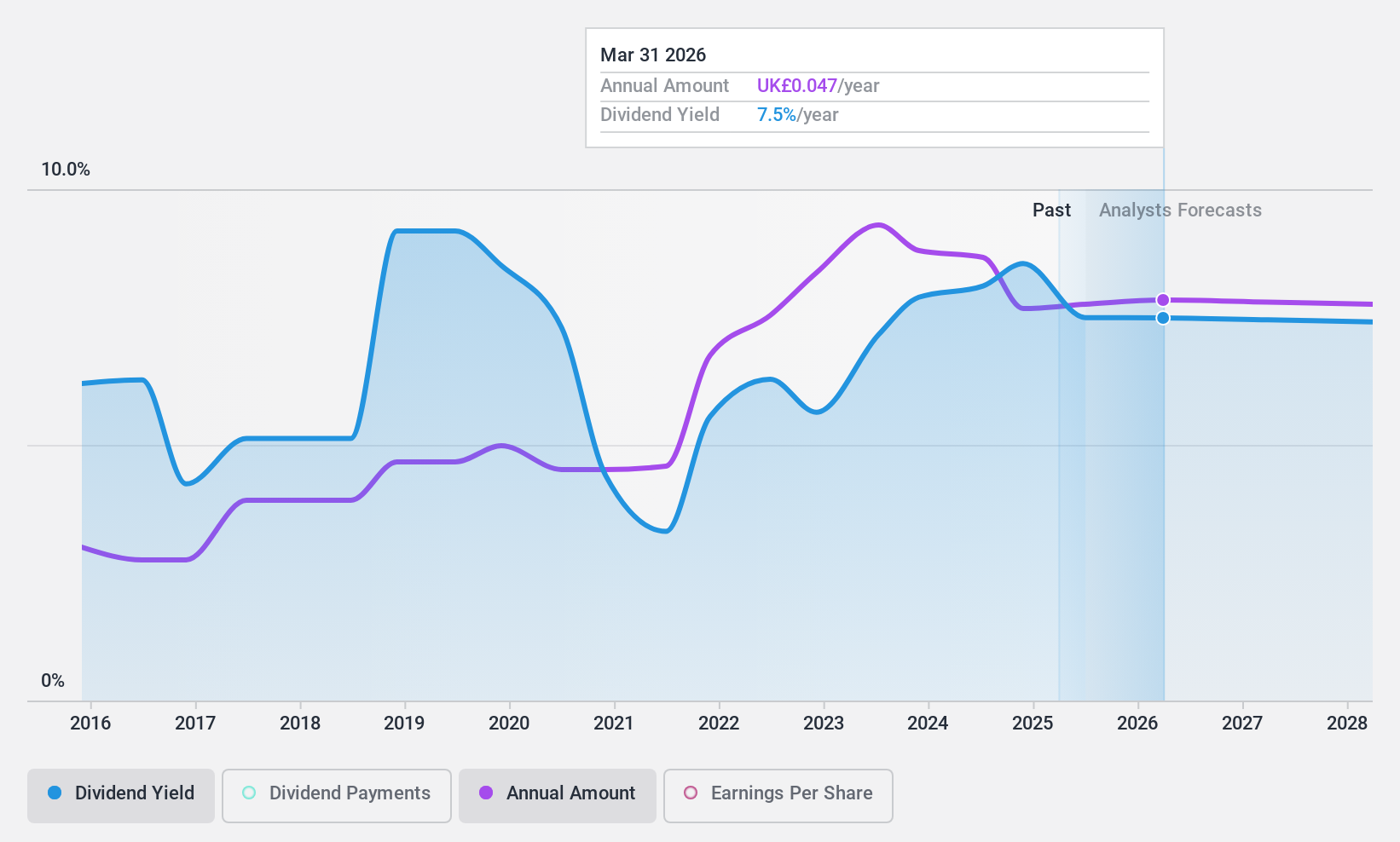

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Record plc operates globally, offering currency and derivative management services through its subsidiaries in the United Kingdom, North America, Continental Europe, and Australia, with a market capitalization of approximately £0.13 billion.

Operations: Record plc generates revenue primarily through the provision of currency and derivatives management services, totaling £44.10 million.

Dividend Yield: 7.9%

Record plc offers a high dividend yield of 7.88%, ranking in the top 25% of UK dividend payers. The dividends are well-supported with a payout ratio of 89.1% and a similar cash payout ratio, ensuring sustainability from both earnings and cash flow perspectives. Despite significant insider selling recently, the company's dividend history is robust, showing stability and growth over the past decade. Recent executive changes, including new CEO Dr. Jan Witte and CFO Richard Heading, could influence future financial strategies as they transition into leadership by mid-2024.

- Unlock comprehensive insights into our analysis of Record stock in this dividend report.

- The analysis detailed in our Record valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Embark on your investment journey to our 57 Top Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Pets at Home Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PETS

Pets at Home Group

Engages in the specialist omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

Established dividend payer with adequate balance sheet.