Is B&M (LSE:BME) Undervalued? Assessing the Stock After Its Recent Share Price Rebound

Reviewed by Simply Wall St

With the recent bump in B&M European Value Retail (LSE:BME) shares, some investors are taking a closer look to figure out what is really driving the movement. While there was no single headline-grabbing event to explain the uptick, the positive shift might be catching the attention of those on the sidelines. This raises questions about whether the market is picking up on early signs of a turnaround or simply responding to broader sentiment.

Looking at the bigger picture, B&M’s performance this year has been mixed. The shares have dropped over 40% in the past twelve months, giving back gains even as underlying annual revenue and profit ticked slightly upward. Short-term momentum has been more volatile, with swings both up and down over the past month. The result is a company with some growth in its core business, but a stock price that has lagged behind sector peers and the broader market.

So after this year’s sharp pullback, is B&M starting to look like a bargain, or are investors already pricing in every glimmer of future growth?

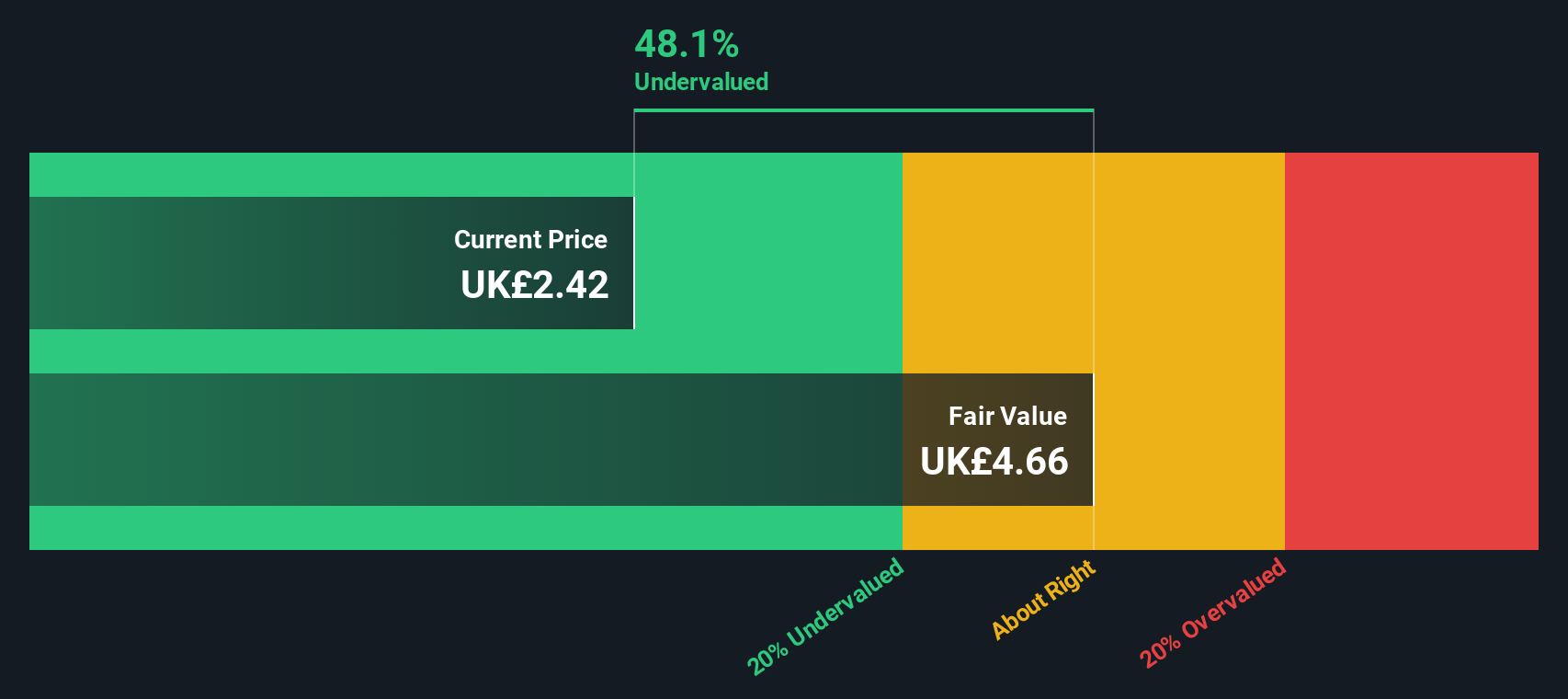

Most Popular Narrative: 40.5% Undervalued

According to community narrative, B&M European Value Retail is viewed as significantly undervalued, with analysts believing the current share price does not fully reflect the company’s future earnings and revenue growth potential. The narrative outlines the rationale behind the optimistic valuation, highlighting anticipated expansion, margin efficiency, and cash returns as central drivers.

B&M's continued emphasis on driving prices down through EDLP (Everyday Low Price) combined with volume growth provides a strong value proposition that aims to increase its customer base and market share. This could potentially boost future revenues and earnings by increasing sales volumes. The strategic and disciplined expansion of new store openings, including the plan to open 45 shops in the U.K as well as expanding operations in France with more stores planned than in 2023, is expected to drive top-line growth and increase revenue.

Curious how analysts arrive at such a bullish fair value? Their calculation is powered by surprisingly aggressive assumptions about B&M’s operational strategy and future financial results. Want to see what makes their revenue and profit forecasts bold enough to support this valuation? The details could shift your view of the company’s potential upside.

Result: Fair Value of £4.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising supply chain risks and the challenge of sustaining low prices could quickly shift analyst optimism if these issues are not carefully managed.

Find out about the key risks to this B&M European Value Retail narrative.Another View: Discounted Cash Flow Perspective

Taking a different approach, our DCF model also points to B&M European Value Retail being undervalued. This supports the notion that its current share price may not reflect its future cash flow potential. Could both valuation methods be missing important risks or opportunities?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own B&M European Value Retail Narrative

If you want to take a different angle or dig deeper into the numbers yourself, you can shape your own view in just a few minutes. do it your way.

A great starting point for your B&M European Value Retail research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not let your next winning idea slip away. If you are eager to expand your portfolio with stocks handpicked for unique strengths, explore these powerful ways to unlock fresh investment angles and stay a step ahead of the market:

- Identify market leaders with consistent payouts by scanning for companies offering dividend stocks with yields > 3%. This approach may help you access reliable income streams in addition to price gains.

- Take advantage of the AI transformation by finding AI penny stocks. These companies are driving tomorrow’s innovation and reshaping entire industries.

- Focus on breakthrough firms central to technological progress by scouting quantum computing stocks. This could allow you to discover opportunities early in a rapidly advancing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B&M European Value Retail might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BME

B&M European Value Retail

B&M European Value Retail S.A. retails general merchandise products and groceries.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives